Big bank ‘loyalty tax’ at risk as technology steps up: Sherlok CEO Adam Grocke says

The big banks have taken advantage of customer loyalty for too long and risk losing home loans when technology eventually makes switching mortgages much easier.

The big banks have taken advantage of customer loyalty for too long and risk losing home loans when technology eventually spurs a “fundamental shift” and makes switching mortgages much easier.

That’s the view of Sherlok chief executive Adam Grocke. He founded the start-up in 2019 to assist mortgage brokers in ensuring customers are paying competitive interest rates, with the aim of boosting retention levels.

Mr Grocke said the “loyalty tax” charged by most lenders, which typically sees longstanding customers paying more than those seeking new loans, would come under pressure as technology made switching easier.

“When that actually comes to fruition, and people can click a button and switch their mortgage to any lender, I think that’s when the big banks and the financial system will take notice,” he said.

“They’ve taken advantage of consumer loyalty for too long, and when they (borrowers) can actually vote with their feet without having barriers to move … that’s when we’re going to see a fundamental shift.”

Non-bank lender Athena offers its existing customers the same rate as new ones.

Mr Grocke said Sherlok was working on a solution that would involve a short conversation with a mortgage broker, clicking to accept a broker’s recommendation, followed by an almost instant unconditional loan approval. That can be possible because Sherlok’s technology has already matched the credit profile of the borrower with the right lender.

Sherlok draws on AI and proprietary technology to screen more than 150 data points and labels in a loan book. That enables it to predict the risk of a customer being unhappy with their interest rate and being open to better offers or switching lenders.

The company is automating this through an assessment of the borrower’s likelihood of leaving, providing a retention score. Sherlok’s customers are mortgage brokers who need to check in or service customers they have placed with lenders.

After Mr Grocke and his family, Sherlok’s largest shareholders include Uniti co-founder Sasha Baranikov, Proviso co-founder Luke Howes and Joe Cook, who sold Riot Wine to Carlton & United Breweries in 2019.

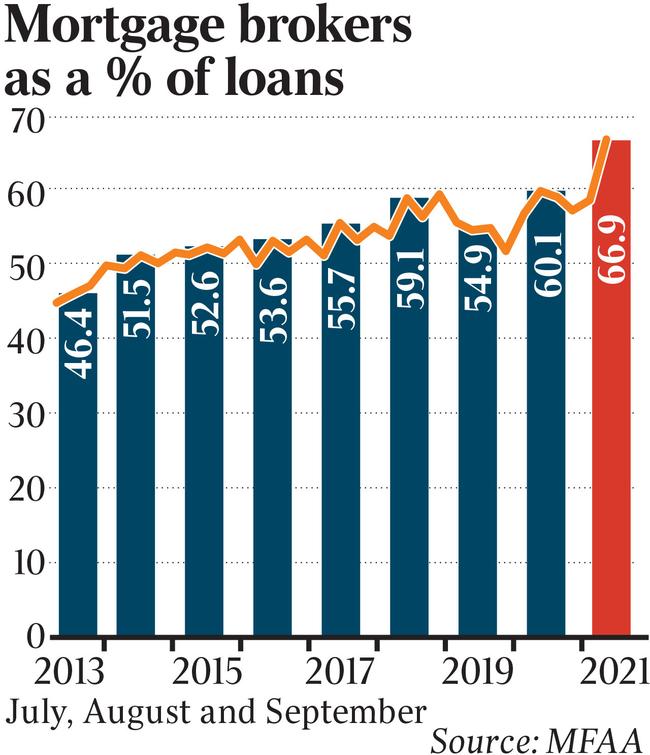

Between July and September 2021 mortgage brokers facilitated almost 67 per cent of new residential home loans, a record.

Mr Grocke, who was a mortgage broker for 12 years, has big plans to grow after launching the technology platform in July. Sherlok monitors about 45,000 mortgages for repricing or refinancing and counts almost 300 brokers as customers. It charges a subscription fee, paid annually.

The firm is targeting two million mortgages by the end of 2023.

But with the banks increasing their focus on retaining customers it will be a tough task.

The home lending process, including mortgage broking, is being increasingly digitised with the major lenders promising faster turnarounds.

CBA will in coming months launch a direct digital mortgage, while ANZ will unveil new banking services to deliver an improvement in speed and capability.

Online broker Lendi and its rival uno have been seeking inroads into the mortgage broking market with digital services. Uno, which was backed by Westpac until 2021, is also pushing a service that sees customers get alerts to assess if they can get a better deal.

Mr Grocke is mindful that banks are more aggressively seeking to retain borrowers.

“One of the key things we’ve actually seen in the last three months that we haven’t seen before, is the discounts from lenders now to keep a client have jumped up by about 35 per cent to 36 per cent, in terms of what they’re offering previously,” he said.

Expectations of hikes in the official cash rate have already prompted higher rates for fixed mortgages, shifting some focus to variable home loans.

Mr Grocke said more borrowers would become aware of their loan rates when interest rates started rising – the first time officially since 2010. “The first one or two interest rate (hikes) are going to cause a bit of a shockwave through the system where people are going to take notice of what their rate is,” he added.

The Sherlok system also seeks to get borrowers a better rate with their existing lender.

It facilitates the process for the mortgage broker that introduced the loan.

“The risk if they (the lender) don‘t play ball, though, and if they don’t offer a competitive rate is our engine will automatically run a comparison and entice them (the borrower) to refinance,” Mr Grocke said.

Sherlok has already conducted a pre-seed and seed capital funding round, and plans to start a Series A raising in 2022.

Mr Grocke said the company was “ahead of targets” and was also pursuing strategic partnerships with larger mortgage aggregator groups which provide administrative and compliance services to thousands of brokers around the country. He expects to execute several partnerships within the next six months.

Sherlok is also a representative for open banking, which gives customers more control of their data.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout