GFC 10 years on: How Bankwest’s sale to CBA was fast-tracked to avoid collapse

Australian financial regulators fast-tracked the 2008 takeover of Bankwest by CBA in ‘a couple of hours’ to head off a collapse.

Australian financial regulators fast-tracked the 2008 takeover of Bankwest by Commonwealth Bank in just “a couple of hours” to head off the almost certain collapse of the regional lender at the height of the global financial crisis.

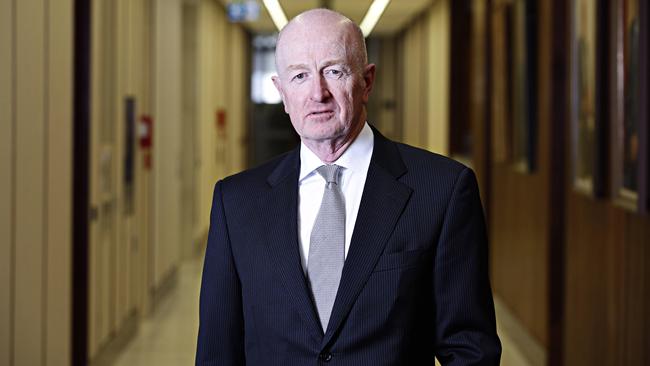

Former Reserve Bank governor Glenn Stevens and Australian Competition & Consumer Commission chairman Graeme Samuel told The Weekend Australian that if the deal in October 2008 had not been approved Bankwest would have ceased to be a competitive force.

Mr Samuel said he was given “a couple of hours” to approve a deal that would normally take months of consultation before a verdict was given because of the crisis engulfing financial markets.

“The RBA said that there was no choice — it was crisis stage,” Mr Samuel said.

“It was a deal that was regulator-required and regulator-motivated.”

The hastily approved deal followed a crisis at Bankwest’s Edinburgh-based parent, HBOS, which had to be taken over by Lloyds as the financial crisis spread from the US housing market to the global financial system.

Markets used by the banks to finance lending seized up following the collapse of Lehman Brothers, with the US government being forced to plough more than $US1 trillion into a series of rescues, including insurer AIG and mortgage lending giants Fannie Mae and Freddie Mac.

Mr Samuel said the urgency of the deal was driven by HBOS planning to withdraw $16bn of funding lines from Bankwest, then the eighth-biggest bank in the Australian market, in order to reinforce its British capital base.

Bankwest, a significant player in Western Australia that had been pushing to expand on the east coast, would have had to replace that funding in the local market at a time it had seized up. HBOS took an $800m loss on its Australian sale.

The sale also came just weeks after the Australian government took the extraordinary step of guaranteeing bank deposits up to $250,000 as well as wholesale funding lines for the banks to ensure that they could continue to lend.

In an interview with The Weekend Australian, Mr Stevens defended the decisions to allow the mergers that took place during the global financial crisis — which include the $2.1bn purchase of Bankwest and Westpac’s takeover of St George Bank, then the fifth-biggest bank in the country. Westpac entered into merger discussions with St George four months before Lehman collapsed.

Mr Stevens said the mergers were necessary even if they meant a loss of competition, because financial markets made it harder for competitors to finance their activities.

“Well, that competition was gone because that funding wasn’t there any more,” Mr Stevens said.

“So, in a sense the capital markets, the closure of the capital markets or the furious tightening up of availability of that funding, had already delivered a blow to the competitive landscape in that space. That’s what the global capital markets delivered to you.”

Mr Stevens said that in the extraordinary circumstances of the GFC it was “inevitable that there’s going to be some absorption of weaker players by stronger ones”.

“That’s what happens in crises and yes there’s going to be less competition in certain spaces later, but that’s because the business model, what was being used to deliver that competition earlier, isn’t a viable model now.”

The comments cast new light on one of the more controversial aspects of the government and regulatory response to the GFC, with the takeovers reducing competition for deposits and loans and increasing the power of the big four banks as the economy emerged from the GFC.

The deal was one of a number of shotgun weddings arranged through the GFC, including JPMorgan’s deal to buy Bear Stearns in March 2008, and Bank of America taking over Merrill Lynch on the weekend of the Lehman Brothers collapse.

Controversy over CBA’s purchase of Bankwest has lingered for the past decade, with a number of customers alleging they were unjustly dealt with by the new owner.

Mr Stevens said the bank guarantee had helped smaller lenders “proportionately more” because of a flight to quality.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout