Cautious optimism for bumper deals year

Buyers expected to shrug off Covid-19 nerves, seek out earnings growth and take advantage of ultra-cheap funding.

Bankers and lawyers are tipping a resurgence in takeover and deal activity in 2021, as buyers shrug off Covid-19 nerves, seek out earnings growth and take advantage of ultra-cheap funding.

But while the majority of those canvassed by The Australian were upbeat about 2021, several urged caution as NSW navigated fresh Covid-19 infections. The federal government support measures are also being wound back and the economy still faces trade ructions and other challenges.

Morgan Stanley Australia chief Richard Wagner is in the bullish camp on the outlook for mergers and acquisitions, labelling the 2021 deal pipeline “as strong as we have seen it for many years”.

It’s “driven by confidence around a vaccine-led recovery, pent-up demand from 2020, continued low interest rates and ready access to strong capital markets. Subject to any major issue emerging in the global vaccine rollout, we anticipate a major year for M&A, with activity expected to exceed the Covid-impacted 2020 as well as earlier year volumes,” he said.

“We are seeing strong activity across all sectors currently, driven by strategic interest as well as financial sponsor activity. Australia’s superannuation industry is also emerging as a major player in the direct investment space, particularly in relation to domestic and global infrastructure assets.”

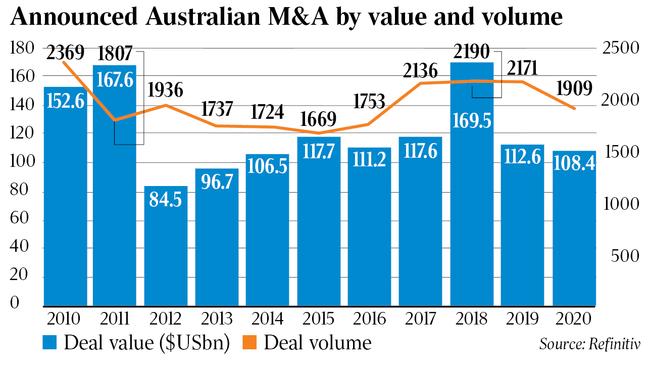

Despite a sharp rebound in M&A activity in 2020’s fourth quarter, announced domestic, inbound and outbound Australian deals last year slid to their lowest levels since 2014. Refinitiv data showed announced annual M&A amounted to $US108.4bn as at December 29, down 3.7 per cent from 2019.

The largest deals – including outbound transactions by Australian acquirers – were Coca-Cola European Partners’ $9.3bn tilt for Coca-Cola Amatil, AustralianSuper’s bid for New Zealand’s Infratil and Ares Management’s $6bn indicative offer for AMP.

UBS Australasia joint boss Anthony Sweetman said given a four-month hiatus in 2020 deal activity due to the pandemic, and the bumper levels of stimulus in the economy, he expected 2021 would be a stronger year.

“As a general comment I would expect activity levels to be higher,” he said.

“It certainly feels overall that people and organisations are more optimistic about the outlook, so there’s a positive sentiment which from my perspective is usually the biggest driver of overall M&A activity levels.

Funding cheap

“Funding, whether it be debt or equity, is probably as cheap as it’s ever been.”

While Mr Sweetman still expects some bumps in the road this year, he doesn’t expect the pandemic to deter activity like it did at its height in mid-2020.

“I’m not sure everything’s going to be as smooth as people might expect from a vaccine and a Covid perspective, given the rollout is going to take time, but… I don’t think you are going to have the same sort of disruptive four to six months.”

Last year created a string of challenges for dealmakers and boards seeking to sign off transactions, as Covid-19 made due diligence and forecasting earnings extremely difficult. That led to a spate of deals being postponed or shelved.

Completed 2020 M&A involving Australian companies tumbled to $US76.9bn ($99.8bn) as at December 29, down from $US107.4bn in 2019, according to Refinitiv.

MinterEllison partner Victoria Allen is taking a cautious approach to deal activity in 2021, noting a lot would be likely to hinge on the uptake and effectiveness of Covid-19 vaccines.

“There are too many variables in my view to make accurate predictions,” she said. “Deals are still taking longer, but they are happening.”

Rothschild & Co Australia chief Marshall Baillieu highlights there are “a lot of challenges” facing the domestic economy and therefore the takeover landscape in 2021.

“We have seen a pick up in the level of activity but not to the same levels we had pre Covid,” he said.

“Domestically, we still have fiscal stimulus that’s alive and well, that’s got to come off at some point from government. We need to see some fiscal reform and there’s a great opportunity for tax reform and other things ... which help GDP (gross domestic product).”

Prospects linked to immigration

Mr Baillieu also said Australia’s prospects would be linked to immigration and growth in the global economy.

“Immigration levels in the past have driven and made such a contribution to GDP growth in Australia for a long time, and how’s that going to play a part?

“The other overarching thing here is world GDP growth and there are still pretty daunting challenges ahead around that.”

The pandemic prompted Treasurer Josh Frydenberg in late March to set the approval threshold for foreign-led deals at zero.

Last year, also saw China Mengniu Dairy’s takeover of Lion Dairy & Drinks blocked on national interest grounds, against the backdrop of escalating trade hostilities between Australia and China.

Early engagement

The new pandemic approval threshold had significant implications for the Foreign Investment Review Board which had to deal with a marked increase in applications. The guidance was wound back effective January 1, although mandatory screening of investments in sensitive national security businesses continues at the zero threshold.

Mr Baillieu said there was a “massive backlog” in FIRB applications which was causing concern, but bidders and advisers were mindful engagement had to occur earlier.

“It’s not coming into the investment case here but it’s a consideration around execution,” he added.

Allens’ partner Tom Story said the FIRB process had been “increasingly complicated and time consuming”, but he noted cross border deals were recovering despite the inability to travel internationally.

Corrs Chambers Westgarth partner Sandy Mak expects FIRB will clear some of last year’s application backlog in early 2021.

“In the same way as we did for our clients throughout the Covid-19 period, we will continue to advise early engagement with FIRB and other regulators so as to keep delays to a minimum and importantly, to be on the front foot,” she said.

“We expect that, even as we return to a relatively ‘normal’ deal-making landscape in the wake of Covid-19, MAC (material adverse change) conditions will continue to exclude Covid-19 triggers and there will be fewer instances of terminated or withdrawn deals triggered by Covid-19 related occurrences.

“We also expect that targets will remain focused on ensuring that ‘conduct of business’ and termination provisions in implementation agreements are drafted narrowly in 2021 in case there are further waves of the virus.”

Morgan Stanley’s Mr Wagner said parties would continue to be “very focused” on termination and other rights in M&A given the potential for adverse events, either Covid-related or otherwise.

Ms Mak is upbeat on M&A prospects for 2021 due to the roll out of Covid-19 vaccines, pent up demand and recovering business confidence.

“Confidence will also be heightened as the potential for international travel becomes more likely, leading to more possibilities for cross-border trade and investment. We do believe that activity levels in 2021 will exceed 2020.”

Mr Story agreed that confidence levels were important given what he described as ripe conditions for M&A in 2021.

“The conditions are really conducive for M&A… very low interest rates and there is a lot of liquidity in the system,” he said.

“Private equity is going to be front and centre in that and we’ve seen that in the last six months… corporates are going to catch up.”

Cashed up

Private equity and venture capital players are cashed up with the sector having $13bn to deploy in takeovers. Last year, saw KKR & Co snap up a 55 per cent stake in Commonwealth Bank’s Colonial business, while local firm BGH Capital completed its takeover of Village Roadshow, spurring its removal from the ASX.

Capital raisings kept bankers and lawyers busy in 2020 as a host of ASX-listed companies looked to shore up their balance sheets to navigate the pandemic. M&A financing also played a role, and initial public offerings sprang back to life in the fourth quarter, albeit with a mixed trading performance from those hitting the market.

Broadening IPO pipeline

UBS head of ECM Alex Dignam said he expected a broadening of the IPO pipeline in 2021, as vendors looked to capitalise on strong valuations.

“We will see some deals in the traditional industrials space, healthcare, broad financials space and potentially the broad real estate space as well over the course of the year, as most sectors are trading at fairly attractive valuations,” he added.

Mr Dignam also tipped capital raisings to fund M&A would pick-up in 2021.

“The cost of capital, the cost of equity for a lot of companies is low and below where it was at the start of the year, but the other dynamic that a low interest rate environment drives is quite a high level of focus on the growth outlook,” he said.

“While the economic impact has not been as severe as what people may have feared the organic growth opportunities across a lot of sectors in the Australian market are still relatively benign, so companies are looking at M&A again.”

Total 2020 equity capital markets issuance was $US36.5bn as at December 29, the highest annual tally since 2015.

The largest ECM transaction of last year came from National Australia Bank’s Covid-19 raising of $4.75bn. Transactions by Sydney Airport and Qantas rounded out the top three ECM deals.

The largest ASX listing of 2020 was that of Dalrymple Bay Infrastructure, which continues to trade below its IPO issue price.

In the investment bank ECM league tables, UBS took top spot for 2020 followed by Macquarie Group, and Goldman Sachs.

For announced M&A, Goldman leads the pack followed by Morgan Stanley and Macquarie.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout