Climate change risk to hit insurance prices in tropical north

Insurers are expected to start pricing for climate change risks for customers in Australia’s tropical north.

Insurers are expected to start pricing for climate change risks for customers in Australia’s tropical north, with some insurers warning that premiums could be adjusted for the rising risk of cyclones in northeastern NSW and southern Queensland.

The comments are among hundreds of submissions to a landmark inquiry into insurance in northern Australia released last week by the Australian Competition and Consumer Commission. The probe, which has been underway since mid-2017, has been looking at measures to help restore the dysfunctional insurance market and protect homeowners and businesses against losses from cyclones and floods.

Among the 40 recommendations reported by The Australian following the release of the 600-page final report last week, the ACCC called on Canberra to directly subsidise insurance premiums in the tropical north to help offset spiralling costs for business and households.

It also recommended the scrapping of stamp duty which is levied on insurance products by state and territory governments.

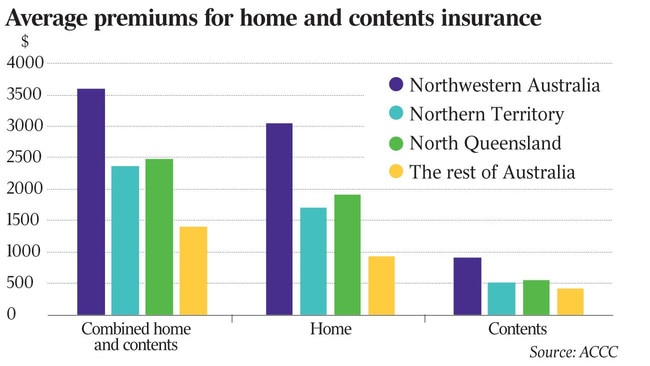

The ACCC report noted that costs in northern Australia — which takes in the whole of the Northern Territory, and parts of Western Australia and Queensland north of the Tropic of Capricorn — have been spiralling.

Home insurance premium growth across northern Australia jumped 178 per cent between 2007 and 2019. This compares to a 52 per cent rise in the rest of the country over the same period.

The high premiums are, in part, due to high costs arising from damage to property given more frequent floods and cyclones hitting the region.

The ACCC said climate change was expected to impact pricing, but insurers were still grappling with exactly how, given their climate models largely rely on historic data.

“There are … indications that insurance premiums have the potential to change in the future as a result of climate change,” the ACCC said.

However, it noted in late 2018, one unnamed insurer conducted modelling which suggested that the cyclones were increasingly moving further south. The insurer’s cyclone risk component of its technical premiums covering Queensland and northeast NSW “were approximately half of what was required”.

“(The insurer) noted that as a result of climate change, cyclone risk premiums were likely to increase in northeast NSW and southeast Queensland. However, it also noted that warming to date has likely already significantly increased the risk of cyclones and will continue to do so with further warming,” the ACCC said in its report.

In addition, the same insurer said changes to cyclone premium components in Queensland “should only be viewed as an interim position that most likely does not represent today’s changed climate,” the ACCC said.

“Similarly, another insurer has commented in a board paper that in the medium to long term, persistent increases in pricing in response to climate-related factors may result in affordability issues for some market segments,” the report said.

The ACCC said another insurer indicated in a submission that there would be increased costs relating to cyclone, storm and flood as a result of climate change effects, although it also considered that it would “take many years for the impact to become obvious”.

The report concluded pricing for cyclone risk was high for many policies in northern Australia, but was particularly large in north Western Australia.

In 2019, for combined home and contents insurance the average cyclone component for some insurers — also known as the technical premium — was estimated to be between $2800 and nearly $4000 per year across north WA, and $6890 on average in Port Hedland, the ACCC said.

Cyclone pricing could also be high in north Queensland, the ACCC said, with pricing by a number of insurers in parts of Townsville was $6300 annually.

In terms of total premiums, Queensland’s cyclone-vulnerable Hamilton Island had the highest annual premiums, averaging $14,800 a year, while WA’s Port Hedland averaged just under $6000.

This compares with average home and contents insurance premiums across the rest of Australia at $1400.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout