APRA warned banks of risky lending as housing market boomed

New documents reveal the banking regulator became increasing worried about the frenzied pace of mortgage lending.

The banking regulator became increasing worried about the frenzied pace of mortgage lending in April and put the nation’s banks on notice not to relax standards and to ensure borrowers weren’t taking on excessive debt in the face of ultra-low interest rates, according to new internal documents.

The letter from the head of the Australian Prudential and Regulation Commission sent to the boards of the biggest banks warns lenders to be “especially vigilant in managing the risks within their residential mortgage portfolios in the current environment”.

The letter, released under freedom of information rules, also gave bank boards just weeks to sign off on assurances that lending growth across the sector wasn’t reckless. The last time it asked banks to give such assurances was in 2018 when the market remained heated even after a period of lending restriction put in place.

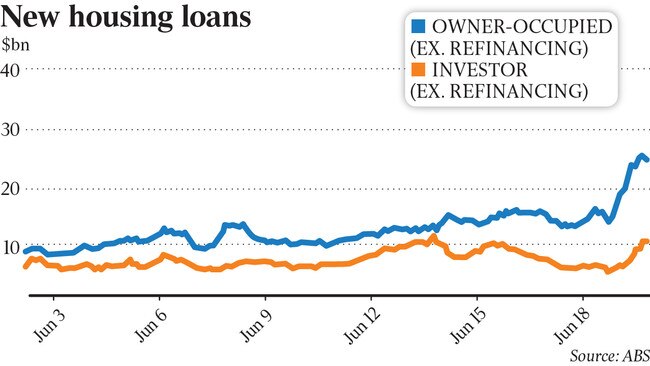

While housing finance commitments fell 1.6 per cent month-on-month in June they are up a hefty 83 per cent over the past year.

In addition, investor lending is accelerating, rising more than 40 per cent since January, suggesting a speculative element is emerging in the market as prices rise at their fastest rate in more than 17 years.

A cocktail of ultra-low interest rates and a fast recovery in the economy has been fuelling the housing market. However the economy is set to be tested with the latest wave of lockdowns sweeping eastern Australia.

APRA chairman Wayne Byres told the banks in the letter, dated April 23, that the lending growth was coming in a backdrop of “extraordinarily low interest rates, high household indebtedness and accelerating housing prices”.

“Given the importance of mortgage lending to the balance sheet of the banking system, it is important for the resilience of the system that standards for new lending remain prudent and responsive to changing market conditions,” Mr Byres said.

“APRA expects (banks), and particularly the largest lenders, to be especially vigilant in managing the risks within their residential mortgage portfolios in the current environment.

“APRA would not expect to see (a bank) relax its risk appetite limits at this time,” he said.

While borrowers were expected to have serviceability buffers in place it was important that “excessive debt levels are not being incurred by customers during a period of exceptionally low interest rates,” Mr Byres said.

Australia’s powerful Council of Financial Regulators has been looking at potential policy options to address the risks in the housing market. On Friday Reserve Bank government Philip Lowe told a parliamentary committee that while home lending standards were “sensible and reasonable”, fast-growth in interest-only loans was adding risk to the financial system.

Dr Lowe also told the committee he couldn’t “rule out regulators taking action to curb excessive household credit growth over the coming year”.

He said the bank was “turning our attention to the sustainability of trends in household borrowing”, noting recent credit growth of six per cent for the year.

“Let’s say we are talking about double-digit credit growth running for some time (and household incomes were growing by only around 5 per cent), APRA at some point would be preparing interventions,” Dr Lowe said.

He said this may see regulators intervene to force banks to “raise the minimum rate when banks are deciding how much they will lend”.

Even with millions in lockdown, the RBA is optimistic higher vaccination rates will free Sydney from its current lockdown by October and a sharp bounce back will return the economy to its pre-Delta trajectory as soon as March next year.

In the letter send to bank boards, APRA’s Mr Byres also asked banks to show “assurances provided to APRA in 2018 continue to be met”, adding “if this is no longer the case, the cause of any exceptions”.

He said APRA needed to be satisfied that a bank’s risk appetite limits and lending standards in light of current lending.

Banks were also required to show they had “processes in place to actively monitor risks in residential mortgage lending, with a focus on the quality of new lending”.

Mr Byres also revealed APRA was “conducting a hypothetical borrower exercise” which would benchmark the banks on risk settings were placed compared to their rivals.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout