Investment bank Canaccord Genuity hits options goldmine

The major investment bank regularly fails to provide clear disclosure about potential conflicts of interest in the companies it spruiks to clients.

One of the country’s most active investment banks, Canaccord Genuity, owns millions of options in the companies it spruiks as opportunities to its clients – and regularly fails to provide clear disclosures about the potential for conflicts of interest.

An investigation by The Australian has found that research notes and purchase recommendations circulated by Canaccord to clients about the companies that the investment bank has provided services to give little clear disclosure that its payments are partially tied to share performance.

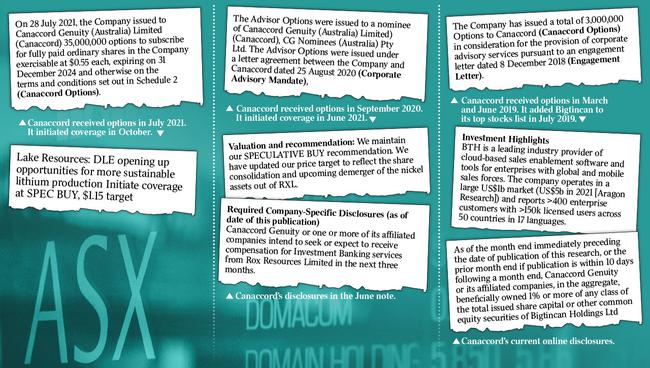

In October, Canaccord circulated a note to clients placing a “speculative buy” rating on ASX-listed lithium explorer Lake Resources and gave it a price target of $1.15. At the time, the company was trading at 77c per share.

In an extensive research paper, Canaccord analysts discussed the “superior sustainability credentials” of Lake Resources’s flagship Kachi project in Argentina, noting that its characteristics “could allow a more rapid capacity expansion” and that a lack of sales contracts “significantly” enhances its strategic value.

The paper does not disclose, however, that Lake Resources in July issued 35 million options to Canaccord as payment for investment banking services. Those options, which can be converted to shares for 55c each, would vest in four tranches as the company’s long-run share price rose.

Despite a lower profile than the larger investment banks such as Macquarie, UBS and Goldman Sachs, Canaccord has built a highly successful business specialising in smaller and medium-size companies listing on the ASX or raising additional capital. It has expanded significantly in the last three years, in 2019 purchasing rival broker Patersons Securities.

Canaccord now has more than 300 staff across its Melbourne, Sydney and Perth offices.

In another instance, Canaccord was issued one million options in Bigtincan, an ASX-listed training platform for salespeople, in March 2019, and another two million in June that year.

In July 2019, Bigtincan was added to Canaccord’s list of top stock picks. The bank’s equities analysts wrote that the company was “increasingly on the radar of domestic investors as the business matures” and cheap compared to more established peers.

Because the research note contained more than six companies, it did not include any specific disclosures – although an appendix did direct readers to visit the Canaccord website or write to the company to check if there were potential conflicts of interest.

Canaccord’s equities analysts continue to be bullish on Bigtincan’s future. Another note to clients, sent in June 2021, said Bigtincan was “evolving as a serious SaaS player” and had an “improving sales pipeline, likely accelerating growth rate, extensive product releases, unique functionality improvements, and a large cross-sell opportunity”. The share price could hit $1.55, it said.

On this occasion Canaccord disclosed on the note’s cover page that it had received a fee for its services in a capital raising late the previous year. In the appendix it added that it or one of its affiliated companied owned more than 1 per cent of Bigtincan.

Equities research circulated by investment banks and stockbrokers is a key communication tool in recommending positions for their clients. Major investment banks insist their analysis and recommendations are completely independent of their capital markets business, given the potential for significant conflicts of interest.

In a statement, Canaccord said it had “significant policies and procedures designed to ensure compliance with the securities law in all jurisdictions in which we operate. Like all integrated investment banking firms, our global research product, and our publishing research analysts are independent from sales and investment banking throughout our operations.

“As required by applicable securities laws, this independence is reinforced by information barriers and other compliance systems designed to separate research from other parts of our business and manage any conflicts of interest that arise.

“These systems include disclosures in our research reports designed to comply with the securities laws in all jurisdictions in which our global research product is disseminated … When Canaccord has a material ownership position in a covered company, we make the required disclosures.

“Like many investment banks, Canaccord regularly publishes research on companies for whom we act as underwriter, however, ratings, price targets and valuations of individual companies are determined by the publishing analyst and are vetted through our global research supervisory system.”

The Australian is not suggesting Canaccord broke disclosure rules, only that more explicit disclosure of options would benefit clients using its research to inform investment decisions.

‘No clear standard’

The corporate regulator has long had its sights on equities research and brokers’ notes circulated by companies that are also in the advisory and capital markets business. In 2016, an ASIC review found “some instances of firms’ corporate advisory staff seeking to influence their research team to cover particular companies or to adjust their approach to valuation”.

That review, however, was focused on the possibility that material, non-public information could end up in the hands of only a small number of investors – those that subscribed to the analysis.

“Conflicts, whether real or potential, may adversely affect the independence and reliability of research reports. If these conflicts are too difficult to manage they should be avoided,” the review concluded.

“Where conflicts arise, it is important that firms’ research reports accurately disclose them so that users of those reports can have confidence in the integrity of the research and decide how much reliance they should place on it.”

One firm that has been caught up in regulatory action over its research function is Foster Stockbroking, which in November 2017 was hit by an enforceable undertaking following an investigation.

Those inquiries related to the July 2015 float of small-cap tech company Reffind, for which it acted as the sole lead manager. Not only was ASIC concerned that Foster Stockbroking gave its own directors preferential treatment, it also had “no effective separation of (its) research function from its other functions and a research report about (Reffind) was written by the head of investment banking at Foster Stockbroking, who had an ongoing corporate advisory role with (Reffind)”.

“At the time of the publication of the report, both the head of investment banking and associates of Foster Stockbroking had significant holdings in Reffind that were not adequately disclosed in the research; and statements contained in the research in relation to its objectivity were potentially misleading,” the regulator concluded after an investigation.

In its recent equities notes, Foster Stockbroking now displays its disclosures prominently. One note produced in December for Prospect Resources noted that the analyst writing the research owned 71,000 shares in the company while associated entities owned more than three million shares.

The firm’s chief executive, Stuart Foster, told The Australian on Sunday that there needed “to be a standard, or at least a stronger recommendation, laid down by ASIC so that everyone can follow the same rules”. “We’ve adopted a policy of putting full disclosure of all our holdings and of any related party. We put all of that at the top of the note so no one can say that we didn’t disclose that we had a position in a stock or had dealings with a company,” he said. “The problem is there’s just not a clear standard. And there should be, not just for brokers but for funds too.”

Vested interest

In September 2020, Rox Resources quietly issued 60 million options to Canaccord in exchange for services and assistance “with its ongoing capital markets strategy”. According to the appendix to an ASX announcement, a third of the options could be exercised at 10c per share, another third at 12.5c and the final third at 15c. They would expire in December 2023. At the time the options were issued, the shares were trading around 5c.

Six months later, with shares at 3.4c, Canaccord published their first piece of research on Rox Resources. The note rated the company a “speculative buy” and gave it a price target of 10c.

“Rox is busily crunching the numbers ... which will likely include updates to the existing resources at (the Youanmi gold project in Western Australia),” the note reads. “With consolidation an ongoing trend in the region/sector, we believe Rox may appear on the radar of potential acquirers.”

The research report’s cover page noted Canaccord had received a fee for a capital raising conducted in May. In the appendices, it noted: “Canaccord Genuity or one or more of its affiliated companies intend to seek or expect to receive compensation for Investment Banking services from Rox Resources Limited in the next three months.”

But there is no clear mention of any options. Either way, Canaccord clients who took that advice would have benefited greatly. Shares now trade near 50c.

In August 2019, wagering technology firm BetMakers agreed to issue Canaccord 10 million options with an exercise price of 6c and an expiry date of July 2022. Nine months later, in May 2020, Canaccord began its coverage of the company with a price target of 40c.

“We see a variety of opportunities for BetMakers to leverage the capabilities it has developed in Australia to play a critical role in growing the size of race wagering in New Jersey, and assisting bookmakers to develop a highly profitable add-on product to their sports betting offering,” wrote the Canaccord research team.

Over more than a dozen pages, Canaccord explained its recommendation, describing how the technology would be used in new mobile applications developed in conjunction with Tom Waterhouse and noting major themes in the bookmaking industry.

The cover page noted a fee paid to Canaccord for capital raising work, and the appendix said the investment bank intended to seek or expected “to receive compensation” in the next three months.

On Canaccord’s online disclosure log, the company now makes this disclosure: “The primary analyst, a member of primary analyst’s household, or any individual directly involved in the preparation of this research, has a long position in the shares or derivatives, or has any other financial interest in BetMakers … the value of which increases as the value of the underlying equity increases.”

Canaccord is based in Vancouver and is one of the largest financial services firms in Canada. It is unusually bullish on the stocks it watches. Of 956 covered by its equities analysts, it currently recommends selling just eight.

Dean Paatsch, director of proxy and governance risk advisory firm Ownership Matters, said it was “undeniable that there is a conflict there that most retail punters wouldn’t appreciate”.

“There’s nothing in and of itself that is wrong with options being part of the consideration for capital raising (fees),” Mr Paatsch told The Australian. “But if the holder of the option is promoting the stock price, that’s not necessarily in the interests of the client. And just sheer disclosure alone doesn’t necessarily remedy that conflict.”

Independent research

Canaccord declined to respond to specific questions or examples raised by The Australian last week.

“The value of ownership positions is recorded in our publicly available financial statements in accordance with (International Financial Reporting Standards), such that unrealised gains or losses in these positions are recorded as part of revenue. We refer you to our financial disclosures for more information,” the company said in a statement on Sunday.

The most recent accounts lodged by Canaccord’s Australian operations, for the 12 months to the end of March 2021, show the company had financial assets worth more than $55.6m. The majority of those were unlisted options valued at $38.2m. Options in listed companies, the accounts show, were worth $1.9m and shares in listed corporations were worth $11.6m. That was a rise from financial assets valued at $7.3m in the previous financial year.

In all, Canaccord’s local operations recorded a profit of $42.9m for the year. It raised more than $124.8m from corporate fees for investment banking services.

The firm’s head of research, Aaron Muller, said: “It’s very simple: our research analysts are completely independent. We have built the largest and most experienced small cap research team in the market. That requires significant investment. We are research-led and always have been. It’s the foundation of our business.”