Scott Morrison top of the G7 leaders’ Covid class as S&P upgrades outlook on AAA rating

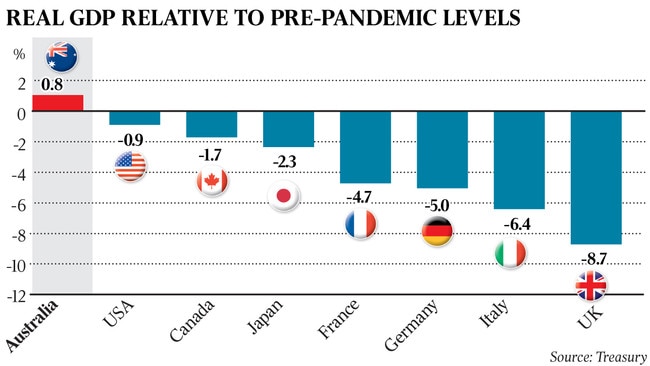

Scott Morrison will head to the G7 leaders’ meeting with the boast that Australia’s economy leads the major advanced nations.

Scott Morrison will head to the G7 leaders’ meeting with the boast that Australia leads the major advanced nations with an economy that has exceeded its pre-pandemic size, as ratings agencies praised the “swift and decisive” response to the virus as a global standout.

S&P Global Ratings on Monday upgraded its outlook on Australia’s coveted AAA debt rating from “negative” to “stable”, ranking the economy as only one of three this year to have received a positive upgrade.

In a move that surprised some economists, the agency said the government had managed the pandemic “remarkably well” with a “swift and decisive” response to the virus, leading to a quicker and stronger economic rebound than global agencies had expected.

S&P also expected that “circuit-breaker” lockdowns such as that imposed by the Victorian government on May 27 would not be expected to have an impact on the broader economic outlook.

The Prime Minister told The Australian on Monday that the S&P upgrade represented an endorsement of Australia’s model of economic recovery going into the G7 meeting in the UK.

“Our AAA rating is now stronger today than before the pandemic,” Mr Morrison said.

“(S&P) is very clear in its acknowledgment that it has been the government’s decisive and timely actions that have taken the economy through its most significant challenge since the Great Depression.

“As always, we put our achievements down to the resilience of the Australian people and Australian businesses. The decisions we made were about a business-led recovery – not a -government-led recovery. That was the foundation of the plan.

“When you sit down with G7 nations which are business-led economies, this is an endorsement for our model of economic recovery.”

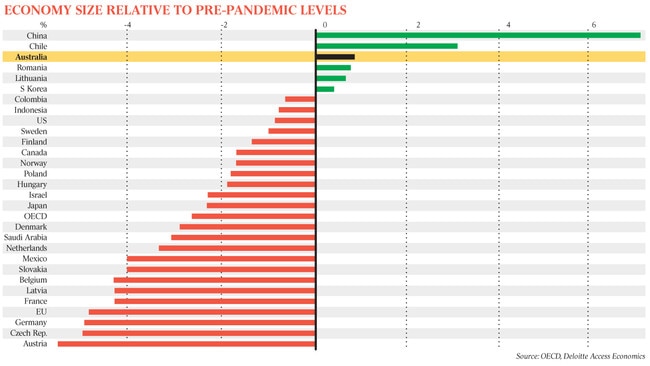

Mr Morrison said Australia was “one of just a handful of developed countries with economies that are bigger now than before the pandemic”.

“Lower taxes, business incentives and open trade are key to our plan that S&P has recognised,” the Prime Minister said.

Australia will attend the G7 summit in Cornwall this weekend as a guest member alongside India, South Africa and South Korea and the seven permanent members: the US, Britain, Japan, Germany, France, Canada and Italy. But it will be the only comparable economy, with the exception of South Korea, not only to have restored all its output lost to Covid-19 but expanded the economy beyond its pre-pandemic levels as well as boasting more people in employment than prior to the outbreak.

“The government’s swift and decisive fiscal and health response to contain the pandemic and limit long-term economic scarring has seen the economy recover quicker and stronger than we previously expected,” S&P said.

“Australia has a strong track record of managing major economic shocks, moderating our concern over its high level of external and household debt.”

Josh Frydenberg said the Australian economy’s upgrade had “defied the doubters yet again”.

“In the middle of a pandemic, S&P not only reaffirmed our AAA credit rating but upgraded Australia,” the Treasurer said.

“Significantly, S&P does not expect small outbreaks or short circuit-breaker lockdowns to derail our fiscal recovery.

“This welcome news comes off the back of 12 consecutive months of job ads growth and Australia – ahead of any major advanced economy – seeing employment levels higher than they were going into the pandemic.”

In a report released on Monday, the New York-based ratings agency said it was “more confident” the federal deficit would narrow to 2-3 per cent of GDP over the next two to three years, after peaking at 10 per cent in this financial year.

S&P analyst Anthony Walker said Australia’s upgrade was one of only three positive rating actions this year, alongside Taiwan’s and New Zealand’s.

Mr Walker said the government had managed the pandemic “remarkably well”, leading to a recovery that had been among the best in the world.

National accounts figures last week showed national output in the March quarter was 0.8 per cent higher than before the health crisis. “There are very few economies that are bigger today than they were before the pandemic, and this is translating into a strong fiscal recovery,” Mr Walker said.

The budget forecast the underlying cash deficit would peak at 7.8 per cent of GDP in this financial year, before falling to 5 per cent in 2021-22 and reaching an estimated 2.4 per cent by 2024-25.

“We do not expect to see a large increase in spending initiatives in the next budget in the lead-up to the federal election due in May 2022,” the S&P report read. “Nor do we expect small outbreaks or short ‘circuit-breaker’ lockdowns to derail our expected fiscal recovery at the general government level.”

S&P warned that it could lower the rating if it believed the general government deficit was unlikely to narrow over the next two to three years.

A “prolonged” lockdown – which Mr Walker defined as something akin to severe restrictions that persisted for a month or more – had the potential to trigger a ratings downgrade.

Westpac senior international economist Elliot Clarke said S&P’s announcement would not have an impact on the commonwealth’s cost of borrowing but it did “provide comfort” around the country’s recovery and debt trajectory.

“The stronger the economy, the less you need to borrow, and that puts you on the right path,” Mr Clarke said.

He said Australia’s success in keeping workers attached to employers through the pandemic, and the sharp labour market recovery as restrictions had been eased, were the true gauge of the nation’s performance.

For example, the US economy is expected to return to pre-Covid levels by the middle of the year - only three months behind Australia’s. “But if you look at the labour market, they are in a fundamentally different situation,” Mr Clarke said.

There are more Australians employed now than before the health crisis, but 7.6 million fewer Americans. Over the past two months, the US economy has created about 420,000 jobs, suggesting “they are a long way from achieving that pre-pandemic level of employment,” Mr Clarke said.

Australia is one of just nine countries to hold a AAA credit rating from the three major rating agencies, which include Fitch and Moody’s.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout