Low interest rates to boost fixed home loans: NAB

National Australia Bank boss Ross McEwan expects the level of fixed rate home loans in Australia will balloon.

National Australia Bank boss Ross McEwan expects the level of fixed rate home loans in Australia will balloon, potentially to more than 30 per cent of the mortgage market as interest rates stay at historic lows.

The big banks attracted criticism this week when they chose not to pass on an official rate cut to the majority of home loan borrowers, through lower variable rates. They instead cut fixed rate mortgage pricing and business rates.

But the majority of mortgage borrowers, between 70 to 90 per cent, depending on the bank, have variable rates in Australia which is in contrast to markets including the UK where fixed rate home loans dominate.

Asked by banking analysts whether Australia was heading in a similar direction as the UK, Mr McEwan said current trends suggested fixed rate loans in Australia could soon account for more than 30 per cent of the market.

“It could be more than 30 per cent (across the banking sector) … but I wouldn’t fear that,” he added.

“The reality is that this market is moving more toward fixed rates for certainty, it was about 10 per cent of the (NAB) book I think you’ll see it quite quickly getting to 30 per cent … we are seeing that in the (new mortgage) flows.”

In the UK about 90 per cent of home loans are fixed rate products, and borrowers are getting more comfortable with fixing for longer periods of time.

None of the big four banks passed on this week’s 15 basis point cut in official rates to variable rate customers. They opted to reduce fixed rate mortgage pricing, taking some of those loans below 2 per cent for the first time.

The official cash rate sits at 0.1 per cent and banks have access to cheaper funding through the RBA’s term funding facility.

But Mr McEwan highlighted that low interest rates were creating a challenging earnings environment for banks, alongside managing COVID-19 loan repayment pauses.

“We haven’t seen for 30 years a difficult time in Australia so we are quietly seeing that now, with a low interest rate environment that is going to stay around for a long period of time.

“It makes running a bank more difficult so you have to concentrate on costs, efficiency, straight through processing, make it easy for customers,” he said.

Mr McEwan admitted a shift to fixed rates by Australian borrowers would impede the flow-through of RBA interest rate changes and the impact on the economy.

NAB expects the sustained low interest will see its net interest margin – what it earns on loans minus funding and other costs – hit by about six basis points in its 2021 year.

After this week’s changes, Westpac is offering the lowest four-year fixed rate in the market — at 1.89 per cent per annum – with a deposit at least 30 per cent.

With a smaller home loan deposit, NAB has the lowest four-year fixed rate among its main rivals. That is after it announced an 81 basis points cut to its four-year fixed mortgage rate to 1.98 per cent per annum.

On Thursday, Suncorp held its variable mortgage rates steady while introducing a 1.89 per cent per annum two-year fixed home loan rate.

ME Bank took a different approach and joined a handful smaller lenders that have committed to passing on the full RBA rate cut to existing customers, most from late this month.

This week’s offers by the big banks were strategic – given they are trying to manage the profitability of their lending portfolios and are reluctant to cut deposit rates any further. But after the announced changes, ANZ was an outlier among the majors, not having a fixed rate product below 2 per cent.

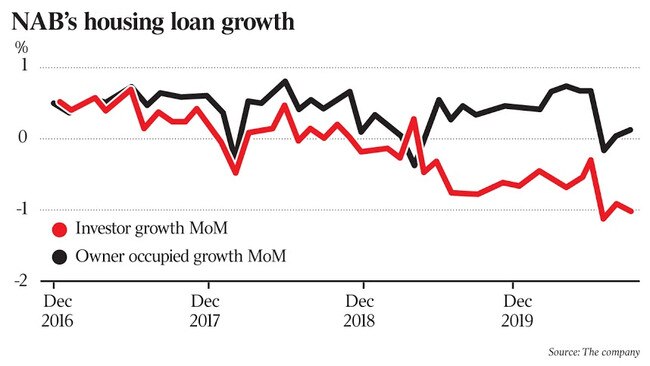

Mr McEwan said despite NAB ceding some home loan market share this year after removing a cash back offer, it wanted to be a bigger force in mortgages.

“We want to be strong in this market, and I’m clearly signalling we are going to be,” he added.

NAB expects subdued home loan demand in the year ahead with its economists estimating industry growth of around 0.5 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout