Boutique fundies share in $240m dividend bonanza but profits fall in COVID-hit market

The best stockpickers in Australia racked up big profits and paid themselves big dividends – but not at the levels they have enjoyed in recent years.

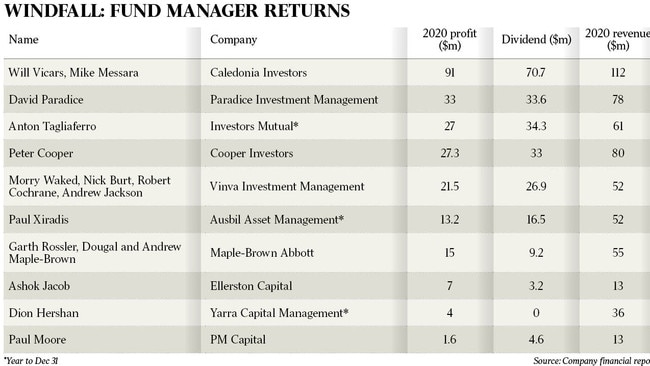

Ten of Australia’s best-known boutique fund managers have defied the hit the market took with COVID-19 this year to post combined profits and dividends of more than $240m.

Yet while the fund managers, led by big names such as Will Vicars, Peter Cooper and David Paradice, combined for revenue of more than $500m, their profit and income fell for the second consecutive year as finding value in a falling market proved a hard task.

The accounts of the privately owned firms, some of which are controlled by members of The List — Australian’s Richest 250 and others by little-known portfolio managers, revealed that profits fell by about 10 per cent from last year, following a similar drop in 2019.

Some defied tougher times on the market, with Vicars and Mike Messara’s Caledonia Investments recording a fivefold increase in profit after picking a series of strongly performing US stocks.

Others suffered falls in performance fees as their performances suffered in the second half of the financial year, with March a particularly tough month at the height of the COVID-19 pandemic.

Vinva, a quant-driven fund which keeps a low profile but manages money for some of Australia’s biggest investment funds, saw its funds under management drop $4bn to $24bn after a year in which revenue fell $10m to $52m and net profit dropped $6m to about $21m.

Vinva, established by a team led by managing director and head of equity investments Morry Waked after he left BlackRock in 2010, paid a $26.9m dividend to its shareholders in respect of the 2019 financial year, when it made a $27m profit.

Most of the boutique fund managers are small operations but pay big dividends to the founders and portfolio managers who also hold stakes in the firms.

Peter Cooper’s Cooper Investors and David Paradice’s Paradice Investment Management each paid dividends of about $33m. Profits and dividends at both firms were slightly less than in 2019. Cooper Investors’ $80m revenue was in line with last year, though performance fees rose slightly to $6m. Revenue at PIM was down about 10 per cent to $77m.

Cooper’s Australian Equities Fund has since outperformed its benchmark by 6.3 per cent in the year to September 30. It has stuck with stalwarts such as Cleanaway, ASX, Brambles and Woolworths that Cooper says have “world-class privileged markets and competitive positions”. It recently initiated a position in poker machines maker and online games company Aristocrat, betting on a recovery in the US casino sector.

The biggest dividend was paid by Mr Vicars’ and Mr Messara’s Caledonia, $70m, or more than the combined payout by Mr Cooper’s and Mr Paradice’s firms. Caledonia benefited from strong performances of stocks such as global bookmaker Flutter and food delivery service Grubhub.

Another strong performer was Ashok Jacob’s Ellerston Capital, which recorded a net profit of about $7m after a loss of $286,000 last year. In a recent note to investors, Jacob predicted 2021 is “lining up to be the biggest year in M&A history as companies and (private equity) swoop on low valuations” of businesses that have low to no growth but sizeable, maintainable cashflows while interest rates are low.

Meanwhile, performance fees at Maple-Brown Abbott fell from $3.67m in 2019 to $13,232 and revenue dropped about $14m, while revenue and profit at PM Capital and Investors Mutual were broadly in line with the previous year.

Dion Hershan’s Yarra Capital Management made adjusted EBITDA of $11.6m in the year to December 31, up from $6.8m a year earlier. Net profit of $4m was up from $335,000.

But its Yarra Australian Equities Fund was down 14.3 per cent in the year to September 30, about 4 per cent more than its benchmark. It has established positions in stocks such as Reece and mineral sands miner Iluka Resources.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout