Fears big banks’ bonus system leads to poor conduct

Bonuses make up more than half the salaries of the big four’s top bankers.

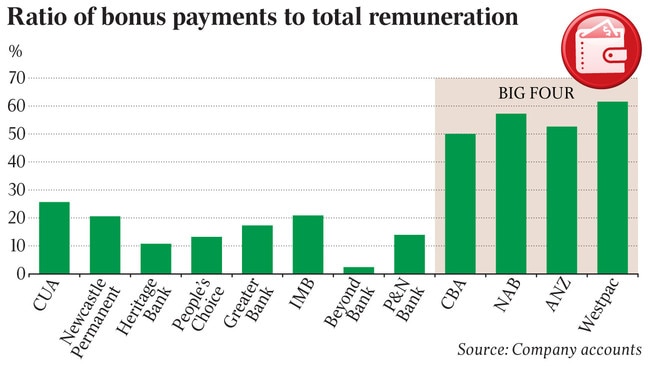

Bonuses make up four times as big a share of top managers’ pay at the four largest banks compared to their equivalents at customer-owned banks, analysis shows, fuelling concern that pay incentives might be motivating poor conduct in the finance sector.

At the nation’s four largest banks, almost 55 per cent of the $212 million in pay their 151 top managers earned last financial year was made up of bonuses, according to an analysis of banks’ regulatory disclosures, which require financial institutions to identify “senior managers” and reveal the composition of their pay.

At the top-10 largest customer-owned banks, which identified 107 senior managers over the same period, 12.5 per cent of their $52m in total pay comprised bonuses.

“Bonuses linked to listed shares necessarily shift the focus from customer outcomes to profit maximisation,” said Melina Morrison, CEO of the Business Council of Co-operatives and Mutuals.

The banking regulator is poised to release a review of senior executive remuneration at large financial institutions, foreshadowing new rules from July that give it the power to claw back bonuses and require a portion of incentive pay to be deferred for up to four years.

“It examined the extent to which remuneration outcomes were consistent with good risk management and long-term financial soundness,” said Australian Prudential Regulation

Authority chief Wayne Byres, speaking before a parliamentary committee last Wednesday.

New revelations of misconduct at the major banks at Justice Kenneth Hayne’s royal commission have prompted renewed focus on payment structures, including calls to scrap commissions and bonuses linked to the size and number of mortgages written.

James Shipton, in his first speech as head of the corporate watchdog, ASIC, last week said finance was not “just a means to receive a commission or a bonus”.

“Too often, those working in finance are so focused on complexity, or their particular specialisation, or their own commissions or bonuses that they lose sight of the broader purpose,” he said.

Westpac’s 25 “senior managers”, a term defined by APRA to include executives and employees who have “the capacity to affect significantly (a bank’s) financial standing”, received the highest proportion of their pay in bonuses, at 62 per cent.

The biggest credit union, CUA, issued just over 25 per cent, while two mutual banks, Bank Australia and Teachers Credit Union, paid no bonuses, according to analysis by The Australian.

Anna Bligh, head of the Australian Bankers Association, said banks faced “fierce” competition for talent with tech firms and within finance.

“Banks often use a different mix of bonus and base salary to poach the right people to key positions,” Ms Bligh said.

Banks are curbing use of bonuses for retail staff and third-party referrers selling mortgages, credit cards and deposit accounts, following recommendations from a review by senior public servant Stephen Sedgwick.

Chris Whitehead, the chief executive of FINSIA, a professional body for the financial services sector, said incentives were “powerful at every level but the further up the corporate ladder they are the larger those incentives become financially”.

“Some pay structures put the shareholders ahead of the customer, while at customer-owned banks customers are higher up the hierarchy,” he said.

Building societies and credit unions, the two biggest categories of customer-owned banks, held about 1 per cent of the assets in the banking system late last year, compared to the majors’ 76 per cent. “The challenge for the customer-owned banks is they haven’t had a strong sales culture, so on the one hand perhaps they have not had the same problems, but on the other they haven’t been increasing market share,” Mr Whitehead said.

Bank regulators in Europe and the US have struggled to reconcile the tension between governments’ desire for banks to act in customers’ best interests and banks’ rights as legally private firms to maximise the incentive of their staff to generate revenue.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout