Commonwealth Bank to pay $700m in settlement with Austrac over anti-money laundering claims

Austrac says CBA is too slow to fix compliance systems, as it was cautioned against passing a $700m fine on to customers.

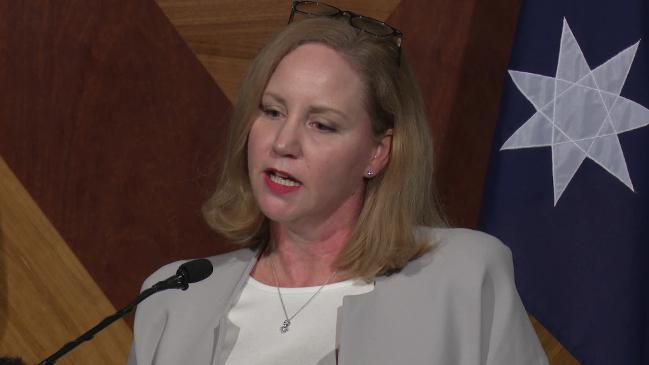

Head of the anti-money laundering agency Austrac, Nicole Rose, has slammed Commonwealth Bank’s plan for a five-year overhaul of its compliance systems as taking “too long” and urged the lender to hasten its remediation program.

Speaking after striking a $700 million settlement with the nation’s largest bank -- the biggest corporate penalty in Australian history -- Ms Rose said she was “certainly surprised” by an admission from CBA’s chief risk officer last week that it would take up to five years to complete a thorough overhaul of the bank’s risk management department.

CBA chief risk officer David Cohen, appearing at the royal commission into banking and financial services last Wednesday, said a revamp of the bank’s systems to measure and report on risk would likely take between three and five years because of the “significant investment” needed to “invest in large projects like that”.

Ms Rose said she was “certainly surprised by the length of time” planned for the overhaul.

“A company that’s got over 50,000 staff, I can’t imagine it’s a small task, but three to five years is too long,” Ms Rose said.

She said Austrac would be “looking at a remediation program with a time frame a lot shorter than that”.

Ms Rose also defended the size of the settlement. Had CBA been stung with the maximum penalty available under the law, the bank would have faced a $1 trillion fine. She said a penalty of that size would never have been enforceable.

“We think this an appropriate settlement and it reflects the extent of the non-compliance,” Ms Rose said.

“This needs to be a deterrent. It’s going to need to be a punishment,” she said.

The $700m settlement with Austrac was almost double the bank’s previous estimates for breaching regulations more than 50,000 times.

CBA will also Austrac’s costs of $2.5m, after admitting to breaching anti-money laundering and counter-terrorism financing legislation, including failing to properly carry out risk procedures and customer monitoring. Some of Austrac’s allegations were dismissed as part of the mediated deal.

As part of the settlement, which must be approved by the Federal Court, CBA also admitted further law breaches beyond those already conceded.

Treasurer Scott Morrison cautioned CBA against passing on the penalty in higher fees and charges on its customers, as government ministers said the breaches “should never have been allowed to happen”.

“It is for them to incur these penalties and get on with the job of restoring trust in the conduct of the CBA,” Mr Morrison, adding he did not think the bank will pass on the penalty to the public. “So I am sure CBA would be thinking about that very, very carefully.”

CBA shares surged nearly two per cent in early trade following the settlement, as investors welcomed the removal of uncertainty over the issue. CBA shares closed up 1.44 per cent at $69.69 after briefly breaking through $70.00.

CBA (CBA) had put aside $375 million in a provision for possible penalties stemming from Austrac’s allegations, which were launched in the Federal Court last August.

CBA’s intelligent deposit machines, which were rolled out in 2012, failed to automatically send the regulator information about potential washing of money through its smart ATMs by criminal syndicates and terrorist financiers.

The bank’s provision of $375 million for a civil penalty, set out in its interim result on February 7, was described as a reliable estimate of the expected penalty, taking into account legal advice obtained by the bank in relation to Austrac’s claims.

CBA chief executive Matt Comyn said the agreement still needed to be approved by the Federal Court.

“While not deliberate, we fully appreciate the seriousness of the mistakes we made. Our agreement today is a clear acknowledgment of our failures and is an important step towards moving the bank forward,” Mr Comyn said. “On behalf of Commonwealth Bank, I apologise to the community for letting them down.

“In reaching this position, we have also agreed with Austrac that we will work closely together based on an open and constructive approach.”

The Federal Court could still decide to impose a higher or lower fine on the bank, and CBA said it would book the $700m provision in its accounts to be unveiled in August.

As part of the settlement, CBA agreed it had filed late 53,506 transaction reports for cash deposits through its intelligent deposit machines. The bank also had inadequate risk assessment requirements for the ATMs on 14 occasions. The lender further failed to properly monitor its customers, with the late filing of 149 suspicious matters and sloppy customer due diligence in 80 instances.

“We are committed to build on the significant changes made in recent years as part of a comprehensive program to improve operational risk management and compliance at the bank,” Mr Comyn said.

The bank has spent more than $400m overhauling its compliance systems.

“We have changed senior leadership in the key roles overseeing financial crimes compliance supported by significant resources and clear accountabilities,” Mr Comyn said.

“We have started implementing our response to the recommendations provided to us by our prudential regulator, APRA, to ensure our governance, culture and accountability frameworks and practices meet the high standards expected of us.

“Today is another very important step forward, and continuing to make the changes we need in an open, transparent and timely way is my absolute priority as CBA’s new chief executive,” Mr Comyn said.

CBA previously said it would defend itself against the “majority” of the expanded claims brought against it and has “categorically” denied liability in a separate class action.

Austrac chief executive Nicole Rose said in April she was open to a settlement with CBA over the alleged breaches.

The federal government welcomed the “successful and speedy” settlement.

Home Affairs Peter Dutton said CBA’s disregard of its anti-money laundering and counter-terrorism obligations had allowed criminals to exploit its systems and put the Australian community at risk.

“This very large number of breaches over several years is unacceptable and should never have been allowed to happen,” Mr Dutton said.

Treasurer Scott Morrison said the law was non-negotiable, especially when it came to the country’s largest financial institutions.

“The government is serious about enforcing any breaches,” he said. “Banks should be leaders in ensuring their systems cannot be compromised by criminals seeking to launder money or finance terrorist activities.”

Labor opposition assistant treasurer Andrew Leigh said the size of the fine reflected the gravity of CBA’s wrongdoing.

“Again it reinforces the call we have been making for the last two years for a royal commission,” Dr Leigh told Sky News. “We have seen from CBA alone, scandals ranging from children’s bank accounts to charging dead people for work that hadn’t been done.”

With AAP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout