Greensill family go to ground but remain big business in Bundaberg

While corporate investigators rummage through the wreckage of Greensill Capital, builders are still on the tools at the embattled family’s many hometown projects.

Bundaberg’s under pressure Greensill family is still spending up big in their hometown including a million-dollar home renovation for a key scion of the clan.

The Queensland coastal town is a world away from the money markets of Wall St and London where Lex Greensill built a $6bn financial empire that has now collapsed, potentially leaving billions owed around the world and forcing others to scramble for financing.

The city of almost 100,000 fringed by emerald-green cane fields and small crops farms could yet play a pivotal role in the fall out of Greensill Capital given much of the family’s wealth remains in the area, including substantial land holdings.

While corporate investigators rummaged through the wreckage of Greensill Capital, builders remained on the tools this week at the oceanfront home of Peter Greensill, Lex’s younger brother.

The boss of the family’s substantial Bundaberg-based agricultural operations is installing expensive blackwood timber ceilings and roofing imported from Germany as part of the renovation of the home that has stunning views of the southern Great Barrier Reef.

“Peter wants to spend locally wherever he can,” says builder Trevor McLeod, who says the seven-bedroom home at Bargara should be completed by Christmas.

“But some things have to be brought from outside.”

Construction also is continuing a few kilometres down the road at the Greensill’s main farming operations at Qunaba.

The finishing touches are being made to a green recycling centre Green Solutions that will compost trees and other vegetation for use on crops including sweet potatoes, peanuts, cane and feedstock.

Adjacent to the recycling centre, bulldozers are digging large settlement ponds out of the red soil as part of the family’s focus on sustainable farming.

There are signs the family may be pulling back on some of its more ambitious plans. In March, last year, Greensill Farms applied to the Bundaberg Regional Council to build a three-storey office complex near its main farming operations to house up to 140 staff including a contingent from the now failed Greensill Capital.

Greensill Farms told the council that its presence in agribusiness finance was expanding with a team “dedicated to unlocking capital for the entire agricultural production chain.”

“Greensill is the market-leading provider of working capital finance for companies globally,” it boasted in support of its application for the project.

“Greensill’s unique model provides early payments to suppliers so that businesses have the capital they need when they need it.”

But earlier this month, Greensill’s head of planning, infrastructure and projects Nathan Freeman wrote to the council withdrawing the proposal and asking for a refund of $7815 on its development application fees.

Former Papua New Guinea potato farmer Dale Holliss, who is now manager of the Bundaberg Canegrowers, has over the past two decades watched the Greensills along with other farming families diversify from cane to more lucrative crops such as sweet potatoes and peanuts.

The Greensills still have large cane holdings and remain members of the Bundaberg Canegrowers, which operates from a substantial 1940s brick office in the city’s main thoroughfare of Bourbong St.

“We hope the international arm does not impact on the local farming operations,” said Mr Holliss, who praised the family as a “very professional agricultural operator.”

Despite their current troubles, it’s hard to find anyone in the sugar city unwilling to praise the Greensills, not only for their investment in the area but their community spirit.

When Bundaberg Regional Council set up a mentoring program for local unemployed families, Lex and Peter’s parents, Lloyd and Judy, were among the first to volunteer.

Ben Artup, the council’s executive director of economic development, said generational unemployment remained a major problem in the city of almost 100,000. “We have 36 per cent of 15-year-olds in Bundaberg who don’t have a parent who is working,’ he said.

“The Greensills attend every meeting of our mentoring program and tell the story of raising their boys with very little money and sending them to the local Kalkie State School (on the rural outskirts of Bundaberg).

“They worked hard to send the boys to university and now want to use their sons as an example of what the young generation can achieve.”

Locals recall Peter Greensill having a large presence in the town as head of the farming operations while his more high-profile brother built a financial empire based in London. “I don’t recall ever seeing Lex,” said local builder Trevor McLeod.

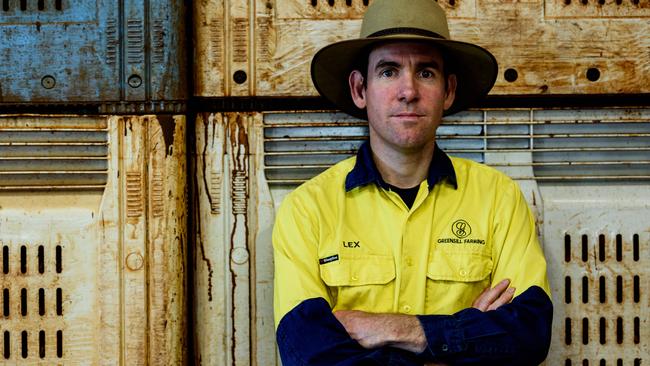

When Lex did return to Bundaberg it was seen as a photo opportunity to depict a local farm boy made good. In 2018, Lex was photographed on a tractor when he made a visit home.

The Greensills now appear to have gone to ground. Neither Peter Greensill or senior executives of Greensill Farms returned phone calls or interview requests this week.

The impact of the collapsed financial arm on Greensill’s farming operations, which employ close to 170 people in the city, remains a hot topic in Bundaberg.

Administrator Grant Thornton said its initial investigations had not revealed any exposure from the collapse of Greensill Capital in Australia on the farms but it could not comment on the UK side of the business. Grant Thornton in the UK declined to comment.

The Peter Greensill Family Trust is owed $US60m by Greensill Capital while ASIC records show the Peter Greensill Family Co was a substantial shareholder in the company.

At Peter Greensill’s Bargara residence, a family member told The Australian he “was working on the farm” and not available for an interview.

Bundaberg Mayor Jack Dempsey sees families like the Greensills as playing a pivotal role in establishing Bundaberg not only as the food bowl of Australia but the food bowl of Asia.

Last year, the council undertook a feasibility study into upgrading the city’s airport to allow 747 freighters to fly local produce to cities including Hong Kong and Singapore. Bundaberg grows 85 per cent of Australia’s sweet potato crop and 70 per cent of its chilli.

The Greensills alone have multiple farms covering more than 7000 acres around Bundaberg and produce close to a million cartons of sweet potatoes each year.

“The Greensills are one of the many great agricultural families in Bundaberg,” said Mr Dempsey.

The Greensills also are involved in a new ag tech centre run by the council, the Federal Government and CQ University that aims to improve farming techniques.

Despite his optimism, local leaders like Mr Dempsey remain concerned the collapse of Greensill Capital overseas will eventually be felt in Bundaberg. Agriculture, including cane, vegetables, fruit and nuts, contributes about $1.24bn to the region’s $4bn economy each year.

Mr Dempsey said he had spoken to Greensill Farms chief executive Damien Botha, who had given him assurances about job security and investment in infrastructure. But he cautioned: “We still don’t know how things will play out in the business world.”

While the Greensill family argues the farms are separate from their collapsed financial empire, as recently as a year ago they were boasting of the links between the two businesses.

Greensill Farms has “diversified into agribusiness and finance and is leading the industry for how the two markets can interact,” Greensill Farms told the council last year in its office development submission.

“The result of this is a business that drives regionally significant levels of employment and economic growth.”

Bundaberg Brewed Drinks managing director John McLean said it was sad to see a local business suffering.

“It is a tragedy for a family that is so well respected,” said Mr McLean, whose family-owned company produces the world famous Bundaberg Ginger Beer and is one the city’s biggest employers. “They are role models for young entrepreneurs.”

More Coverage