Level of Covid-induced deferred loans falls to new low of $14bn

Deferred loans as a result of the COVID-19 pandemic have sunk to their lowest yet, with the scheme that gave relief to borrowers coming to an end.

Loans deferred as a result of the pandemic have sunk to their lowest yet, with the scheme that gave relief to borrowers finally coming to an end.

Overall, only $14bn of loans stood in deferral at the end of February, well down on their peak, according to latest figures from the prudential regulator.

In May last year, almost $245bn in loans were in deferral as borrowers scrambled to batten down the hatches in the face of what threatened to be an economic tidal wave.

The data from the Australian Prudential Regulatory Authority revealed the growth of new or extended loan deferrals had also shrunk as many more borrowers resumed repayment of loans.

“As expected, exits from deferral continue to significantly outweigh entries into deferral, with $22bn in loans expiring or exiting deferral and less than $500m entering or being extended,” APRA said.

Victoria is the state with the highest proportion of loans subject to deferral, at 0.7 per cent compared with the rest of the country at 0.4 per cent, though this difference tightened in February. At their peak in August last year, some 16 per cent of small and mid-sized business loans were in deferral in Victoria, Tasmania, Queensland and NSW.

It was a similar story with one in 10 home loans in Victoria in deferral in August 2020.

This follows comments by APRA deputy chairman John Lonsdale who told a parliamentary committee this week the regulator was pleased with the speed of the economic recovery.

“It’s a very significant reduction in deferrals,” he said.

“We think that’s a very good news story — that the vast majority of people on deferrals have moved on to paying their loans in (the) way that they were before.”

However, the regulator signalled it would closely watch the impact of the end of the JobKeeper supplement, which had supported many businesses and borrowers.

The latest data comes as the bank loan deferrals scheme, originally set to expire in September last year, concluded at the end of March.

However, Wednesday’s data is the last in the reporting series on non-performing loans from APRA.

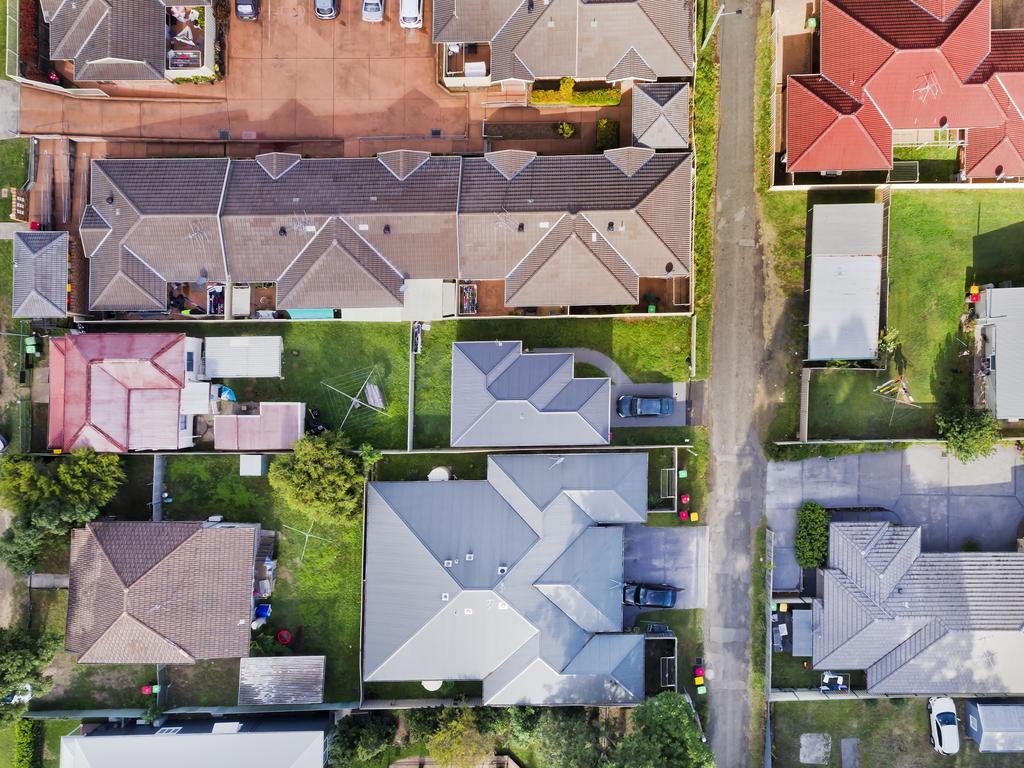

Housing continues to take in the lion’s share of total deferred loans, where almost $11.7bn remains on deferral.

This is well down on the almost $1.7 trillion of total home lending.

Only $1.5bn of business loans remains outstanding of the total $314.4bn in overall small business lending.

Commonwealth Bank is the best performer of the lenders. ANZ is the laggard of the big four for borrowers, with nearly 1 per cent of small and mid-sized business and housing loans still unable to resume paying.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout