ACCC recommends government subsidise insurance in top end

The corporate regulator’s review of the insurance market in Australia’s north dubs it ‘dysfunctional’ and ‘expensive’.

The nation’s competition regulator has called on Canberra to directly subsidise insurance premiums in Australia’s tropical north to help offset spiralling costs for business and households.

The recommendation by the Australian Competition and Consumer Commission was one of nearly 40 urgent reforms needed to help restore the dysfunctional insurance market and protect against losses from cyclones and floods.

The insurance in northern Australia, particularly through coastal Queensland, has been in the spotlight for several years, after catastrophic floods smashed Townsville in 2019, capping off a run of several years of significant weather events.

Also taking in Northern Territory and north Western Australia, for insurers it is high-risk and generally returns low profits or even delivers losses because of regular flood and cyclones. Average rebuild costs are also higher due to the remoteness of houses and buildings.

Some of Australia’s biggest insurance damages bills have been linked to cyclones. Cyclone Debbie, which hit the coast at Airlie Beach in Queensland’s north in 2017, was one of the most expensive in recent years, costing more than $1.71bn to fix damage. It came on the back of Cyclone Yasi in 2011, where payouts exceeded $1.5bn. Meanwhile the Townsville floods saw insurance claims top $1.2bn.

“There are genuine reasons why insurance premiums are more expensive in northern Australia. The region is riskier and the cost to serve it can be very high. But insurance markets in northern Australia are not working as effectively as they could be for consumers and this is exacerbating affordability concerns,” the ACCC report said.

The release of the final report of the Northern Australia Insurance Inquiry comes three years after the federal government commissioned it.

The ACCC notes in the report the top end insurance market is covered by eight insurers, forming only 5.6 per cent of overall policies issued nationally.

However, the high price of insurance in the north of Australia sees the 240,000 home and contents policyholders paying $773m in premiums, almost 10 per cent of total premiums for the entire Australian market.

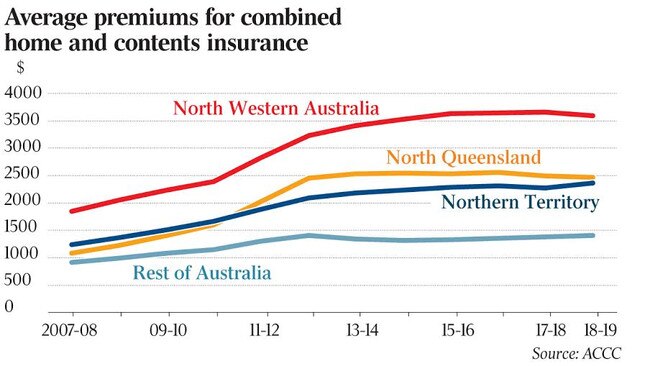

“In financial 2019, the average premium for combined home and contents insurance across Northern Australia was approximately $2500, almost double that for the rest of Australia ($1400),” the Northern Australia Insurance Inquiry report said.

The high cost is, in part, due to high costs arising from insured properties in the top end.

Weather patterns

A recent note from Bell Potter analysts predicted the La Niña weather patterns could cause significant damage and insurance losses in the coming wet period.

“So far, the present La Niña may not be as strong as in 2010-12 but costs can still be material – as evidenced by recent NSW and Queensland hailstorms,” Bell Potter analysts said.

The ACCC report notes costs have been spiralling, with home insurance premium growth across the northern Australia jumping 178 per cent between 2007 and 2019.

That can be compared with home insurance premium growth in the rest of Australia of only 52 per cent.

Increases in average premiums over this period were greatest in north Queensland where combined home and contents insurance increased by 127 per cent for north Queensland, 95 per cent for north Western Australia and 90 per cent for the Northern Territory.

The report also notes the high cost of coverage across the north of Australia has led many to being uninsured.

The ACCC recommends the best way to improve the insurance dysfunction in the top end would be through direct subsidy “to relieve some of the acute affordability and cost of living pressures facing consumers in higher risk areas, at a lower cost and more effectively than other measures”.

However, the regulator cautions that direct subsidy might distort price signals to consumers or become absorbed by insurers “where price competition is not strong”.

Look at stamp duties

The ACCC notes a perverse consequence of rising premiums is an associated rise of stamp duty levied on insurance products by state and territory governments.

“In financial 2019, consumers in Northern Australia paid $79.6m in stamp duty on their home, contents and strata insurance,” the report said.

The report calls for those stamp duties to be abolished to provide immediate relief to policyholders.

Early recommendations from the interim report released in 2018 include banning commissions for insurance brokers and simplifying products.

The Insurance Council of Australia CEO Andrew Hall welcomed the report’s call to remove stamp duties as well as its recommendations for governments to reform planning and building standards to include property protection from significant weather events.

“The burden of stamp duties is falling more heavily on consumers exposed to greater natural disasters and other risks and support the idea of reforms to remove or re-base state and territory stamp duties on home, contents, and strata insurance products,” Mr Hall said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout