Falkiner Merino empire next in rush to sell farm

The historic birthplace of the modern merino sheep and Australia’s golden era of wool prosperity is for sale.

The historic birthplace of the modern merino sheep and Australia’s golden era of wool prosperity is for sale, with the legendary Wanganella, Peppinella and Boonoke sheep stations in southern NSW being touted to overseas buyers as part of a potential $330 million deal.

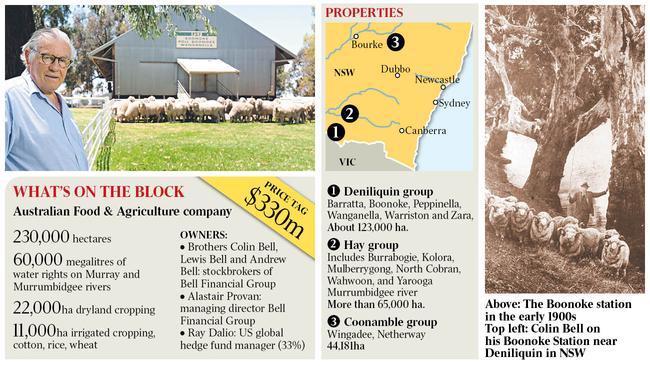

A Riverina pastoral empire known since the 1880s as the FSF Falkiner group has been quietly put on the market by its five owners, as part of the much larger Australia Food & Agriculture company’s agricultural portfolio.

The AFA sale of its 18 properties in southern NSW was confirmed yesterday to The Australian by part-owner and stockbroker Colin Bell. The $330m asking price — for a portfolio of 18 farms covering 226,000ha clustered around Deniliquin, Hay and Coonamble — compares with $380m paid for the Kidman cattle empire of 10 million hectares, which sold last year to an Australian-Chinese joint venture led by mining magnate Gina Rinehart. Overseas buyers are already circling the highly productive rural group, which includes the merino wool properties of Boonoke, Wanganella, Peppinella, Zara and Baratta — from where 80 per cent of all modern merinos can be traced — and 13,000 merino stud sheep.

Mr Bell said Chinese companies were among prospective buyers looking at major Australian agricultural assets. Shanghai Pengxin — which was twice blocked by the federal government from buying the vast Kidman holding as a majority owner — is considered a possible bidder for Australia Food and Agriculture, although it recently splashed out $US290m for one of Brazil’s largest agricultural businesses.

Foreign Investment Review Board chairman Brian Wilson, who must approve the sale of the AFA conglomerate to any foreign bidder, warned Chinese investors last week to steer clear of “icon” rural properties if they wanted to avoid a political outcry and potential government rejection of their bid.

Confirmation that AFA was for sale came as the Shenzhen Kondarl group, a listed Chinese pig and poultry company, announced it was close to finalising the purchase of Australia’s biggest avocado farm at Busselton, Western Australia, for as much as $190m.

Mr Bell said the group was being sold because all its five part-owners — Mr Bell and his two brothers Andrew and Lewis Bell from the Bell Financial group, Bell managing director Alastair Provan and US hedge fund manager Ray Dalio — were older than 70.

“We are selling all of the company or a share of it, but the properties will not be split up and sold separately,” Mr Bell said yesterday. “We are being selective about who we approach — they have to be high-value individuals or companies both here or overseas with an interest in Australian agriculture — and what we are selling here is a profitable business, not just individual farms.”

AFA released its financial results last week, showing the group had sales of $55m in 2015-16 and recorded a pre-tax profit of $25m.

Mr Bell said the group as a whole produced wool, cattle, sheep, stud rams, cotton, rice, cereal and pulse crops. The AFA sale includes 11,000ha of high-value irrigated land used for rice and cotton, 60,000 megalitres of water entitlements from the Murrumbidgee and Murray river systems, 100,000 merino wool sheep and the magnificent homestead on Boonoke.

The golden era of the wool industry in the 1950s — when wool returned £1 sterling for every pound of wool produced ($3.56 per kilogram) — was centred around the FSF Falkiner pastoral empire and its famed Peppin merino fleeces.

The Bell Group acquired the five FSF Falkiner properties between Conargo and Deniliquin in 2000 — bought from News Limited, publisher of The Australian for a reported $45m — with a covenant attached that stops the historic Wanganella and Boonoke sheep stations being sold separately or their sheep studs being dispersed.

Other trophy properties included in the aggregated AFA sale are Burrabogie and North Cobran on the Murrumbidgee River near Hay, and the former foreign-owned showpiece properties of Netherway and Wingadee on Castlereagh River at Coonamble.

Mr Bell said he did not understand why so many overseas buyers, especially Chinese, seemed obsessed with buying only cattle stations, in the rush to lock-in a “clean, green and safe” supply chain of beef to affluent Chinese consumers.

He denied the $330m price was too high, as some potential bidders have claimed. He said it would take more than 50 years to put together a conglomerate of such quality as AFA’s holdings, with the combined business offering economies that have seen it make a profit 13 years out of the past 16.

Mr Bell said sophisticated investors understood the value of agricultural diversity. “This is so different from Kidman with just its cattle,” Mr Bell said. “We don’t have to sell, and we are in no rush to sell; we will only be selling it as a (combined) business — these are all scale and trophy properties.”

The Australian’s Global Food Forum will be held on March 28 at Crown Melbourne. Tickets at globalfoodforum.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout