Come get the cash, banks tell business

Australia’s big banks are urging small businesses to apply for loans and not tough-out the COVID-19 crisis on their own.

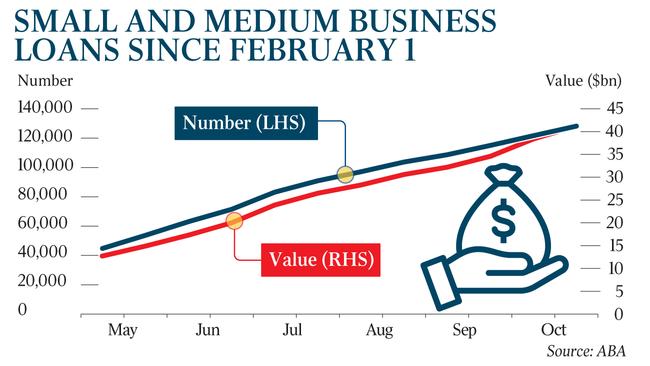

Australia’s big banks are urging small businesses to apply for loans and not tough-out the COVID-19 crisis on their own, as data reveals lenders have approved more than $41bn for SMEs and sole traders since February.

Figures released by the Australian Banking Association show approval rates for loans have

remained high throughout the pandemic, at about 70 per cent of applications received.

In the six weeks to October 7, as COVID-19 restrictions eased across the country, more than $9bn was loaned to small and medium businesses and sole traders. With SMEs contributing more than a quarter of Australia’s GDP and employing almost half of the Australian workforce before the pandemic, ABA chief executive Anna Bligh said the major banks were ready to help businesses expand and access finance. Since February, more than 128,000 Australian firms have accessed support from the banks, with an average loan size of $320,000.

“Australian banks are continuing to provide a lifeline to small and medium businesses across the country. The rate of lending has held up strongly despite the pandemic,” Ms Bligh said.

“These small businesses will drive Australia through the crisis and, after it has passed, employ millions of Australians as the economy rebuilds.

“Banks remain ready to give small and medium businesses the support they need to survive COVID-19.”

The ABA said total lending to all businesses had reached more than $200bn since February 1, with banks continuing to remove merchant fees and defer business loan repayments to help SMEs through the pandemic.

The banks have written more than 500 new SME loans a day for more than 250 days.

Despite the strong rate of lending, demand for credit remains weak, with the Reserve Bank reporting that demand for new loans was low due to economic uncertainty.

Josh Frydenberg said the government was working closely with the banks and regulators to enable the deferral of loan repayments and inject greater flexibility to support customers.

“Credit is the lifeblood of the Australian economy, with billions of dollars in new credit extended to households and businesses in Australia each month,” the Treasurer said. “As Australia continues to recover from the COVID-19 pandemic, it is more important than ever that there are no unnecessary barriers to the flow of credit so that consumers can continue to spend and businesses can invest and create jobs.”

Mr Frydenberg said the government was supporting the most significant reforms to Australia’s credit framework in a decade to “increase the flow of credit to households and businesses”.

“Maintaining the free flow of credit through the economy is critical to Australia’s economic recovery plan,” he said.

Mr Frydenberg said the government’s coronavirus SME Guarantee Scheme, which was extended and expanded on October 1, had helped more than 20,000 businesses access cheaper funding to help them “adapt and innovate” during the pandemic. In March, the federal government relaxed rules around responsible lending obligations to help small businesses access credit quickly.

Ms Bligh said Australia’s banks remained “open for business for small business customers”.