Big four banks will pay dividends: super giants

Both AustralianSuper and Unisuper believe the big four will declare dividends, but at a much reduced level.

Two of Australia’s largest super funds still expect the major banks to pay out dividends this year, despite the prudential regulator last week warning lenders they should “seriously consider” suspending dividends during the COVID-19 crisis.

Both AustralianSuper and Unisuper believe the big four will declare dividends, but at a much reduced level.

In an update to members, Unisuper chief investment officer John Pearce also said he expected the big miners to maintain dividends when they reported their full-year numbers and saw potential for ASX, APA, Telstra and Woolworths to hold or even increase their dividend payouts in the coming months.

“Our major banks have a large retail shareholder base, and understand the importance of dividends to these shareholders,” Mr Pearce wrote.

“Given previous behaviour, our base-case assumption is that the banks will again opt to pay a dividend, albeit materially reduced. They’ll also take a provision to cover an expected increase in bad debts, and we expect that they’ll top up their capital base when conditions are more favourable.”

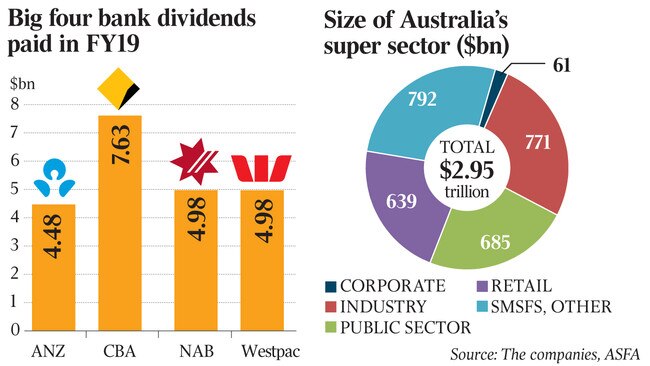

During the global financial crisis, the big four cut dividends by between 14 and 25 per cent, but were never forced to suspend them.

“Our banks have entered this crisis in far better shape than they entered the GFC, with ample capital and liquidity buffers,” Mr Pearce wrote.

“This is just as well, because there’s no doubt that bad debts will rise — the only question being the magnitude. How this translates into dividend policy will be interesting, given that Westpac, ANZ and NAB will be ruling off their financial half-year as at 31 March, which is before bad debts start to mount.”

Mr Pearce’s comments come days after Australian Prudential Regulation Authority boss Wayne Byres issued a directive to banks and insurers, ordering them to “seriously consider deferring decisions on the appropriate level of dividends until the outlook is clearer”.

“APRA expects ADIs and insurers to limit discretionary capital distributions in the months ahead, to ensure that they instead use buffers and maintain capacity to continue to lend and underwrite insurance,” Mr Byres wrote.

If lenders did declare dividends, they should be at a “materially reduced level” and based on robust stress-testing results discussed with APRA, he added.

AustralianSuper, the nation’s biggest super fund with about $170bn in assets and $6bn-$7bn invested in major bank shares, agrees with Unisuper on the likelihood of the big four continuing to pay dividends.

However, in line with APRA’s directive, the payouts were likely to be significantly lower, and only declared after a review of rigorous stress tests by the regulator.

Mr Pearce, who heads the investment team at the $85bn Unisuper super fund, warned members that some of the fund’s biggest Australian-listed investments were likely to reduce dividends, possibly to zero.

These include Transurban, Scentre, GPT and Sydney Airport, all of which are in the fund’s top 10 Australian-listed holdings. He also sees Brisbane and Adelaide airports slashing dividends this year.

UniSuper’s balanced option returned -10.4 per cent in March and is down 8.1 per cent for the financial year to date. This compares with a 13 per cent decline in its high-growth option for March, while the same option is down 10.3 per cent for the year to date.

The fund’s sustainable balanced and growth options were down slightly less than their mainstream peers because of a lower exposure to both emerging markets and the energy sector.

Looking ahead, Mr Pearce said there was cause for optimism and cautioned against expectations of a depression due to the COVID-19 pandemic.

“Together with the government, RBA, and regulators, we’ve seen all the major economic agents — including corporates, unions, banks, and a raft of other institutions — sign up for ‘Team Australia’.

“This rarely happens, and to be fair it’s not just being driven by altruism. It’s also a rare time when collective interests and self-interest are one and the same. Everyone has a common enemy,” he said.

BoQ last week became the first domestic lender to defer its dividend payment, as it handed down its interim results on Wednesday, although chief executive George Frazis indicated the payout would be deferred rather than cancelled altogether.

“Based on this APRA guidance, BoQ has determined that it is prudent to defer the decision on payment of an interim dividend until the economic outlook is clearer and stress testing results have been discussed with APRA,” the bank told the ASX.

However, Commonwealth Bank CEO Matt Comyn earlier this month played down suggestions Australia’s banks could be required to suspend dividends, saying they are better placed to withstand the COVID-19 crisis than their offshore peers.

Meanwhile, ratings agency Standard & Poors has also warned that Australia’s biggest banks are poised to slash dividend payouts to investors, forecasting the majors will weather a forecast threefold increase in defaults over the coming year.

S&P last week lowered its outlook on the credit ratings of Australia’s four major banks to negative, but kept the ratings unchanged.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout