AustralianSuper targets $500bn after stellar 20pc return

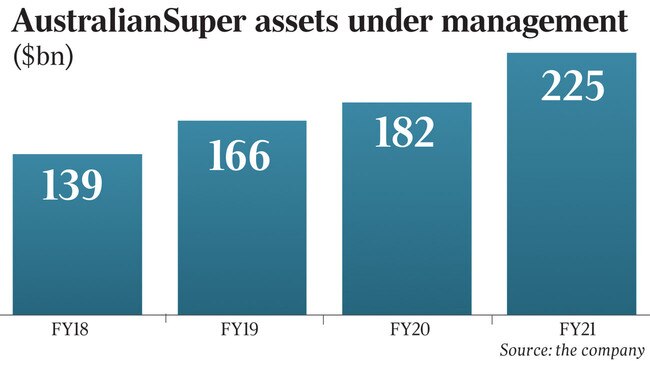

Australia’s largest super fund, the $225bn-plus AustralianSuper, is expecting to more than double its assets to almost $500bn in the next five years.

Australia’s largest super fund, the $225bn-plus AustralianSuper, is expecting to more than double its assets to almost $500bn in the next five years.

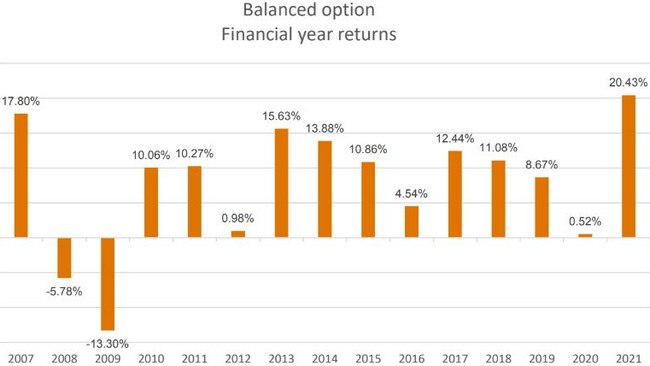

AustralianSuper chief executive Mark Delaney said the fund, which has just recorded its strongest ever year with a return of 20.43 per cent on its balanced fund, had net cashflow of $14bn last year, which was expected to rise to some $20bn this financial year.

“As long as we keep on performing and the markets behave, we are pretty confident the fund is going to continue to grow towards the $500bn mark,” he said.

“We are working, internally, on $470bn by 2026.”

The latest results show that AustralianSuper’s assets have gone up 10 times since its foundation 15 years ago, as once-dominant retail funds such as AMP have struggled and the big banks have exited the super and wealth management sector.

The result is a sharp turnaround from the return of 0.52 per cent last financial year when many super funds reported low returns in the wake of the sharemarket fall as Covid-19 struck.

“This is our best year ever,” Mr Delaney said. “It has been driven by a combination of factors including the super strong stimulus, confidence about the vaccine rollout, a broadening out of equity market performance beyond the tech stocks,” he said.

He said the fund had also benefited from strong performance in its private equity deals and infrastructure investments.

Stock selection and investments had boosted AustralianSuper’s returns by two to three percentage points, he said.

The report comes as AustralianSuper last week jointly topped the MySuper fund rankings on the federal government’s new YourSuper performance comparison tool, alongside hospitality industry fund Hostplus.

Mr Delaney said AustralianSuper planned to bring more of its investment in house after last year’s bumper results, which were boosted by strong growth in the sharemarket in Australia and overseas.

He said the fund has about 200 professional investment staff and already manages 45 per cent of its assets in house.

He said bringing investment in house allowed it to make some big bets on Australian equities, work with major companies such as Transurban on co-investments in projects, and look at big deals in other areas such as private equity, infrastructure and property.

The fund on Monday announced its biggest ever direct property investment in Australia, taking a $744m stake in Australia’s largest intermodal logistics facility in the southwestern Sydney suburb of Moorebank.

The deal, with a consortium of investors, will see the fund take a 40 per cent stake in the logistics facility, which has rail links with freight from Sydney’s Port Botany and was the brainchild of businessman Chris Corrigan.

The fund also has a 20 per cent stake in the port.

“Managing our investments internally gives us a lot of advantages,” Mr Delaney said.

“All our Australian equities are now managed internally, which generates much better outcomes than spreading the investments across fund managers.

“It also makes us a more efficient partner of corporate Australia.”

The fund invested some $600m in capital raised on the Australian sharemarket in the last financial year.

Mr Delaney said AustralianSuper was selling down its stake in NSW electricity company Ausgrid to free up capital to boosts its investment in Sydney toll road company WestConnex.

AustralianSuper was a participant in the private consortium, which bought a 51 per cent stake in the toll road operator from the NSW government in 2018.

The fund is planning to step up its investment as the NSW government sells off its remaining stake of 49 per cent.

Mr Delaney said he expected to see AustralianSuper more than double its staffing in Britain, from about 40 to 100, and eventually have some 60 to 70 staff in New York.

“We will be building our overseas offices and staff to search for more offshore deals,” he said.

The past financial year marks the 12th consecutive year of positive returns for the fund, which has more than 2.3 million members.

Its balanced option has returned 9.56 per cent a year over three years, 10.44 per cent over five years, 9.73 per cent over 10 years and 7.49 per cent over 15 years.

Super fund members who had put $50,000 into its balance fund in 2006 and kept it there would have seen that balance rise to almost $150,000 over the period.

Mr Delaney said the results showed that markets recovered after downturns, “which reinforces the fact that maintaining long-term discipline increases the potential for long-term investment success”.

He said he expected markets to continue to improve but he didn’t expect funds to achieve 20 per cent-plus returns in the current financial year given the steep rise in share and asset prices over the past year.

“We think the next period will still be reasonably favourable for equities with economies recovering quite strongly, but we wont get anywhere near the bounce and size we saw over the last 12 months, particularly when central banks start to pivot towards tightening,” he said.

“Things could be OK for another two years but we don’t expect the big rises we have seen in markets over the past year to continue.”

He said AustralianSuper believed that most members were better off if they stayed in a diversified portfolio throughout market ups and downs.

He expected pent-up consumer demand, along with government stimulus programs and low interest rates, to continue to support economic recovery and improve returns for growth assets.

“AustralianSuper is a long-term investor,” he said. “We have a pro-growth stance in allocating assets in the balanced option.

“That means we have a higher allocation to growth assets such as listed shares and private equity.

“We are continuing to pursue opportunities in infrastructure, private equity, property and credit assets which we expect will deliver long-term growth for members.”

AustralianSuper and Hostplus came in as the leading super fund performers over a six-year period in the federal government’s new comparative table for MySuper funds launched last week.

They recorded 8.1 per cent annual returns over the past six years, ahead of the Local Government Super with a return of 7.9 per cent and construction industry fund Cbus which had annual returns of 7.77 per cent.

Construction industry fund Cbus reported a 19 per cent return on its funds for the financial year last week. The return figures for that comparison table are based on a 30-year-old worker with a balance of $50,000.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout