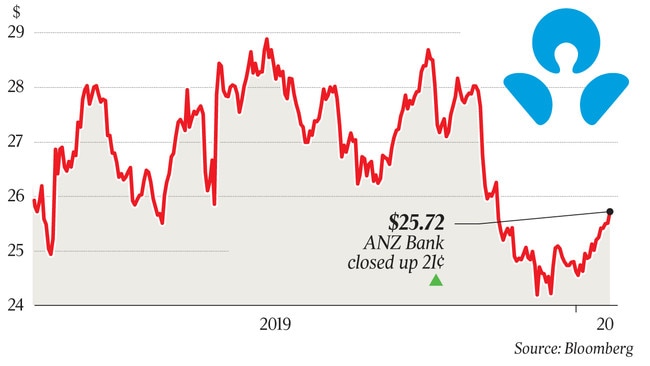

ANZ lifts its game with tech transformation

ANZ has quietly kicked off a technology transformation of its Australian retail and smaller-scale commercial businesses.

ANZ has quietly kicked off a multi-year technology transformation of its Australian retail and smaller-scale commercial businesses that aims to deliver a ten-fold improvement in speed and digital capability.

Dubbed ANZx and overseen by chief executive Shayne Elliott, the new platform is designed to support the advanced, customer-friendly digital applications offered by mobile-only neobanks but at a much greater scale.

ANZ will also decommission more than a third of its IT systems, slashing the number from 330 to a little over 200 in the two to five-year life of the project.

The bank is tight-lipped about the overall cost, saying some of its $1.4bn annual capital expenditure budget will be diverted, but it baulks at any comparison to the $1bn-plus core banking modernisation completed by Commonwealth Bank in 2012.

“We’re not replacing our core banking legacy system, so this is not about our core general ledger,” Peter Dalton, managing director for customer experience and digital channels, told The Australian.

“What we’re doing is leveraging our current core banking system by improving the associated systems and the overall customer experience.

“The technology is really important but it has to be for a purpose, and if you don’t focus on the purpose it’s more likely that you’ll lose your way.”

Investors are deeply cynical about the value of core banking modernisation programs after a series of botched implementations and subsequent asset writedowns, not only in Australia but around the world.

While CBA mostly delivered on expectations, an even more ambitious seven-year transformation at National Australia Bank turned into a capex black hole and is now barely — if ever — mentioned.

Consultancy Oliver Wyman says in its annual State of the Financial Services Industry report for 2020 that only 25 per cent of investors are confident that digital transformation strategies will be effective.

The average size of the programs, it says, is equal to 5 per cent of revenue a year, with ANZ boasting group revenue of $19bn in 2019, or $8bn for retail and commercial in Australia.

The report quotes one fund manager saying there is very little evidence of investments improving revenue or operating profitability, although some benefits will accrue from cost savings.

ANZx was conceived late last year at the end of the financial services royal commission amid a growing realisation that something had to be done to modernise the bank’s creaky systems if it were to deliver on Mr Elliott’s ambition for a digital legacy.

Many of the industry’s products and paper-based processes were created in the pre-internet era, before smartphones and cloud-based computing.

The royal commission demonstrated that many customers were left with a sour taste after interacting with the industry’s outdated products and systems.

For ANZ, the key residential mortgage product was a classic example, requiring 408 different processes to complete.

Under ANZx, the process has been reformatted and abridged to 38 steps.

Once fully implemented, the time taken to spit out a fully compliant mortgage that discharges all of the bank’s obligations, including responsible lending, is expected to collapse from days to hours, or even minutes in some cases.

With increased automation, group costs are expected to come down, helping realise Mr Elliott’s dream of an $8bn cost base by 2022, down from $8.6bn last year which was the lowest since 2013.

The overriding objective of ANZx, however, is to modernise banking by helping customers improve their financial well-being instead of just facilitating transactions.

“We think a lot of banking today is predominantly focused on balances, accounts and getting a loan, which is important and obviously we’ll still be doing all that,” Mr Dalton said.

“But we want to take it a step further by using data and other solutions to help customers understand where their money’s going and how they can get into a better financial position. The bank has more than 300 products in retail and commercial, and to reinvent those products using modern technology will take us a number of years.”

At the core of the project, he says, are nine financial well-being principles. They include sound money management, or spend less than you earn; put money aside for an emergency; protect what you can’t afford through insurance and other products; save regularly to achieve your goals; borrow within your means; pay off your most expensive debt first; accumulate savings for your retirement; if you have the capacity, invest in things that will grow in value, and where possible give back to the community.

While some of these principles were already built into the bank, Mr Dalton said ANZx would bring them all together in a comprehensive package.

“We’re designing solutions that are very digital, mobile-focused, highly intuitive and easy to use and very scalable,” he said.

“We’re then building them into our existing technology, or in some cases using cloud-based technology so we can bring them to market in the future.

“It’s essentially a digital offering but a lot of the products were created 20-30 years ago when the system was more paper-based, so we’re rethinking them to make the digital experience a lot more intuitive and easier to use.

“It also makes the bank more efficient because we have simpler processes internally.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout