Macquarie cuts dividend as annual profit slides 8.4pc

Macquarie has slashed its dividend as annual profit fell 8.4pc amid coronavirus turmoil, and has refused to provide guidance.

Macquarie Group has sharply cut its final dividend amid the COVID-19 turmoil and posted a decline in annual profit to $2.73bn, as the asset manager and investment bank also shied away from providing 2021 guidance.

Macquarie’s profit fell 8.4 per cent to $2.73bn for the 12 months ended March 31, compared to a record $2.98bn in the same period a year earlier, the company said in an ASX statement on Friday.

The result missed expectations as analysts were expecting Macquarie to deliver a profit of $2.87bn.

The final dividend fell to $1.80 per share, taking the full year payment to $4.30, which is down 25 per cent on 2019 dividends.

The dividend cut comes after the banking regulator called on banks and financial companies to seriously consider deferring dividend payments during the COVID-19 crisis, or to materially reduce the payments to conserve capital.

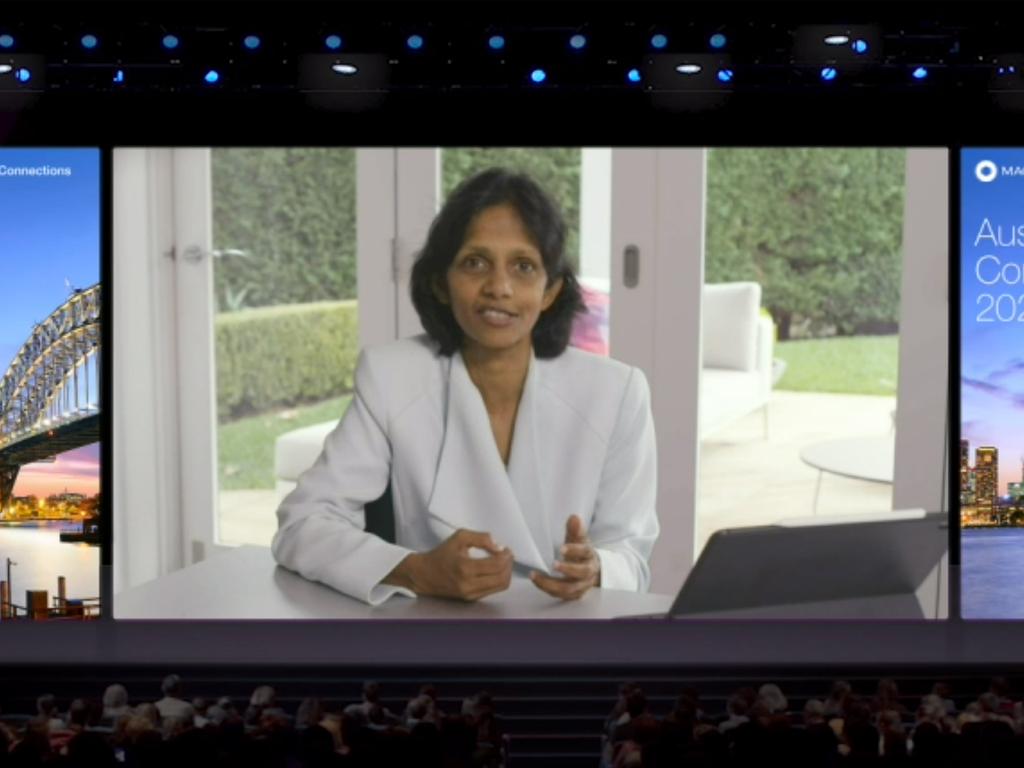

Macquarie’s chief executive Shemara Wikramanayake said given the challenging external backdrop it was too difficult to provide “meaningful guidance”.

“We continue to maintain a cautious stance, with a conservative approach to capital, funding and liquidity that positions us well to respond to the current environment,” she said. “The longstanding fundamentals that have resulted in Macquarie being profitable every year since inception are unchanged.”

Macquarie’s surplus capital printed at $7.1bn as at March 31.

The earnings result was hit by impairment and other charges, relating to the pandemic, of $1.04bn.

Assets under management rose 10 per cent to $606.9bn.

Ms Wikramanayake on Tuesday expressed confidence that Australia was well placed to weather COVID-19 economic shocks and an ensuing global recession, given long-term activity drivers such as trade and demand for infrastructure remain in place.

Macquarie’s shares fell initially in early trading before ralling 1.1 per cent to $100.65 as at 10:21am (AEST). The stock remains down, though, from a 12-month month high of $152.35 touched before the pandemic took hold around the world earlier this year.

Bell Potter analyst TS Lim remains optimistic on Macquarie, given the one-off charges that weighed on the result from COVID-19.

“Statuatory profit would have been about $3.11bn if not for COVID-19 versus $2.98bn in FY19 and so would have beat guidance,” he said. “While this was not to be, we can take comfort in that the underlying business remains strong.”

Macquarie had previously given guidance for 2020 profit to be “slightly down” on the record 2019 result.

Ms Wikramanayake said the final months of Macquarie’s financial year were “overshadowed by the profound human impact of the COVID-19 global health crisis and its economic consequences”.

“Macquarie’s full-year result has also been subject to the effects of this crisis and a strong underlying financial performance in FY20 was impacted by a material increase in credit and other impairment charges, primarily reflecting the deterioration in current and expected macroeconomic conditions as a result of COVID-19,” she added.

Macquarie’s total operating income fell 3 per cent in the year ended March 31, compared to the prior 12 months.

The group’s asset management division - its biggest unit - saw its net profit contribution rise 16 per cent for the 2020 year, underpinned by increased base fees, performance fees and investment-related income.

But Macquarie Capital, the investment banking and advisory arm, posted a 57 per cent slide in profit contribution for 2020 as it was hit by lower fee revenue from debt capital markets deals and higher operating expenses.

The commodities and global markets unit made a steady net profit contribution, compared to 2019, while the banking and financial services division saw its contribution edge up on higher deposit and loan volumes.

Macquarie’s annualised return on equity was 14.5 per cent for the 12 months ended March 31, down from 18 per cent a year earlier.

The group didn’t follow two of the major retail banks, ANZ and Westpac, in deferring dividend decisions due to the economic fallout of COVID-19.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout