Lex Greensill ‘devastated’ by jobs lost as empire collapses

With quiet charm he went from Bundaberg all the way to Downing Street. But in the gentle English village he now calls home, friends say Lex Greensill is devastated as it all begins to slip away.

From a gentle English village called Saughall, the beating heart of Lex Greensill’s Cheshire headquarters outside Liverpool, comes an earnest plea to the many thousands of people who will suffer from the collapse of his global financial empire.

A family friend of Mr Greensill, speaking to The Weekend Australian from close to his renovated Georgian home, “The Old Vicarage’’ in Saughall, said: “Lex is devastated at the loss of jobs at Greensill’s. This is a man who is now dedicated to working with the administrators, and all over the world too, to ensure that everyone who did business with the Greensill family name is treated with the upmost respect and fairness.’’

Those that know the 44-year-old Mr Greensill — with the backstory of trying to help small business prosper after witnessing the impact of delayed payments to his family’s three generation melon and sugar cane farm in Bundaberg, rising to becoming one of the world’s biggest supply chain financiers — say his heartache runs deep and that he will devote as long as it takes to work with the administrators to recover as much money from his former empire as possible. That will take years, perhaps decades, to untangle.

Those efforts start here at Saughall, where Greensill’s three-storey, eight-bedroom family home, just across from a vintage bus shelter filled with books to swap, is modest for a man once valued at $7bn.

Even with $3.5m of recent architectural renovations and perfectly aligned flower beds filled with tulips and daffodils, the family home is on the main street next to the village pub, The Greyhound Inn, where huge tractors trundle by every half hour and small traffic jams accumulate as neighbours negotiate parked cars down the narrow passage.

Mr Greensill’s wife Vicky is a local doctor and the family has invested heavily in the local community, even buying a new mill for a the oldest organic farm over the border in North Wales so neighbours can mill pesticide-free wheat, spelt and rye for 20 pence a kilogram during the country’s coronavirus lockdown.

However, his other big community project has split the village. Mr Greensill wants to “re-wild’’ a neighbouring plot of land that once formed the surrounds of a 10th century castle if he can purchase it. Those that were upset about losing community ownership of open space without going to tender might not have to worry now.

Lex Greensill’s downfall has sparked defaults of loans worth billions of dollars, threatening the future of steel and coal industries, shaking up major firms like Credit Suisse and wiping the savings of 26 German councils. Forget Alan Bond or Christopher Skase — this has been deeper and quicker than any before him, and the ramifications from Greensill’s failed business — the main working company was Greensill Capital — are only just starting to emerge.

In the UK, Greensill Capital’s consultant and former prime minister David Cameron is facing an inquiry by a lobbying watchdog he set up himself about the appropriateness of texting the Chancellor to access taxpayer COVID-19 money.

In January 2020, Australia’s former foreign minister Julie Bishop, also a Greensill Adviser, was lobbying the federal government to allow Greensill companies to provide, at cost, a wages on demand system for 150,000 commonwealth health workers. Ms Bishop, Mr Cameron and Mr Greensill even met the then finance minister Matthias Cormann in Davos, Switzerland, but the plan collapsed because Australian officials feared the scheme resembled payday lending.

Yet there were few concerns elsewhere in the world about Greensill’s financial model, which included debt repackaging, with Credit Suisse’s chief executive now being probed for how 1000 of his firm’s clients face up to $US3bn in losses associated with Greensill Capital and billions more of superannuation and pension monies invested in big tech funds and insurance companies looking distinctly wobbly.

German councils have banded together to legally claw back $303m for ratepayers after Greensill’s German bank was frozen by regulators, and there are fears UK taxpayers could be exposed to £2bn of liabilities. Despite this financial collapse, Mr Greensill’s supporters in and around Cheshire are many: from the village townsfolk protecting his privacy to his former employees packing up the remnants of paperwork at the Daresbury business park near Warrington, some 20 minutes down the road.

“He’s a great bloke, easy to talk to,’’ said one.

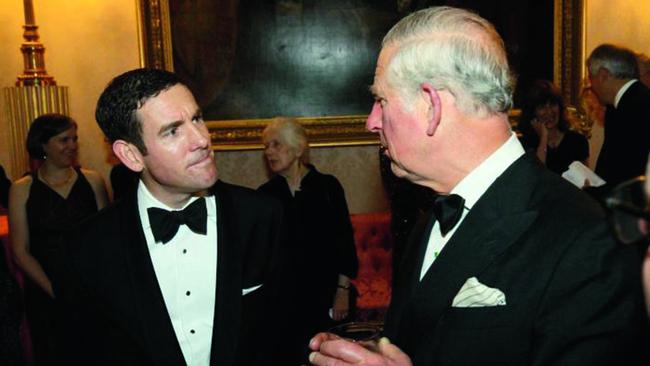

Mr Greensill has been able to charm his way from working for the Fruit and Vegetable Grower’s Association to Morgan Stanley, then Citibank and then into the inner workings of Downing Street, where Mr Cameron even name-checked him at a 2014 speech for the Federation of Small Businesses.

“I’ve got my top team from the Number 10 Policy unit sitting here. We’ve also got Lex Greenhill (sic) — Lex where are you? Give us a wave. Thank you very much.’’

Mr Cameron added: “Lex is sorting out the whole supply chain finance issue for us, which is often a very good way of small businesses helping small businesses to get credit and to get finance when they are part of the supply chain.’’

The problem, though, was that at that time Greensill Capital, formed in 2011, was on the way to becoming a very big business helping monolithic low-performing steel businesses get high-risk finance.

There were some alarm bells in 2018, when 70 per cent of Greensill capital’s net income came from the steel businesses associated with the British metals tycoon Sanjeev Gupta, but then two significant tech funds invested huge sums of money. Firstly General Atlantic, a well respected US private equity investor, pumped in $US250m and spruiked how Greensill Capital had facilitated payments to 1.5 million suppliers and provided over $40bn of financing across 50 countries since its inception.

Then SoftBank, a Japanese investment powerhouse, followed with $US1.5bn into Greensill Capital on the basis that if it was OK for General Atlantic then it was OK for them.

The nine-figure ‘‘management fees’’ from this SoftBank deal meant Mr Greensill could indulge on a spending spree, splashing out on a $4.1m beachfront home near Bundaberg and a new private plane, his fourth. This new “billionaire’s toy’’ purchase was a long-range Gulfstream €650 bought from the Russian mining oligarch Iskander Makhmudov, to hop across the Atlantic and pop down to the family farm in Bundaberg for pre-Christmas drinks and an Australian summer. Second-hand Gulfstreams sell in the range of $US40m to $US50m. Mr Greensill and other family members took around $200m out of the company at this time.

And the spending spree continued. For Greensill Capital and the parent company in Australia, Mr Greensill picked up Finacity, Earnd Pty Ltd and Earnd UK Ltd, and signed up $6m of new office space in Daresbury for hundreds of new staff.

The very first public hint that all was not well in the Greensill empire was a year later, in November 2020, when Mr Greensill put his four private planes up for sale, a request from the board. Out went the Gulfstream, two Piaggio P-180 Avanti II’s and a Dassault Falcon 7X.

By December, at the very time his company was sponsoring the Rose D’or lifetime award to Sir David Attenborough in a pitch to get television business, he was in conversations with the insolvency company Grant Thornton about ways to reduce potential risks and shocks.

Not that any of that was communicated in the 2019 financial accounts, which were signed off in early 2020.

Mr Greensill even assessed the COVID-19 implications in that report, saying: “The directors believe the company is in a unique position to source liquidity for its clients, through a combination of new and existing funding sources attracted by the stability of the net asset value of the assets it originated, and Central Bank funding schemes. The company expects to be able to support customers through the pandemic.’’

Yet by the end of January this year, Mr Greensill’s brother, Peter, who heads up the family farm, resigned as a director of the company’s associated entities and six weeks later the big end of town suddenly cut off insurance to the Greensill businesses, effectively unravelling the entire concern.

The Peter Greensill Family Trust, which is the farming company owned by Lex, Peter and a third brother, Andrew, is quarantined from the Greensill Capital downfall, although the trust is a creditor after Lex Greensill put $40m of trust monies into Greensill Capital late last year.

Respected business analysts shake their heads at how exposed Greensill Capital was to Gupta’s companies, including GFG Alliance, which owns Liberty Steel in the UK and several Australian mining assets, including the Whyalla steelworks. Court papers show Greensill lent about $US5bn to Gupta which the steelmaker is now unable to pay back.

Clearly the longstanding Lex Greensill-Sanjeev Gupta business relationship has utterly failed, but The Weekend Australian has learned their personal relationship remains warm.

Insider finger-pointing at what went wrong for Greensill is instead directed squarely towards another company, Tokio Marine, which withdrew insurance support for Greensill Capital after becoming skittish about the volume of Greensill money being provided to Mr Gupta’s entities.

Former Greensill staffers have taken to LinkedIn to look for work. Matthew Costello, a close friend of Lex Greensill, said he started up Greensill Capital in Australia in 2014 and built the company over seven years to a peak of managing over $5bn in assets for clients and investors. “… we did know how to build a business and take new products to market,’’ he wrote. “… the Australian business and the Australian team built one of the strongest working capital finance books in the local finance industry.’’

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout