Commonwealth Bank in sights of property developer Rory O’Brien

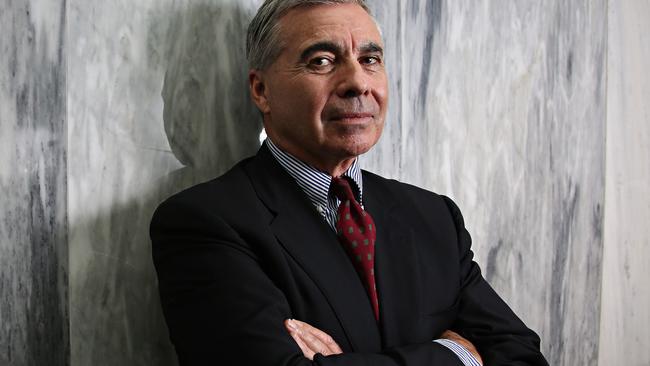

Property developer Rory O’Brien will today attempt to inflict damage on Commonwealth Bank.

Compared to the “total financial annihilation” he suffered at the hands of Commonwealth Bank, property developer Rory O’Brien’s capacity to inflict lasting damage on his tormentor seems limited, at best.

This morning, however, Mr O’Brien will give it his best shot.

He will tell a federal parliamentary committee the full, uncensored story of the 2009 collapse of his luxury $282 million Whisper Bay project in the Whitsundays, and spice it up with a blow-by-blow account of the bizarre, confidential settlement reached with CBA five years later when he recanted all the serious allegations he had made against the bank.

The joint committee on corporations and financial services, which is investigating the impairment of customer loans, has gone out of its way to accommodate him.

By confirming in writing that parliamentary privilege overrides any confidentiality obligation in a contract, it has set the stage for Mr O’Brien to appear — megaphone if needed — at the Sheraton Wentworth Hotel in Sydney at 9am.

“I will be sharing with the committee CBA’s atrocious dealings with me over the years, the legal action I took against them, and the nature and terms of my confidential settlement with the bank,” Mr O’Brien told The Australian yesterday from his office in Double Bay, Sydney.

“Until now, I’ve been constrained by confidentiality but I now have the opportunity to assist the government in getting to the bottom of CBA’s actions in relation to the acquisition of Bankwest and its appalling treatment of inherited Bankwest customers.”

Until last year’s settlement, Mr O’Brien had alleged CBA engaged in unconscionable conduct by effectively demanding immediate repayment of $178m in loans for the Whisper Bay project at Airlie Beach in Queensland.

The bank, he claimed, intended to benefit from his loan default by invoking a clawback arrangement in its $2.1 billion acquisition of Bankwest in 2008, when the financial crisis was closing in.

CBA has strenuously denied this several times, and once again for the benefit of this committee, with chief legal counsel and head of group corporate affairs David Cohen saying last month that the bank “categorically” denies manufacturing defaults to lower the Bankwest purchase price.

It says any adjustment to the acquisition price had to reflect provisions made by Bankwest before the ownership change on December 18, 2008.

Not only that, but all disputes had to be resolved by an independent umpire before July 2009, with the expert ultimately ruling that CBA had to pay $26m more, not less.

The committee’s probe into customer impairments is the sixth parliamentary inquiry into the banking sector in the past 12 months. An inquiry in 2012 also raked over the coals of the Bankwest acquisition.

CBA will have an opportunity to respond to the committee on December 2.

Whisper Bay stands as a monument to a different era in banking. The 104-villa project was successfully marketed in the Middle East through the Duke of York, Prince Andrew, and was on budget and all but complete, with $106m in pre-sales to buyers including former prime minister Bob Hawke.

Mr O’Brien told this newspaper in 2013 that CBA’s move to pull its loan had caused him “total financial annihilation”.