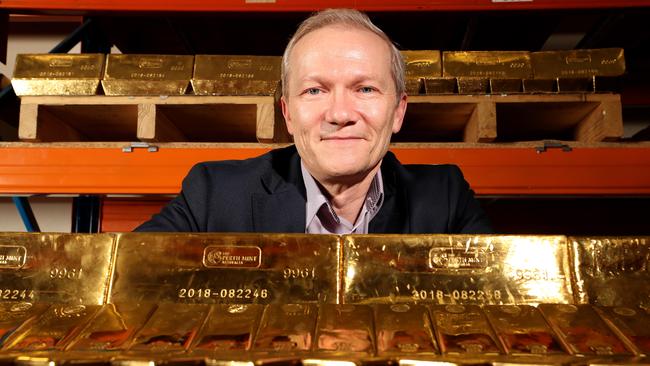

Gold surge lifts Perth Mint haul to record $4bn

The Perth Mint’s gold holdings have surged to a record value amid heightened concern about the economic outlook.

The Perth Mint’s gold holdings have surged to a record value amid heightened concern about the economic outlook and the future of paper money.

The chief executive of the mint, Richard Hayes, said his holdings of gold and other precious metals had pushed above $4bn by value in recent weeks, its highest level.

Mr Hayes said concerns about fiat currency — the government and bank issued money most people use, which isn’t backed by anything — were motivating central banks and individuals to buy more gold, which underpinned the global monetary system on and off until 1971 when it was $US35 an ounce. “Globally, government debt problems were never solved. In fact, when Donald Trump assumed office US sovereign debt was $US18 trillion. Now it’s $US23 trillion. All this fuels concerns about printing money in the future,” Mr Hayes said. “It will all come home to roost at the end of the day.”

The Perth Mint — the largest central bank grade vault in the southern hemisphere, and the only one in Australia whose holdings are guaranteed by government (Western Australia) — said the value of its gold holdings had increased about 20 per cent over the past 18 months.

“A lot of the demand globally is central bank buying, mainly Russian and Chinese; the Poles are big buyers too,” Mr Hayes said, adding that the mint stored gold for about 40,000 clients, half of whom were from Australia.

The price of gold per ounce reached a record high of $2285 earlier this month, up 29 per cent in 12 months, and 88.5 per cent over a decade.

The Reserve Bank sold its gold reserves, about 167 tonnes, for $2.4bn, or just over $400 an ounce, in 1997. “The whole Washington Accord was founded on to some extent (the) false premise that gold was no longer relevant,” Mr Hayes said, referring to a 1999 agreement among governments to co-ordinate sales of their official gold reserves. In US dollars, the gold price reached a post-GFC high of $US1550 an ounce in August amid concern about the China-US trade war.

Citi lifted its medium-term gold price forecast on Thursday to $US2000 — above the record in 2011 of $US1895 — saying the precious metal would trade “stronger for longer” amid geopolitical uncertainty.

The mint had noticed increased interest in storing silver, which trades about $US18 an ounce, over the past six months. “The rise of the far left and far right, Brexit, a war in Syria, Chinese territorial expansion, the rise of Russia, and the energy war between London and Tehran has all fuelled the rise in precious metals,” Mr Hayes said.

The RBA has canvassed the possibility of quantitative easing — creation of new money to buy existing assets — following in the path of central banks abroad.

Concerns about the safety of financial systems since the GFC have also prompted growth in the share of cash outstanding in advanced countries. Despite declining use of cash for transactions, the value of banknotes in circulation has increased to 4 per cent of GDP in Australia, higher than 50 years ago.