Future Fund ‘voiced concerns’ to Rio Tinto

The nation’s sovereign wealth fund has confirmed it demanded further action from Rio Tinto over the destruction of the Juukan Gorge caves.

The nation’s sovereign wealth fund has confirmed it demanded further action from Rio Tinto days before the miner forced the resignation of its chief executive over the destruction of the Juukan Gorge caves.

Appearing at a Senate estimates hearing on Wednesday, Raphael Arndt, the chief executive of the $163bn Future Fund, also signalled he was not yet satisfied with the steps taken by Rio Tinto to ensure the failures that led to the blasts have been remedied.

“We did have a meeting with the Rio Tinto board around this issue and it was attended by the chair and myself. At that meeting we did voice our concerns,” Dr Arndt told the hearing.

“We expressed the view that we didn’t think at that time that the consequences were sufficient.”

Rio Tinto in September buckled to investor pressure following months of criticism over the destruction of the sites and announced its chief executive Jean-Sébastien Jacques would leave the company once a replacement was found. Two other key executives, iron ore chief Chris Salisbury and corporate relations head Simone Niven, were also pushed to exit.

“I think it’s certainly a strong statement that that type of outcome is unacceptable for the company and also for its shareholders, Dr Arndt said of the departures.

“It’s certainly a good sign that the board was responding to the strong engagement from ourselves and also a large number of other shareholders both in Australia and the UK and elsewhere.

“But it remains to be seen how the company will improve its processes and ensure that that type of situation doesn’t occur again.”

Dr Arndt’s comments suggest that the Future Fund is looking for Rio Tinto to take further social responsibility steps even after the outgoing Mr Jacques last week detailed to a parliamentary hearing the changes the miner had made in recent months, including that it was undertaking a review of all activities that had the potential to impact heritage sites.

Dr Arndt also said the Future Fund had beefed up its resources to better deal with environmental, social and governance issues.

“We’ve always thought that ESG issues … are important. In respect of listed holdings in Australia and elsewhere, we have always exercised our ownership rights through proxy voting. It’s fair to say that we’re devoting more resources now,” Dr Arndt said.

But the fund was not becoming more activist, he said, and still preferred to engage with companies rather than divest.

Dr Arndt’s appearance at the estimates hearing came hours after the Future Fund revealed it had grown its funds under management by 1.1 per cent in the September quarter and had boosted its cash position as it readies to “take advantage of opportunities that arise in the current market”.

The Future Fund was sitting on funds of $163bn at the end of September, up from $161bn at the end of June, and has earned over $102bn since its inception in 2006.

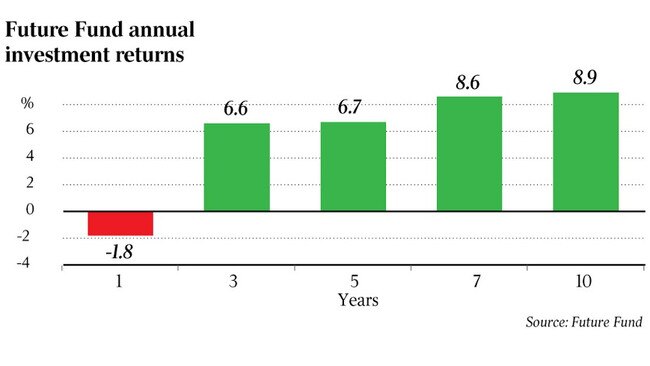

But it is still counting the cost of the sharemarket crash this year, with its one-year return in negative territory at minus 1.8 per cent.

Total funds under management, which include the Medical Research Future Fund, stood at $210bn at the end of the September quarter. Over the same period, the fund bolstered its cash holdings to $31.2bn.

Chairman Peter Costello said the fund had performed strongly through the crisis as he warned on the investment outlook.

“The global economy has begun to rebound and is showing signs of consolidating. Markets in some developed economies have fully recovered the price falls brought on by the COVID shock.

“Whether this can be maintained depends on the health outlook, the level of government lockdowns, and the support of expansionary fiscal and monetary policy. Given the extent of economic dislocation globally, we remain cautious about the long-term investment outlook,” he said.

While the fund’s one-year return was negative, its 10-year return was 8.9 per cent and its return since inception is 7.4 per cent.

Global equities accounted for a quarter of the fund’s total assets at the end of September, while cash sat at 19 per cent, alternatives at 15 per cent and private equity at 14 per cent. Australian equities accounted for 6.5 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout