Australian Banking Association hardship figures ring alarm bells as borrowers struggle

Hardship assistance to under-pressure borrowers almost tripled over the past month with loan deferrals in NSW spiking the most.

Hardship cases are rocketing as businesses and homeowners struggle through lengthy lockdowns, setting alarm bells ringing for the nation’s economic recovery.

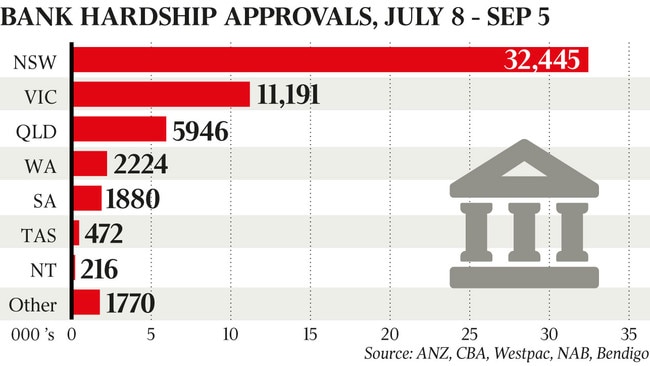

Hardship assistance to under-pressure borrowers almost tripled over the past month, with 57,000 customers now having reached out to their lender for help, up from 20,000 the month prior, according to the Australian Banking Association.

Home-loan deferrals close to doubled over the same period, jumping from 14,500 to more than 27,000, while deferred business loans surged from 600 in August to more than 3500 by mid-September.

The bulk of hardship and deferral cases are still coming from NSW, where residents of greater Sydney have been locked down since June.

ABA CEO Anna Bligh urged borrowers to reach out to their lender if they needed help.

“As lockdowns continue to be extended across cities and states, it is no surprise more strain is being put on people and businesses but it is important to remember that banks are here to help,” Ms Bligh said. “Over the last month, we have seen a substantial rise in business owners putting their hand up for assistance, and I encourage anyone else who is feeling the strain to do the same.

“Support is available to all small businesses and home loan customers significantly impacted by current lockdowns or recovering from recent lockdowns, no matter where they live or their line of work,” she said.

More than 32,000 hardship requests across NSW have been approved since July, while 18,700 borrowers have had their home loan repayments deferred and 2600 businesses have taken repayment holidays.

All up, 57 per cent of hardship assistance has been provided to NSW borrowers, while the state accounted for 69 per cent of all home loan and 72 per cent of all business deferrals, the ABA figures show.

Victorian borrowers, who are enduring their sixth lockdown since the pandemic began, have had more than 11,000 hardship assistance requests approved since early July, with 5000 homeowners deferring their mortgage repayments and 600 businesses taking a break on their loans.

The figures come days after NSW Premier Gladys Berejiklian unveiled the state government’s road map out of lockdown, giving businesses hope of a recovery with the reopening of hospitality and retail venues once the state achieves its double dose target for 70 per cent of people aged over 16, expected in mid-October.

People who are fully vaccinated will enjoy freedoms such as dining out at restaurants, going to the pub, getting their hair cut, and hitting the gym.

NSW recorded 1542 new infections on Tuesday, taking the total number of cases to 45,593 since the Delta outbreak began in June.

While 79.5 per cent of the state’s eligible population have had their first dose, 47.5 per cent have been double jabbed.

For Victorians, the path out of lockdown is likely to be a longer one, with 41.4 per cent fully vaccinated and 67.6 per cent having had one dose. Premier Daniel Andrews is expected to unveil his government’s road map out of lockdown in the coming days.

The rising number of hardship cases comes after the ABS national accounts data released earlier this month showed economic growth slowed to 0.7 per cent in the June quarter, with the next set of figures out in December to show a contraction in the September quarter.

The federal government has been urging the states to stick with the national reopening plan once vaccination rates hit 80 per cent to avert a contraction in the December quarter.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout