Amid uncertainty, Macquarie Group ditches full year earnings guidance

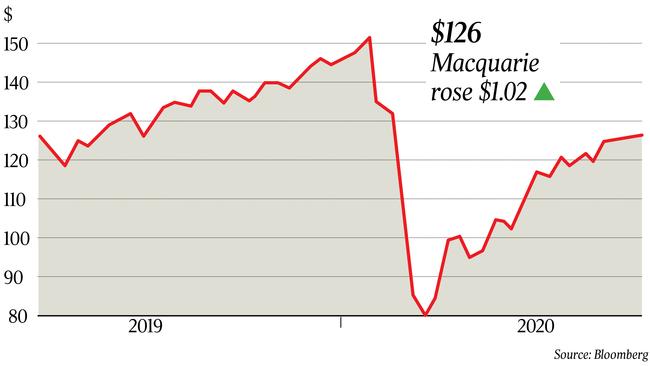

Macquarie scraps earnings guidance for the first time since the GFC as it warns of ‘unprecedented uncertainty’.

Homegrown investment bank Macquarie Group has scrapped its earnings guidance for the first time since the global financial crisis as it warned “unprecedented uncertainty” caused by the COVID-19 pandemic was likely to hamper its ability to sell assets held across its vast infrastructure funds.

The bank also revealed it is slowly bringing staff back into the office in cities that are not crippled by the pandemic, with nearly 20 per cent of its 16,000 global workers now back at their desks.

Speaking ahead of Macquarie’s annual meeting on Thursday, chief executive Shemara Wikramanayake said that market conditions “are likely to remain challenging”, especially given the significant and unprecedented uncertainty caused by the worldwide COVID-19 pandemic and the uncertain speed of the global economic recovery.

She also noted the economic hit to Australia had been masked by support from the government and central bank.

“The extent to which these conditions will adversely impact our fiscal 2021 result is uncertain and that makes short-term forecasting extremely difficult for us, so we’re unable to provide meaningful earnings guidance at this point,” she said.

The comments underscore how global pandemic and ultra-low interest rates are playing havoc on markets and asset valuations, which has clouded the outlook for the investment bank.

The warning came as Macquarie unveiled its first quarter results, which were down slightly on the same period a year ago amid “mixed” trading conditions.

The group’s base case scenario as outlined at its full-year result in May — a 9 per cent unemployment rate, a 9 per cent contraction in GDP and a 15 per cent drop in house prices — was broadly playing out as expected, chief financial officer Alex Harvey said.

Australia had seen a “slightly lower dip” than it had forecast, with a similar recovery story, “but obviously masked a little bit, in particular on the unemployment side by the great support that has come out of the government and central bank”. Europe was seeing a slightly sharper downturn but with expectations of a faster recovery and the US remained “pretty consistent”, he said.

The group saw lower income in its banking and financial services arm in the quarter as it topped up its provisioning for bad and doubtful debts, but Ms Wikramanayake was quick to point to the quality of the bank’s loan book.

“The quality of our book is very, very good,” she said.

“Our loan-to-value ratio … is sitting on a dynamic basis at about 57 per cent. So whether it be in the mortgage book or even with our small to medium enterprise clients, where we‘re a small player in business banking, we have a high-quality book.

“But we have to play out that for some of those people, depending on what industry they‘re in, they could suffer more than others,” she said.

In the June quarter 13 per cent of its clients accessed assistance, she said.

The bank had already seen downgrades in some of its small to medium business clients in sectors that were most affected by the pandemic, she said, as she cautioned on the escalating crisis in Victoria.

“As the Victorian situation gets worse, we may have people face greater difficulty, and I think like all our peers, we’re very committed to bringing as many of our customers through this as possible.

“So we’re stepping up to help them through,” she said.

“We’re working with all our clients to bring them and the economy through this (crisis) as best as possible.”

Commenting on the outlook for dividends at the bank’s annual meeting, chairman Peter Warne said Macquarie would again look to the latest guidance from the prudential regulator when making a decision at the half-year.

“Our No 1 focus is to ensure that the payment of the dividend has no negative effect on our capital position. That is utmost in our mind and so it is very hard to predict at this stage,” he said.

The uncertain environment had affected a number of the group’s businesses, Ms Wikramanayake said, including Macquarie Capital, which saw significantly lower investment income in the quarter. But the division had a good book that positioned it well as the market recovered, she said, as she warned of the near-term headwinds for asset sales.

“This is not going to be a very conducive environment for realising those investments, whether they be in on the balance sheet in Macquarie capital, in the infrastructure and energy group, the advisory capital solutions, or the asset manager … we’ll be looking to realise assets at the time they get the best return instead of forcing an exit at a particular time.”

Bell Potter analyst TS Lim said the group’s performance over the quarter was “a remarkable achievement” given the challenging environment.

Strong capital levels gave it “a lot of firepower” to take advantage of any opportunities that came up, he said.

The group had a capital surplus of $8.1bn at June 30.

“I think they’ll be patient and wait for the right opportunity. It could be anything but mainly infrastructure because that’s their key strength,” he said.

The virtual annual meeting saw shareholders overwhelmingly back the bank’s remuneration report with more than 95 per cent in favour. The vote is increasingly seen as a proxy for shareholder satisfaction over a company’s overall performance.

Macquarie shares finished the session up 1 per cent at $126.23.

with Samantha Bailey

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout