Reserve Bank’s Guy Debelle slaps down banks on lending slump

RBA flags a ‘sizeable’ downturn in house building which threatens to drag on the economy over the next year.

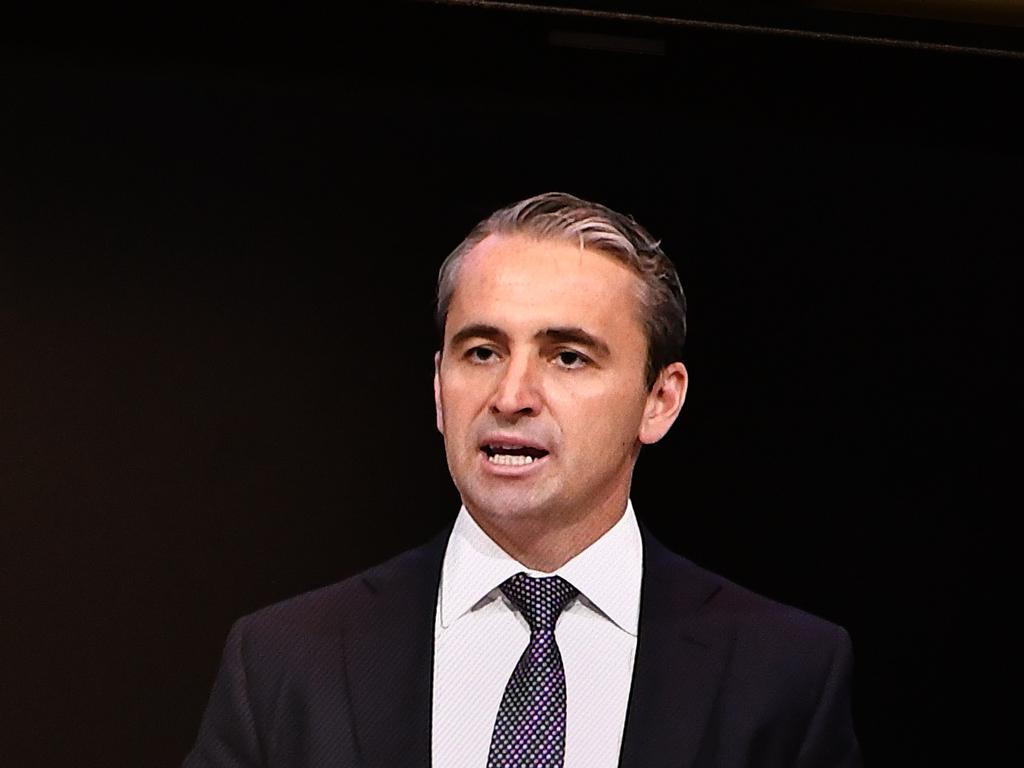

Australia’s biggest banks have received a slapdown from Reserve Bank deputy governor Guy Debelle, who says a lack of demand from home buyers -- not a regulatory crackdown on loose lending standards -- is “primarily” behind the slump in credit growth and the weak housing market.

Speaking at an industry conference in Sydney on Thursday, Dr Debelle also raised the prospect that lower interest rates across the nation would not be enough to resuscitate the housing market alone, and warned that the downturn in the construction market would worsen and would have a greater impact on the broader economy than previously thought.

“There is a sizeable downturn in construction underway,” he said.

“We are forecasting a further 7 per cent decline in dwelling investment over the next year, and there is some risk the decline could be even larger. This will directly subtract around 1 percentage point from GDP growth from peak to trough,” Dr Debelle said.

“The effect of the downturn in housing construction on the broader economy, though, is likely to be somewhat larger than 1 percentage point given the linkages the sector has with other parts of the economy,” he said.

PODCAST: Is the property downturn over?

Dr Debelle said supply and demand factors in the housing market, such as population growth, housing income growth and the rate of construction of new dwellings, had often had a greater effect on the property market cycle than interest rates alone, echoing comments from former treasurer Peter Costello who this week said monetary policy had “run its course”.

The Reserve Bank has sliced the official cash rate three times this year to a new record low of 0.75 per cent in a bid to drive unemployment lower amid the slowest economic growth since the global financial crisis.

Treasurer Josh Frydenberg recently urged regulators not to enforce responsible lending laws “too stringently” after a campaign from the banking sector that raised concerns the law was unnecessarily restricting credit and harming the economy.

“My main argument is that the slowdown in housing credit growth to households has primarily reflected the housing cycle rather than driven it,” Dr Debelle said. “That is, the slowdown in credit growth is primarily a demand story rather than a supply story.

“The dynamics of supply and demand have been paramount,” he said.

“Yes, there was a tightening in lending standards from 2014 onwards. But through the first part of this, housing lending continued to grow at a fast pace. There was some further tightening over 2018 following the royal commission, mostly through stronger enforcement of existing policies.

“But the bulk of the tightening had preceded that. Credit growth started to slow materially in mid-2017. Investor demand has slowed to such an extent that the stock of outstanding credit to investors has actually fallen in recent months.

“In my view this is primarily a decrease in investor demand given falling housing prices, more than the impact of tighter lending conditions,” Dr Debelle said.

“Throughout, competition for high-quality borrowers with standard loan applications has remained strong. In the end, it is difficult to separate the effect of demand and supply, but this strong competition suggests there is more of a demand than a supply story.”

The comments come after an increasingly vocal campaign from the banking sector, which has complained the decision by the Australian Securities and Investments Commission to appeal a responsible lending lawsuit against Westpac is adding to the uncertainty for rules surrounding lending and risking further crimping credit growth. Credit growth recently slumped to its worst pace on record amid the sliding housing market.

A number of government MPs have also accused the corporate watchdog of injecting further uncertainty into the lending market over the move.

Westpac provided one of the more forceful submissions, arguing against ASIC’s proposals to clear up responsible lending guidance, saying it could restrict credit growth, and the bank earlier this year earned a slapdown from the prudential regulator after jumping the gun on a proposal to lower the hurdles for borrowers to gain approval for loans.

“Interest rates are historically low,” Dr Debelle said. “Will we see a material increase in borrowing as a result?

“While turnover in the housing market remains low, credit growth is likely to remain low, even as prices pick up. Households may be more conservative in their willingness to borrow given low income growth. Lenders are applying tighter standards than in the past. Both of these may well combine to result in a more muted pick-up in lending than in the past.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout