Rate hikes won’t be a clear major bank tailwind in 2022: Citigroup

A rising rate environment will not create a ‘sharp bounce back’ in mortgage margins at the major banks this year, Citigroup warns.

A rising interest rate environment will not create a “sharp bounce back” in mortgage margins at the major banks in 2022, Citigroup analysts warn.

A detailed report on the sector – led by Citigroup banking analyst Brendan Sproules – cautioned that the banks would face a number of earnings pressures this year.

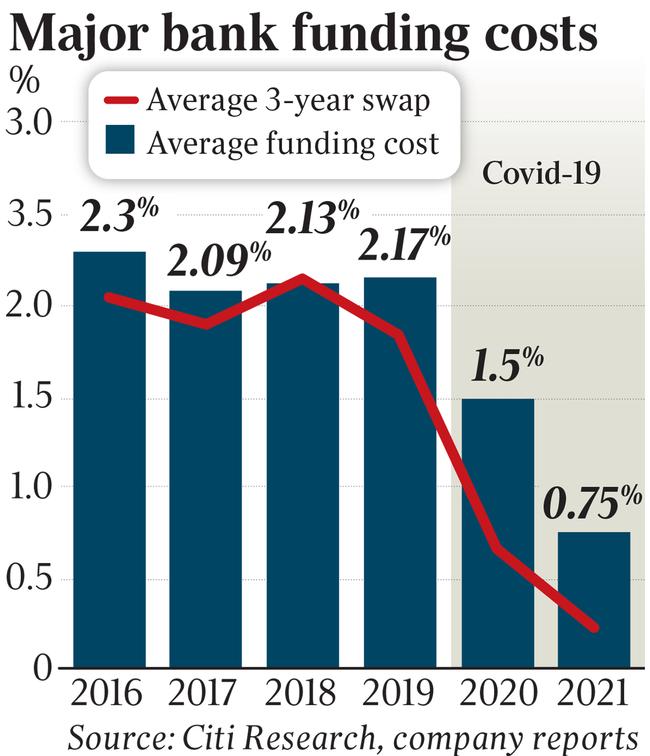

Mr Sproules said banks would continue to fiercely compete for new home loans even though pricing pressures were moderating as fixed mortgage rates were increased. But the report also noted banks would face higher funding costs as they looked to refinance ultra-cheap Covid-19 funding that was on offer via the Reserve Bank of Australia.

The report highlighted that interest rate markets were pricing in three official rate rises by the end of 2022, despite the local central bank’s commentary suggesting it wouldn’t not tighten until 2023 or when significant wage and inflationary pressures were evident. The US Federal Reserve is expected to start raising rates in coming months to curb inflation.

“When we model a 75 basis point increase in the RBA cash rate, we … see virtually no NIM (net interest margin) improvement over two years.” Mr Sproules said.

“The emergence of 75 basis points of cash rate rises will not create a sharp bounce back in NIMs that is expected by many investors. Instead, we think the banks’ better deposit margins will be consumed by the unwind of artificially low funding costs, as well as a continuation of the strategy to reinvest benefits back into sharp front book mortgage pricing.”

It highlighted significant mortgage margin pressure had begun filtering through last year.

“Despite a material circa 100 basis point upward shift in the yield curve, the Australian banks materially underperformed the ASX 200.

“While the banks were expected to outperform as P/E ratios (price-to-earnings) expanded, and earnings should have benefited from higher swap rates signalling less fixed rate mortgage lending. This wasn’t the case, as only NAB managed to match the ASX 200,” it said.

Net interest margins – which are closely tracked by investors and analysts – are what banks earn on loans, less funding and other costs.

Commonwealth Bank’s first-quarter trading update in November and a warning on marked margin pressure spurred concerns about the earnings trajectory of the sector.

Westpac’s annual results came under heavy analyst and investor fire due to a large decline in its net interest margin and questions being raised about the bank’s ability to meet its headline annual $8bn cost target. Westpac, National Australia Bank and ANZ rule off their financial year on September 30, while CBA has a June 30 balance date.

Morgan Stanley equity strategist Chris Nicol said following the expected completion of quantitative easing in February, the 2022 focus would shift to the timing of RBA rate rises.

“We expect the RBA will be consistent in its criteria for rate hikes: actual inflation sustainably in the 2-3 per cent target range (which we expect the RBA will acknowledge will be met through 2022) and wage growth ‘materially’ higher,” he said.

“We expect the RBA will keep a steady hiking pace once it achieves rate lift off – for 2023, we currently expect three rate hikes – in February, August and November.”

While Citigroup is treading cautiously on 2022, it sees more upside for bank earnings flowing through in 2023.

“Strong mortgage competition and adverse mix will continue to feature, while cost growth will continue to be stubborn,” Mr Sproules said.

“While the multi-year contraction in core earnings will abate, we expect green shoots from less fixed rates, a repositioning of replicating portfolios and credit growth will hit the P&L (profit and loss) more meaningfully in 2023.”

The only bank stocks rated a ‘buy’ at Citigroup were Westpac and Bank of Queensland. Citigroup has a ‘sell’ on Australia’s biggest bank CBA and a ‘neutral’ rating on Bendigo & Adelaide Bank.

“BOQ has elected to deploy excess capital into the attractively priced ME Bank acquisition, adding scale and earnings to the franchise,” Mr Sproules said.

On Westpac, he sees the bank’s underperformance over the past three months “as overdone”, leaving its valuation looking compelling versus its peers.

Bell Potter analyst TS Lim also raised concerns around margin compression on Westpac, even as he upgraded his stock price target by about 4.5 per cent to $23.

“We believe (Westpac’s) mortgages should continue to grow at system (deposits will instead grow at greater than system – a plus in a way) but NIM will be even lower,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout