Households to cut back on spending in face of interest rates surge

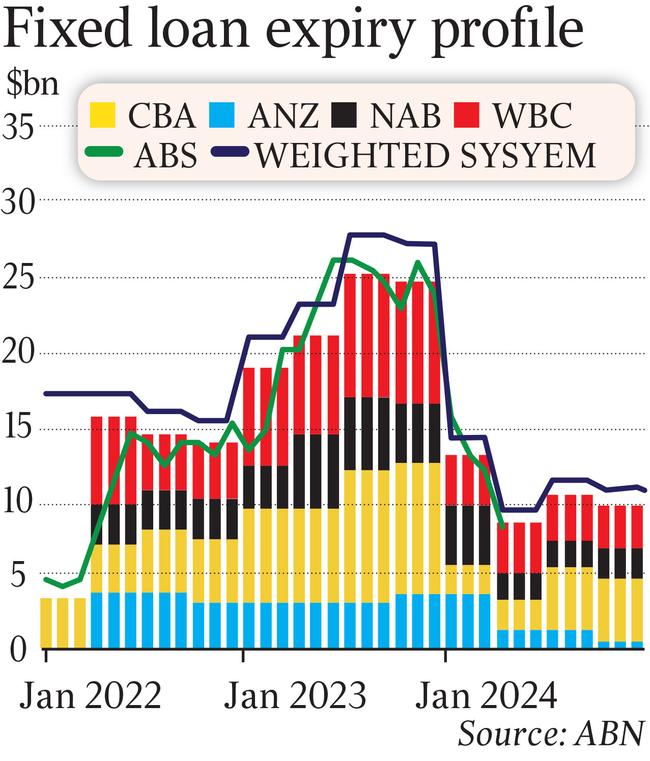

Households are likely to respond with cuts in discretionary spending to a $45bn-a-year increase in their collective mortgage repayments by the end of next year.

Australian households will take a $45bn-a-year hit on higher mortgage payments by the end of next year and will likely respond with cuts in discretionary spending, as cheap fixed-rate loans expire and banks pass on hikes in official rates to their customers.

The annual interest bill will surge 80 per cent to $100bn, or three per cent of disposable income, according to Jarden Group chief economist and bank analyst Carlos Cacho.

Mr Cacho said in a note on Thursday that highly indebted households with a debt-to-income ratio of more than six times would struggle as repayments lifted to half their total income.

Broadly, however, “solid” buffers remained in place, with deposits up $200bn, a $103bn increase in offset accounts, and 40 per cent of owner-occupiers ahead on their repayments by two or more years, or 21 months on average.

“While higher rates will represent a financial challenge for many households and likely see consumers cut back on spending, particularly in discretionary areas, we are not concerned about a significant rise in mortgage defaults at this stage,” Mr Cacho said.

“We believe the key data to watch for this will be unemployment and that as long as unemployment remains relatively low, the risk of mortgage defaults should be contained.”

The Jarden assessment came as Commonwealth Bank hiked all its fixed-rate mortgage terms by a whopping 140 basis points, ahead of an expected 50 basis-point increase in the cash rate at next week’s Reserve Bank board meeting.

CBA attributed the move to “current market conditions” and an increase in funding costs, noting that it had also cut its lowest variable rate home loan by 15 basis points to 2.79 per cent.

The revised rate was limited to new customers with a 30 per cent deposit.

Analysts said CBA’s move on fixed rates was unprecedented, lifting the majority of its fixed-rate terms to well above six per cent compared to less than two per cent about a year ago.

“We haven’t seen one-off hikes of this size and scale from CBA in our records,” said Sally Tindall, research director at independent financial comparison website RateCity.

“The bank is responding to the rising cost of fixed-rate funding and a market that refuses to believe the RBA will stop hiking the cash rate at around 2.5 per cent.

“It’s incredible to see fixed rates move this dramatically in such a short space of time.”

Ms Tindall predicted other banks would soon follow the dramatic move by the nation’s biggest home lender, with Westpac and National Australia Bank currently undercutting CBA in many cases by more than a percentage-point.

In contrast to the massive rise in its fixed-rate loans, CBA and ANZ announced a modest and highly targeted rise in deposit rates.

While CBA lifted the introductory rate on its popular NetBank Saver account by 30 basis points, the more attractive offer only lasts for five months.

The nation’s fourth-largest lender, ANZ, increased rates on its Progress Saver and Online Saver accounts by 25 basis points.

Variable rates, meanwhile, are expected to continue their upward trajectory next week, as most pundits lock in a second consecutive 50 basis-point hike in the cash rate to 1.35 per cent.

CBA’s economics team described it on Thursday as “the most obvious policy choice”.

“(RBA governor Philip Lowe) will likely refer to the increase in the 2022-23 minimum wage of 5.2 per cent and the RBA’s upward revision to their assessment of the near-term inflation outlook as justification for a consecutive 50 basis-point increase,” CBA said.

Minutes of the RBA’s June board meeting said directors discussed the possibility of a 25 basis-point hike as well as 50 basis points, opting for the latter because of the inflation outlook and the fact that official rates were still very low for an economy with high inflation and low unemployment.

Dr Lowe said in a speech last week that he expected to have the same discussion with directors about the magnitude of the July increase.

While CBA said the RBA appeared to be “front-loading” its tightening cycle, it noted Dr Lowe’s commentary in his speech that the central bank was not on a preset path.

CBA economists also said there were early signs that their forecast of a relatively low, 2.1 per cent terminal rate was correct, with most interest rate-sensitive parts of the economy already responding to the RBA’s policy tightening.

House prices, for example, had already started their descent.

CoreLogic data to be released on Friday was expected to show that national house prices fell by about 0.9 per cent in June.

Sydney, the nation’s biggest market, was forecast to be down by 1.5 per cent over the month.

Canstar said on Thursday that 125 basis points of cash-rate increases passed on to variable-rate borrowers since the RBA’s May board meeting, including a 50 basis-point hike in July, would drain an extra $351 from household budgets, assuming a 30-year, $500,000 loan.

RBA Governor Phil Lowe and NAB chief executive Ross McEwan will be talking live about the impact of rising rates on the economy at The Australian‘s Strategic Business Forum on July 20. Get tickets at theaustralian.com.au/business/strategic-forum

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout