Reserve Bank of Australia pushes back on speculation of rate hikes

The RBA has pushed back against speculation of rate hikes, as NAB’s business survey backed the central bank’s view the economy will quickly recover.

The Reserve Bank has pushed back against speculation of interest rate hikes as NAB’s monthly business survey backed the central bank’s view that the economy will quickly recover once the Covid-19 lockdowns end and vaccination rates rise.

Business conditions and confidence rose slightly in August but confidence stayed negative, reflecting a sharp deterioration in Victoria and, more generally, the degree of uncertainty in the economy as lockdowns persist and the timing of a full reopening remains unknown.

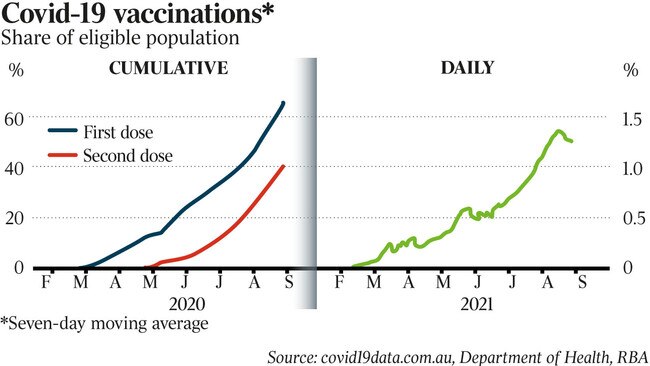

“The resilience of the survey during the current episode likely reflects the healthy momentum in the economy before the lockdowns, ongoing fiscal and monetary support as well as greater certainty that the lockdowns will end as vaccines roll out,” NAB chief economist Alan Oster said.

It came after the RBA decided this month to extend unconventional monetary policy support via its bond-buying program until at least February because of a “delay in the economic recovery and the associated increase in uncertainty about the future”.

In an address to the Anika Foundation, RBA governor Philip Lowe reiterated that the central bank expected the economy to start recovering by year’s end after a September quarter contraction of “at least 2 per cent, and possibly significantly larger” due to lockdowns, but continuing with its bond purchases until February would “provide some additional insurance against downside scenarios”.

“This shock is largely the result of government efforts to contain the movement of people and economic activity,” Dr Lowe said. “It is also expected to be temporary, given the expected easing of containment measures over coming months.”

He said the RBA has seen its role as being part of a “national effort to build a bridge to the other side and make sure that the economy is well placed to rebound strongly when the time comes”.

With a package of RBA support measures already in place, “our assessment was that fiscal policy is the more effective policy instrument in responding to the Delta outbreak”, Dr Lowe said.

“In contrast, monetary policy works mainly on the demand side and the effects on income are felt with a lag – realistically, there is little we can do to offset the hit to demand in the September and December quarters,” he added.

“This is the role of fiscal policy and indeed there has been a sizeable and welcome fiscal response.”

He reiterated that the Delta outbreak had “delayed but not derailed” Australia’s economic recovery, and it should be “back on its pre-Delta track” by the second half of next year.

However, Dr Lowe also maintained that the bank would not increase the cash rate until “actual inflation is sustainably within the 2-3 per cent target range”.

It was “difficult to understand” why financial markets had priced in rate hikes before that time.

“It won’t be enough for inflation to just sneak across the 2 per cent line for a quarter or two,” he said.

“We want to see inflation around the middle of the target range and have reasonable confidence that inflation will not fall below the 2-3 per cent band again.

“Our judgment is that this condition for a lift in the cash rate will not be met before 2024.”

Dr Lowe said that this precondition for rate hikes would require a “tighter labour market than we have now” and the RBA’s assessment was that “wages will need to be growing by at least 3 per cent”.

“We remain well short of this,” he said. “Even in industries where there has been strong demand for labour, wage increases remain mostly modest.”

UBS chief economist George Tharenou said: “RBA governor Lowe remains on the dovish side of expectations and global central banks. Lowe’s speech was incrementally more dovish.

“UBS continues to expect rates on hold over our forecast horizon until at least end-2022.”

The Australian dollar hit a two-week low of US73.31c after Dr Lowe’s speech. The S&P/ASX 200 index share index hit a three-day high of 7446.

Dr Lowe said there was “a lot of inertia in the wage-setting process” and it would “take some time for wage increases to lift to a rate that is consistent with achieving the inflation target”.

“This judgment stands in contrast to the expected path of the cash rate implied by market pricing.”

He noted that money market pricing implied the cash rate would rise to 25 basis points by the end of 2022, 60 basis points at the end of 2023 and close to 100 basis points at the end of 2024.

“These expectations are difficult to reconcile with the picture I just outlined,” Dr Lowe said. “I find it difficult to understand why rate rises are being priced in next year or early 2023.

“While policy rates might be increased in other countries over this time frame, Australia’s wage and inflation experience is quite different.”

Dr Lowe also said a lift in cash rates to cool the property market was “not on our agenda”.

Raising rates to cool housing would mean fewer jobs and lower wage growth, and this would be a “poor trade-off in the current circumstances”.

But the sustainability of trends in household borrowing was a “public policy issue to be addressed”.

“We are continuing to watch this closely, with the Council of Financial Regulators discussing possible regulatory steps if lending standards deteriorate or credit growth accelerates too much,” Dr Lowe said.

While conceding that monetary policy was “contributing to higher house prices”, Dr Lowe said “the way to address these concerns is through structural factors that influence the value of the land”.