Big banks, Reserve Bank of NZ poles apart on capital reforms

One thing is certain in the polarised debate over the Reserve Bank of New Zealand’s proposed capital reforms: hell will freeze over before the Australian banks reach a consensus with their central-bank nemesis about how much high-quality capital their NZ subsidiaries should hold.

There’s a difference, however, between respectful disagreement and entrenched positions that can’t even agree on a starting premise.

The RBNZ capital reforms, which could force the big four Australian banks to inject a minimum of $NZ13bn ($12.1bn) into their NZ units, are in the latter category.

In an interview with this column last week, RBNZ deputy governor Geoff Bascand said independent analysis used by one of the four majors to support its claim that NZ would become the “most highly capitalised banking jurisdiction in the developed world” was flawed.

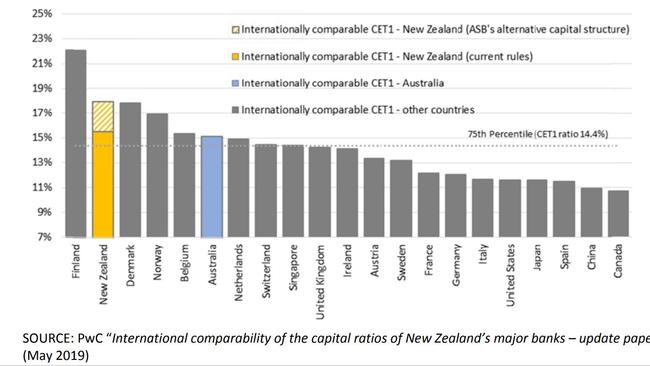

Bascand was referring to Commonwealth Bank unit ASB’s submission to the capital review, which includes a detailed PwC analysis of the average common equity tier-one ratio for NZ’s banks under the new framework compared to other jurisdictions. An accompanying graph shows NZ head and shoulders above the banking systems of Australia, the US, Europe and Asia.

“The NZ banking system is not exposed to risks that demand such a high capital setting on a comparative basis, particularly given the relative simplicity of NZ bank balance sheets,” the ASB submission says.

Bascand barely disguised his scorn for the analysis.

“I have difficulty with some of their methods,” he said.

“They adjusted New Zealand’s numbers to achieve some international comparability, but they didn’t adjust other countries. That’s my understanding.

“It makes one a bit cautious, which is why we rely more on the endeavours of the Basel Committee (on Banking Supervision), and the other thing is that the graph doesn’t take account of the relative riskiness of other countries.”

Read more | Low rates squeezing margins: CBA

Bascand acknowledged that international comparisons were difficult and fraught.

In the end, though, the RBNZ had to assess the level of risk in NZ, the features of its financial system, and the concentration risk that arose from the dominance of the big four banks.

PwC’s analysis says the NZ’s major banks are already well capitalised — in the top quartile of large international banks, and at or above the level that APRA would regard as “unquestionably strong”.

It says the proposed capital changes would cause the NZ major banks to hold more than double the average capital held by large international banks, and while there was some margin for error it wasn’t sufficiently large to undermine the core conclusions.

The fact that there’s such a large, unbridgeable gulf between the RBZ and the banks makes a compromise less likely.

Bascand said the RBNZ was “not trying to go crazy on this”.

“We’re trying to put ourselves in a place where we’ve got confidence that our financial system will keep working if we get a big shock,” he said. “I think being a little risk-averse is a good thing.”

David Hisco resurfaces

On the subject of New Zealand, ANZ Bank is still to decide who will replace David Hisco, or at least the banking executive who used to be known as David Hisco.

You see, very little has been seen of the former head of ANZ Bank New Zealand since an unfortunate incident involving a “mischaracterisation” of expenses involving chauffeured corporate cars and wine storage emerged last June.

But as luck would have it, our colleagues at The New Zealand Herald have managed to track him down. When a reporter tapped on the door of a well-appointed property at Omaha, a small beach town about 75km north of Auckland, a man who looked like a dead ringer to Hisco came to the door.

“David?” the reporter asked.

“No,” was the response.

The man who used to be Hisco said he had visitors and was unable to answer questions.

When the reporter again asked if he was David Hisco and if they could have a talk inside, the response was the same.

There’s a nice symmetry about the Omaha home, which has waterfront views and private beach access.

Hisco reportedly bought the property from former NZ prime minister John Key for $NZ3.1m.

Sir John, who became an ANZ NZ director in October 2017, has said the deal took place before he became chairman in January 2018.

It was Sir John who fronted the press conference last June to announce that ANZ and Hisco had parted ways.

The chairman said Hisco was not repaying the money because he was “adamant” he had the authority to spend it.

The bank’s concern, therefore, was not so much the money itself, but the lack of transparency in how the expenses were recorded in the books.

After almost nine years as chief executive of ANZ NZ, Hisco went overseas for a while on vacation and to recover from some health issues.

He reportedly came back in the last week or so.

Chief financial officer Antonia Watson has been acting CEO until a permanent replacement is found.

While Hisco’s departure followed an expenses fudge of about $50,000, he left a substantial legacy — NZ profit under his stewardship climbed from $NZ867m in 2010 to $NZ1.9bn in 2018.