Lex Greensill denies fraud, says he’s sorry for finance group’s collapse

Lex Greensill has told Britain’s parliament he’s not a fraudster, as he took full responsibility for the collapse of his finance group.

Failed Bundaberg financier Lex Greensill has told Britain’s parliament that he is not a fraudster and said he bore “complete responsibility” for the collapse of his finance group Greensill Capital.

Testifying before a British parliamentary committee and making his first public comments since the collapse, Mr Greensill apologised for job losses resulting from his company’s demise, but refused to be drawn over its links to UK government lobbying.

And it emerged that former British prime minister and hired adviser David Cameron had furiously lobbied for Greensill Capital for more than four months, claiming he “was riding to the rescue’’ of his new friend, Mr Greensill.

However, as Mr Greensill was trying to rescue his reputation amid intensive questioning by the UK parliament’s Treasury select committee, the Financial Conduct Authority revealed it is investigating “potentially criminal” allegations made against Greensill Capital, its subsidiary Greensill Capital Securities and the oversight of the latter by its principal, Mirabella Advisers.

During questioning by the Treasury committee in Westminster, Mr Greensill denied that his business Greensill Capital, which provided billions of US dollars of finance to hundreds of companies around the world, including against non-existent future receivables, “was nothing more than a trick’’.

Mr Greensill told MPs: “In any investment there is risk, we took the history and current activity of our clients and data which enabled us to see what was going to happen in the future. I don’t accept your statement, but I do recognise any financial asset comes with risk.’’

He added that he spent tens of millions of pounds every year purchasing insurance to protect against losses that might arise.

“I continue to believe the business helped the broader economy,” he said.

Greensill Capital, which bypassed strict regulations forced upon traditional banks, specialised in short-term corporate loans via a complex and opaque business model that ultimately sparked its declaration of insolvency.

“Mr Greensill, are you a fraudster?” Siobhain McDonagh, an MP for the main opposition Labour party, asked.

“No, Ms McDonagh, I’m not,” the financier replied.

Mr Greensill failed to answer several questions, claiming he had been advised by the liquidators of his company that he couldn’t comment on specific clients.

Mr Greensill, the 44-year-old son of sugar cane planters, said: “I bear complete responsibility for the collapse of Greensill Capital.”

He said he was “desperately saddened’’ about resulting job losses and impacts on companies and took “full responsibility for any hardship” felt by clients, suppliers and investors.

“To all of those affected by this, I am truly sorry,” Mr Greensill said.

British parliamentarians have accused Mr Greensill of lending against transactions that never happened and that he and his company engaged in high-risk fraudulent activity.

It was put to Mr Greensill that “it seems a bit odd” he had crystal ball-like qualities to predict what was going to happen to different businesses, yet he couldn’t see “this gaping big hole in your own company’’.

Mr Greensill replied: “With the benefit of hindsight, it seems like you are right. One of the real lessons from the failure of my firm is that a heavy reliance on trade credit insurance is dangerous.”

Mr Greensill was also accused of looking to shift his high exposure to the British steel tycoon Sanjeev Gupta by obtaining British government coronavirus loans.

‘Let down’

But Mr Greensill blamed the failure of Greensill Capital on COVID-19, a concentration of his business to larger customers and the actions of the German regulator of the Greensill bank that created uncertainty about providing liquidity.

It was creditors including Credit Suisse and the Association of German Banks which last month placed the Australian parent of Greensill Capital into liquidation.

He also laid blame at insurer Tokio Marine, which withdrew cover to loans issued to Greensill clients amid the coronavirus pandemic.

“It’s deeply regrettable that we were let down by our leading insurer whose actions ensured Greensill’s collapse,” he said.

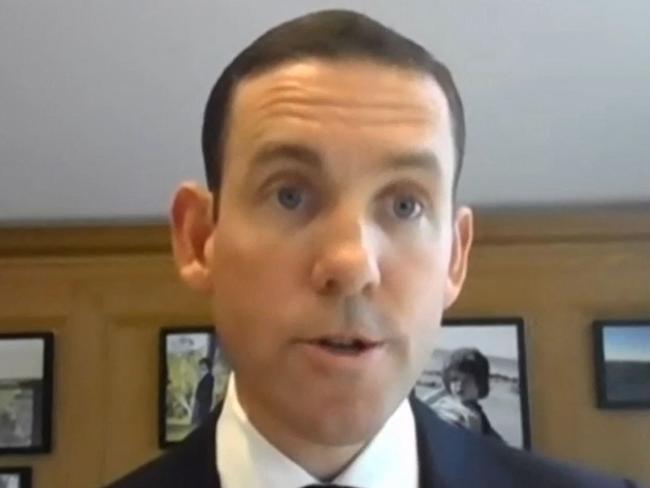

A large press pack had gathered outside Westminster for Mr Greensill’s appearance, but he gave evidence by videolink, apparently from his $2m country house in Saughall, near Liverpool, nearly four hours away.

The parliamentary appearance was the first time Mr Greensill has been seen publicly since Greensill Capital’s collapse earlier this year.

Greensill Capital began unravelling in March when insurance companies became spooked about the high leverage of loans provided to the British steel tycoon Sanjeev Gupta, the owner of the Whyalla steel mill in South Australia, although there were signs of problems in late December, 2020.

The collapse has seen steel and coal industries in the UK, Australia and the United States desperately try to find other sources of funding, while major firms like Credit Suisse, Softbank and even 26 German councils, have taken a big financial hit.

Mr Gupta’s steel empire GFG Alliance GFG runs Liberty Steel, which could be forced to shut some of its dozen UK plants following the collapse of its main financial backer, according to Business Secretary Kwasi Kwarteng.

Greensill Capital’s implosion threatens about 50,000 jobs overall at companies around the world that relied on its financing for their supply chains.

While the focus in the UK has been on Mr Greensill’s relationships with Mr Gupta and Mr Cameron, Australia’s former foreign minister Julie Bishop was also acting for Greensill in January 2020 at the Davos World Economic Forum.

Cameron links

In one of seven different investigations underway following the collapse of Mr Greensill’s $US7bn chain financing company, the Treasury committee is probing the relationship between Mr Greensill and Mr Cameron, who joined Greensill Capital two years after resigning from the government in return for a reported one per cent stake in the company.

Under investigation is how Mr Greensill was able to access the inner workings of 10 Downing Street in 2013 and 2014 with an office and an official business card showing he was “senior adviser, Prime Minister’s office” even though he had no formal employment contract. Parliamentarians are concerned about Mr Greensill’s ability to influence government policy, which then benefited his supply chain business.

Mr Cameron, who is also due to appear before the committee, is accused of abusing his political connections to seek hundreds of millions of pounds in taxpayer favours for Greensill Capital, and that he would be remunerated with share options.

Mr Cameron, who was pictured alongside Mr Greensill with the Saudi crown prince Mohammed bin Salman in January 2020, says he only worked for the company for 25 days a year.

On Tuesday the Treasury committee published correspondence showing that Mr Cameron harassed and lobbied British ministers with 25 texts, 12 WhatsApp messages, 11 calls and eight emails throughout a four-month period at the beginning of 2020.

At the beginning of the coronavirus pandemic Mr Cameron told one of his former parliamentary colleagues that he was “riding to the rescue … with my new friend Lex Greensill-my job”. In his messages, Mr Cameron told ministers that the Treasury’s failure to provide financial support to Greensill was “nuts” and “bonkers”.

On April 3, 2020, Mr Cameron, who has denied breaking any rules, sent a message to the Cabinet minister Michael Gove saying: “I know you are maniacally busy – and doing a great job, by the way (this is bloody hard and I think the team is coping extremely well. But do you have a moment for a word? I am on this number and v free. All good wishes Dc.”

Hours later Mr Cameron then sent a separate message to the chancellor Rishi Sunak wanting a “very quick word” about Treasury’s refusal to give Greensill Capital access to the taxpayer coronavirus facility, Covid Corporate Financing Facility (CCFF).

“HMT are refusing to extend CCFF to include supply chain finance, which is nuts as it pumps billions of cheap credit into SMEs,” Mr Cameron wrote. “Think there is a simple misunderstanding that I can explain.”

Mr Cameron then got back to Mr Gove, saying: “Am now speaking to Rishi first thing tomorrow. If I am still stuck, can I call you then?”

Mr Greensill said during the three hour Treasury quizzing that he had employed Mr Cameron as a pay-as-you-go-employee, and although he wasn’t a board member, Mr Cameron had a standing invitation to attend meetings. He refused to detail Mr Cameron’s remuneration but said his share options were worth less than one per cent of the company’s value.

“He advised us on the growth of our business… we added 100 countries to the number of countries which purchased receivables,’’ Mr Greensill said, explaining the value of Mr Cameron in promoting his company. As for Greensill’s four private jets, Mr Greensill said he and Mr Cameron travelled together on company aircraft “it was an efficient way to travel around’’.

Meanwhile Mr Greensill confirmed that Mr Cameron visited the Australian offices of an insurance company when the former prime minister was on a speaking tour of the country in 2018. It was formerly reported the company was BCC, which was Greensill Capital’s key insurance underwriter. The overarching insurance broker Marsh, was also in attendance, Mr Greensill said.

Mr Greensill said Mr Cameron also met with current and prospective customers in Australia.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout