And as we saw in the US overnight, Wall Street swung violently, helping create a difficult environment for governments to work in. Australian shares were thumped at the opening as overseas sellers jumped in thus making our stimulation task even harder than the US’.

In the US, President Trump understands better than most world leaders the impact of stockmarkets so has invited top Wall Street executives to discuss responses to the escalating coronavirus outbreak.

In Australia, Morrison and his Treasurer Josh Frydenberg are putting forward a stimulus package. But the world has given the thumbs down to Australia and our dollar is being hammered.

While the combination of the virus impact and the desperate problems facing the US oil industry cause violent fluctuations on American and global stock markets, the powers of governments are limited because consumers have long established spending patterns which will not change.

In this context Charlie Nelson at Foreseechange has analysed the links between the Australian stockmarket and consumer behaviour.

And sadly the latest share market crash threatens to cause sharply lower household consumption and GDP growth.

Bigger than bushfires, virus

Combine that with the direct impact of bushfires and coronavirus and a technical recession now seems likely. And of course if we shut down schools and have sporting events with no audience, then the direct blows from the virus will multiply.

Foreseechange says that adding to that direct impact, computer trading driven sharemarkets will have their own severe impact.

If the wildly fluctuating market settles anywhere near a 15 to 20 per cent fall, then the market impact on Australia’s economy may be greater the bushfires and the coronavirus combined.

Consumption expenditure comprises nearly 60 per cent of the expenditure measure of GDP.

Sharply lower sharemarkets increase the household saving ratio (the percentage of household disposable income not used for consumption).

Foreseechange concludes that, not surprisingly when Australians see their household wealth reduced significantly they lift their saving rate to repair the damage.

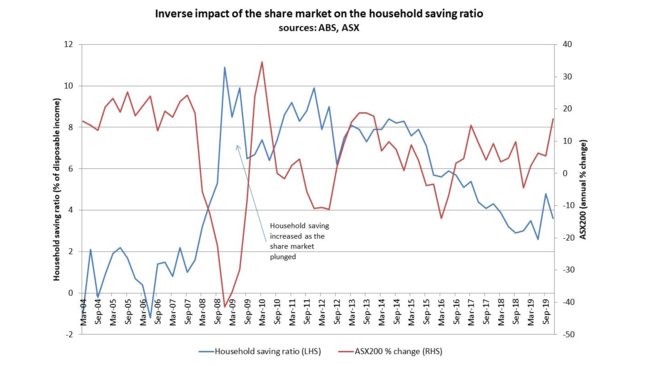

For example, as the graph shows the ASX had a peak in late 2007 and then fell by 40 per cent over the following year. During this period, the household saving ratio skyrocketed from 1.6 per cent to 10.9 per cent of disposable income.

On the other side, the household spending ratio fell from 98.4 per cent to 89.1 per cent of disposable income. History shows us that for every 10 per cent fall in the sharemarket, the household saving ratio increases by 1 per cent. If a 20 per cent fall in the share market persists, this would increase the household saving ratio by 2 per cent. Conversely, the household spending ratio would decline by about 2 per cent.

Depending on price movements, this could reduce real GDP by 1 per cent. This “stockmarket impact” would be in addition to the estimated direct impact of the bushfires and coronavirus of around 0.7 per cent.

Scott Morrison and Josh Frydenberg will need a very aggressive stimulus package to overcome these forces which threaten to create negative economic growth in both the March and June quarters, which would constitute a technical recession.

It’s clear that both the Australian and US governments need to not only make big moves, but to make them very fast. And that’s exactly what the Wall Street leaders will be telling President Trump.

Global forces

Meanwhile, we continue to get good news from China and President Xi Jinping is visiting Wuhan. And President Putin looks like he has “blinked” as he saw the pending catastrophic impacts on Russia from an oil price war and more talks are likely with Saudi Arabia.

And what happens to oil ranks high in US priorities. The US credit market is sensitive to moves in oil because a large portion of high-yield bonds in America are issued by companies involved in energy production, distribution and exploration.

Some US shale producers are on the brink of bankruptcy, which threatens to be a big blow to credit markets, the banking system and the entire US economy.

In simple terms shale oil and other energy producers structured their enterprises with very high debt and that debt has become high risk given the fall in oil, gas and coal prices. The decline in the value of the energy bonds may have been part of the swing to US government bonds despite the token yields.

Highly volatile stockmarkets are going to play a big role in governing the fortunes of US President Donald Trump and Australian Prime Minister Scott Morrison.