Low rates squeezing margins: CBA

CBA chief executive Matt Comyn warned record low interest rates were hurting banks and depositors.

Commonwealth Bank chief executive Matt Comyn has talked up the availability of credit for housing, but warned that record low interest rates were hurting banks and depositors.

After the major banks clashed with the federal government over decisions to withhold a large part of the October official rate cut, Mr Comyn yesterday highlighted that the bank’s deposit customer numbers far outweighed residential borrower numbers.

Investors at the bank’s annual general meeting were told CBA has about 1.6 million borrowers and 6 million depositors.

Mr Comyn said 69 per cent of CBA’s funding came from deposits, up from 60 per cent a decade ago, while the remainder was sourced from wholesale markets.

That meant changes to deposit rates had the “largest impact” on CBA and its customers, he added.

Comyn hits back over ‘loyalty tax’

CBA has cited a figure of about $160bn in deposits it cannot reduce, given rates for savers were already at historic lows.

His comments came as former treasurer Peter Costello said interest rate cuts were losing their impact to spur on the economy and supply side reforms were needed.

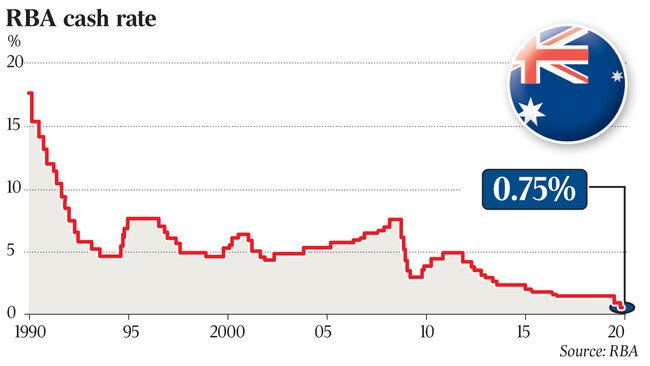

Despite three successive RBA cuts to a record-low cash rate of 0.75 per cent, Mr Costello told a Citi investor conference in Sydney there had been little impact on confidence levels.

In fact, the outcome was perverse, with people now asking the question: “Why are they so worried?”

“Monetary and fiscal policy has run its course, so we have to do something on the supply side to take away some of the handbrakes and help boost supply.

“After 10 years of deficits and 28 years of continuous growth, we could really get a boost by dealing with some of the imbalances that have built up in the economy.”

Mr Costello said he felt sorry for retirees in the environment of ultra-low rates.

While borrowers and sophisticated investors benefited as asset prices such as shares and property were bid up — retirees were getting little or no return on their savings.

According to RateCity, Westpac this week became the last of the big four banks to reduce deposit rates following the third cut by the Reserve Bank this year. CBA lowered the base rate on its Net Saver online account by five basis points, and made cuts of up to 35 basis points on its bonus savings rates. For home loan borrowers, paying principal and interest, the bank passed on 13 basis points of the 25 basis point official cut.

“Lower interest rates are a feature globally, and the local cash rate has fallen 75 basis points since May. This low rate environment creates challenges for our customers and for financial institutions,” Mr Comyn said.

He noted, though, that the economy has been supported by the federal government’s tax cuts, despite uncertainty about the outlook for global growth increasing through 2019.

Mr Comyn’s comments on the economy came after the International Monetary Fund this week slashed its global growth outlook to the lowest in a decade and downgraded its forecasts for Australia.

The IMF’s World Economic Outlook cut its growth forecast for the Australian economy from 2.1 per cent to 1.7 per cent — below the government’s and the Reserve Bank’s forecasts of about 2.25 per cent.

Mr Comyn also highlighted that there was an “abundance of housing credit available”. But that comes against the backdrop of record low housing credit growth and concerns that a clampdown by banks on responsible lending rules have made it harder to secure loans.

But lower official interest rates have helped the housing market in CBA’s view.

“There are encouraging signs that the market has stabilised,” Mr Comyn said, noting that came after house prices had fallen in Sydney and Melbourne for 18 months.

On the bank’s home loan growth, he added: “Home lending to our customers has grown 30 per cent faster than market growth. This means that we have lent $92bn to our home loan customers in the last year.”

In response to the competition regulator’s probe on mortgage pricing, Mr Comyn said there were a string of factors that banks could provide more detail on.

He said the bank’s rate pricing decisions were also linked to the lower rates CBA earned on $48bn in shareholder equity and retained earnings.

“There are multiple reasons why a lower interest rate environment actually impacts net interest margin, not just in the current period but continues to impact future periods,” he added.

Mr Comyn also said CBA wanted to step up its lending to business, which was running at more than $500m a week.

“Australian businesses remain the engine room of the economy, and their continued innovation, investment and growth is critical,” he said.

Shareholders were also keen to hear about whether the bank would need to revise up its charges for customer compensation.

Chair Catherine Livingstone said she was satisfied the provisions it had taken so far to compensate customers for a range of past scandals — including charging fees for advice that wasn’t provided — were enough.

“We’ve taken the provisions that we think are appropriate,” she told the AGM.

Between 2014 and fiscal 2019, CBA has outlined total remediation and program costs of $2.17bn.