Afterpay hits out at banks over BNPL regulation, hindering competition

Afterpay has accused banks of trying to stifle competition as it called for consumer protection and financial inclusion to be at the centre of any BNPL regulation.

Afterpay has accused banks of trying to stifle competition through their support of proposed tough “buy now, pay later” (BNPL) regulation, as it called for consumer protection and financial inclusion to be at the centre of any reform.

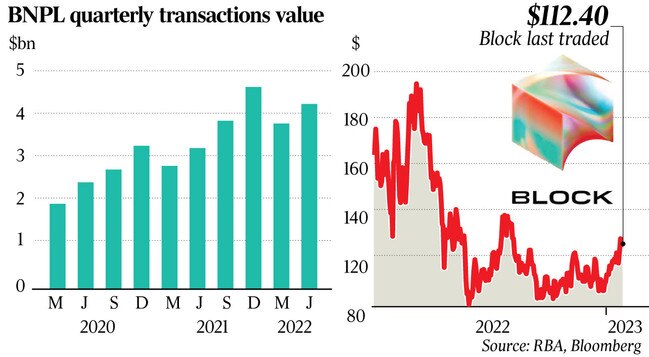

The BNPL giant’s submission to Treasury – which is considering three models for regulation – endorses the least onerous option on the sector, and aspects of the middle-ground option. Afterpay, which is owned by US company Block, also said the credit score reporting system required “significant modernisation” and to draw on real-time data, if it was to prove effective for BNPL users and transactions.

“The point that BNPL regulation should be designed to serve consumers and not protect the banks against competition I think is really, really important,” Block’s international head of public policy Michael Saadat said.

“That competition lens is really important in terms of understanding why certain submissions are saying what they are.”

Mr Saadat formerly worked for the corporate regulator before joining Afterpay in 2019.

Treasury’s first BNPL regulatory option would amend the Credit Act to impose an industry-specific requirement for BNPL providers to check that a product was not unaffordable before it was offered. That would rely on co-regulation and the strengthening of an existing industry code, but BNPL players would not require a licence.

The second option requires players to obtain and keep a credit licence, and abide by responsible lending rules, specific to BNPL products. That would see firms determine if instalment products were unsuitable for consumers. Treasury’s third option would regulate the sector in the same way as other credit products, such as home loans and credit cards. That requires players to hold a licence and conduct responsible lending checks to assess whether a customer can afford repayments.

Afterpay’s submission cautioned that the third option was a “disproportionate and damaging response” that did not reflect evidence of consumer harm in the BNPL sector.

“If the regulation is disproportionate and overly burdensome that drives providers to provide consumers with much higher upfront (BNPL) limits, so it does have that impact. That would be an unfortunate result,” Mr Saadat said.

“This point around financial inclusion is really important because the counterfactual in all of this is consumers rely on these kinds of products to buy things that they need or want, and if these types of products are not accessible, then they will look to alternatives.”

Mr Saadat said credit cards were more dangerous for consumers, if they were paying interest rates above 20 per cent and making only minimum repayments. “We don’t engage in the kind of debt collection practices that traditional credit providers do, so we really do limit the potential risks for consumers.”

Consumer advocates lodged a joint submission to the Treasury review – signed by 22 organisations – which urged option three to be the model followed in Australia, with additional safeguards. They found some consumers were getting into unmanageable debt by using BNPL for essentials or drawing on multiple accounts.

Commonwealth Bank has said it supports Treasury’s second option, alongside National Australia Bank, but both lenders also noted they were also in favour of credit score reporting. Westpac, however, is endorsing option three and has called for reforms to disallow consumers paying BNPL debts with credit cards.

Zip Co chairman Diane Smith-Gander this month said the sooner the BNPL sector was regulated properly, “the better”, after the company initially supported Treasury’s option two.

Afterpay’s submission cited a Mandala Research poll of 1000 consumers that found 85 per cent preferred the use of rapid credit score checks or an assessment of BNPL repayments, over the use of income and bank statement checks. “We are constantly assessing what limit to provide someone and whether they should be able to use the product and we stop people using the product as soon as they miss a payment,” Mr Saadat said.

“It’s really critical that we go back to those first principles … and not just saying it’s (BNPL) credit and therefore it should be regulated like other credit. That is an unsophisticated position to be taking. It doesn’t have any room for nuances and doesn’t really put consumers at the front of the debate.”

Afterpay’s submission said it didn’t believe credit checks were necessary for low-cost purchases, but the company would support lowering the threshold in the industry code to allow new customers to get a limit of $1000, down from $2000. “For existing BNPL customers, we believe spending limits of between $1000 and $3000 should be available so long as customers are demonstrating strong repayment history. Above $3000, we are supportive of additional requirements such as credit checks,” it said. Afterpay also said if the use of BNPL to purchase gift cards for groceries was a concern, Treasury could adopt the model it takes and ban consumers using BNPL for gift cards on their first purchase.

FinTech Australia’s submission said its members expressed “strong opposition” to Treasury’s third regulatory option, and a blanket requirement for affordability tests across all transactions would prove challenging for small players. “FinTech Australia members are broadly supportive of option one or a lighter touch approach to option two – in particular the application of RLOs (responsible lending obligations) which are scaled to the level of the risk and recognition that BNPL products are not aligned with many other credit products in the market,” the submission said.

An Australian Finance Industry Association spokesman said the BNPL code had set a “strong foundation” and should form the basis of proportionate regulations.

“Simply applying credit laws designed for different products will undermine the demonstrable consumer benefits BNPL delivers for millions of Australians,” he said.

AFIA declined to provide its submission to The Australian or clarify which model it is supporting.

Last week, the Australian Retail Credit Association urged affordability checks and credit score reporting occur on all BNPL accounts to protect against consumer harm, with the proviso that smaller-ticket purchases have a slightly simpler set of regulations.

Markets including New Zealand and the United Kingdom are also separately pursuing BNPL regulation.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout