Ideologies clash in battle for superannuation reform

At last month’s Senate hearing Silk accused the government of bizarre and unjustified intervention that would bring sovereign risk to the sector.

Last week, Treasurer Josh Frydenberg dialled up the pressure on industry super by proposing new rules on the independence of proxy advisers, which would spell the end of the industry super-owned ACSI. Proxies are increasingly influential with public company boards on everything from executive remuneration to climate policies.

What we now have running alongside the Your Future, Your Super bill is a tense negotiation steeped in politics and ideology that will determine the new ground rules for super.

Silk says the reform agenda, which aims to save Australians almost $80bn over 10 years, is already reshaping the sector. The pace of consolidation is far faster than industry forecasts of five or six years. “The frenetic activity we are seeing with funds either merging or discussing potential mergers with other funds will see the industry in dramatically different shape in just two to three years,” says Silk.

“We had one fund that has said to us they want to come to this fund; we are in discussion with a number of others. I don’t think there would be a single fund, I say that advisedly, not a single fund that is not in discussion with at least one other fund.”

The political backdrop to reform is the rise in influence of industry funds fed by billions of dollars of inflows. “Profit for member funds”, as they like to be called, are union- and Labor-backed and they control the default funds of millions of Australians.

Unfortunately for the government, industry funds snatched the moral high ground after the royal commission exposed fee gouging by the for-profit retail sector and then rubbed it in by spending member money on shock advertisements like The Fox and the Henhouse.

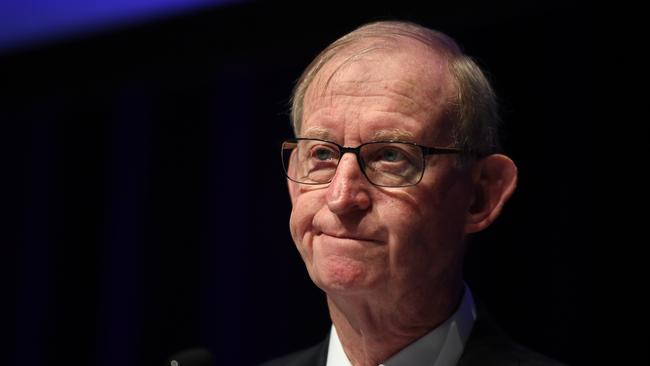

The well-respected Silk is calling for partisanship in super to end, but this is unlikely.

The Your Future, Your Super Bill wants industry super to put members’ financial interest first, not just members’ interest. That’s fine, says Silk, but he baulks at government intervention.

“The most concerning provision is the one that would allow the government to identify any expenditure, without materiality, or investment that it doesn’t like, and say to the fund ‘you need to unwind that’,” he says.

“Can you imagine a government saying we don’t like a super fund investment in coal-fired power station or on the other side, maybe solar-powered?

“Funds have a fiduciary duty to act in the best financial interest of their members. It just seems regulatory overreach to have the government able to put their hands into a fund’s investment portfolio and direct the fund not to proceed with an investment.”

Threat overplayed?

Yet surely this change is aimed more at industry fund investments in The New Daily or advertising spending, where it is unclear how the spend is in members’ financial interest? Is it not rather alarmist to talk sovereign risk?

“It is only alarmist based on a plain reading of the bill. If the bill was written in a way to preclude that from happening, then we wouldn’t have mentioned it. You show anything in the Senate reading speech, media release, or politicians’ speeches that precludes it from being used that way.”

Silk agrees that The New Daily (soft left on the media spectrum and often critical of government) is in the crosshairs. “I don’t know whether the government has anything else in mind, but clearly they have The New Daily in mind.”

The super chief says The New Daily was a one-off spend for AustralianSuper. It no longer has direct ownership but the masthead has been passed to Industry Super Australia, the peak body owned by the industry super sector.

The New Daily, he says, is used as tool to engage with members and to improve their financial interest and awareness. “We know where members go to — we track that online. The vast majority of members spent more time on the financial advice, superannuation elements of The New Daily than they do elsewhere.”

In any case, Silk argues, if it does not meet the best financial interest test, both APRA and ASIC have the power to intervene.

On any measure, AustralianSuper is at or near best in class in the industry super sector and is on track to return a remarkable 16 per cent this June. But there have been other industry funds into which workers have been unwittingly defaulted which have made a mockery of “member first”.

‘Opaque and unaccountable’

To its critics, industry super is opaque and unaccountable. Public companies have shareholders who can vote on directors. Members of industry funds, often defaulted into them, do not have that power.

Industry funds appoint “representative boards” half by union and half by employer organisations — people who have member interests and not profit-making at heart, they argue.

Numerous attempts to change this and introduce independent trustees with greater investment skills, including one by David Murray in 2014, have been thwarted. Years later, industry funds flexed their muscles against Murray as AMP chair. The government finally abandoned its push on board changes in 2018.

Silk agrees industry funds need to be transparent. “This is a compulsory system, we are a large organisation, we’ve got a degree of economic power and influence. All of those things point to being open, accountable and transparent.

“The befuddling part for me is there are suggestions that this fund is not transparent. I would invite you to put to me areas where we can improve, because I genuinely want this organisation to be known as the most transparent and accountable superannuation fund in the country.”

Well, there is the fact that members cannot vote a trustee off a board. That said, Silk insists accountability is there. For almost two decades, AustralianSuper has been running annual member meetings.

“In that 20 years we have never ruled a question out of order, never refused entry. We say we are here as your fund, go your hardest with any issues you’ve got.”

Unlike some others in financial services, Silk says for years AustralianSuper has broken out the top five earners in the business (who often earn more than the CEO). The website already provides members with a detailed breakdown of the assets, including shares they are invested in.

“That is part of being actors in a compulsory system, so annual member meetings, portfolio volume disclosure, that’s absolutely appropriate. And if funds aren’t doing it now, absolutely appropriate for the government to mandate.”

Holding funds to account for underperformance is a government priority. Nothing wrong with that either, says Silk, especially now the government is including administrative fees in the test.

“The concern was that funds could shift some of their cost from the investment category into the admin category and not have to have them counted.” While Silk accepts the decision to start the test with the MySuper default funds, he says there needs to be short unambiguous timetable to ensure it applies system-wide.

“The reason for this is not a silly industry fund versus retail fund argument.

“It is because as the Productivity Commission report showed there are millions, not thousands, of Australians in poor performing funds. Many of them are not default funds. Every year that goes by those people are losing money.”

Look across industry super boards and expertise in investment is on the rise. But the union-appointed quota of half the board remains uncomfortable for any Liberal government.

Industry super now has a 10 per cent stake in many ASX-listed companies and owns its own proxy firm ACSI which provides recommendations on how to vote at company meetings.

Last week, Frydenberg took aim at all four big proxy advisory firms. It wants more accountability and transparency, but one specific ask of proxy advisers is that “if their client is a super fund, they be independent from their client”. “The clause is clearly targeted at ACSI,” Silk says. “And I fail to see what the argument is there. Let’s say ACSI is disbanded tomorrow, AustralianSuper would probably take this function in-house. Well there is no independence there.”

Not before time, Australia’s $3 trillion super system, the place where Australians’ retirement nest eggs are housed, is reforming as the government pushes ahead with its Your Future, Your Super legislation. Leading the mission to ensure industry super does not take a backwards step is Ian Silk, CEO of the largest industry fund AustralianSuper, with $200bn of funds under management.