Reserve Bank holds fire on interest rates

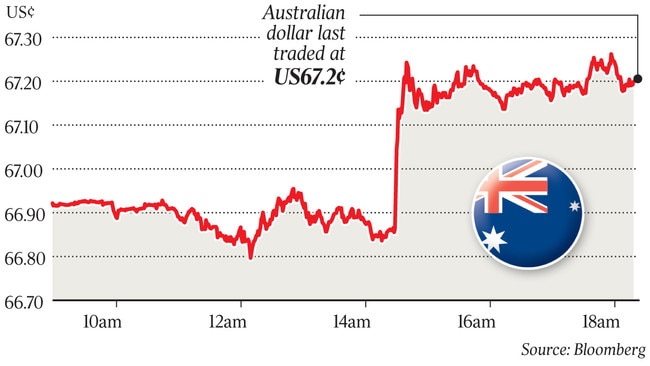

The dollar and government bond yields bounced off four-month lows after the RBA sounded more confident about the economy.

The dollar and benchmark 10-year government bond yields bounced off four-month lows after the Reserve Bank sounded more confident about the economy and shares tracked a global rebound as China ramped up its financial response to the coronavirus outbreak.

While acknowledging that recent bushfires in Australia and the outbreak in China would weigh on Australia’s economic growth in the short term, the central bank said it was “too early to determine how long-lasting the impact will be”. It left rates unchanged at a record low of 0.75 per cent, as widely expected.

The RBA surprised economists by leaving its economic growth forecasts unchanged at 2.75 per cent for this year and 3 per cent for 2021, while also saying that unemployment would stay around the 5.1 per cent rate recorded for December before falling slightly below 5 per cent next year.

RBA governor Philip Lowe will flesh out his view in an important speech on “The year ahead” at the National Press Club in Sydney on Wednesday. Dr Lowe is also due to testify before the House of Representatives’ Standing Committee on Economics on Friday. The RBA will provide the details of its latest economic forecasts in its quarterly statement on monetary policy that day.

The first RBA board meeting of the year came amid the backdrop of consumer confidence being ground down from a summer of bushfires. At the same time, China’s coronavirus is expected to deliver a hit to the global economy, with financial shockwaves now being felt as travel is restricted and supply chains are crimped.

It also comes as investors are bracing for a volatile corporate reporting season with profit downgrades gathering momentum.

Still, the RBA’s optimistic assessment of the domestic economic outlook came as China’s Shanghai Composite bounced 1.3 per cent and commodity prices stabilised after the People’s Bank of China added 400 billion yuan ($85bn) of liquidity via reverse repos — almost twice as much as Monday, and the most since January last year.

The PBOC resisted further weakening of the yuan, setting its official yuan “mid-rate” at 6.98 to the US dollar — its highest level in two months — after the currency had tumbled to 7.0256 to the US dollar on Monday.

The intensification of China’s financial stabilisation efforts followed Monday’s 7.7 per cent plunge in its sharemarket — the biggest one-day fall since 2015 — and a dive in commodities, including iron ore, as Chinese investors began to price an economic hit from the virus after extended Lunar New Year holidays.

The Australian dollar bounced 0.6 per cent to US67.25c and Australia’s 10-year bond yield rose by as much as five basis points to 0.94 per cent after the surprisingly upbeat RBA statement.

The S&P/ASX 200 index rose 0.4 per cent to 6948.7 points after diving as much as 1.8 per cent to a three-week low of 6897 a day earlier. It pared some of a 0.6 per cent intraday rise as the RBA’s optimism on the economy suggested it was in no rush to cut rates again.

But while economists said the RBA was likely to remain on hold again next month, financial markets continued to expect another 25-basis-point cut in the official cash rate to a new record low of 0.5 per cent by June. The market also saw a good chance of another cut to 0.25 per cent by year end.

Westpac chief economist Bill Evans said he was surprised the RBA did not lower its 2020 growth forecast given the weaker momentum that was apparent from the September quarter national accounts and developing questions around the global economy.

And he said it was “somewhat brave” of the RBA — given a range of leading indicators around the labour market — to assume that the recent surprise fall in the unemployment rate over the past two months would be sustained.

“The uncertainty around the coronavirus poses substantial risks to economic forecasts, but certainly the impact of the virus over the course of the first quarter both globally and domestically has to be quite damaging,” Mr Evans said.

“It seems unlikely that subsequent stimulus policies will be able to fully offset the short-term damage done to confidence and activity implying a realistic downward revision to growth forecasts, both globally and domestically.”

Mr Evans continued to expect that a combination of a more moderate growth outlook and deterioration in the labour market would require a further policy response, leading the RBA to cut rates again in April and August.

Similarly, the RBA’s unchanged growth outlook — despite expected hits from bushfires and the coronavirus — led UBS Australia chief economist George Tharenou to push his forecast of the next interest rate cut out from March to April.

Mr Tharenou still sees another cut by the RBA in June, albeit conditional on more global central bank easing and no material fiscal stimulus.

Morgan Stanley Australia economist Chris Read said the RBA was being “firmly reactive” rather than pre-emptive of weaker economic data, after cutting rates three times last year.

“In our view, this statement makes clear that the RBA is happy to stay reactive to the data, with a further move away from its inflation or employment targets the key catalysts for further easing,” Mr Read said.

“Given that we expect this — particularly on the unemployment side — we still think rate cuts are likely and have pencilled them in for April and August.”

In his statement, Dr Lowe said: “With interest rates having already been reduced to a very low level and recognising the long and variable lags in the transmission of monetary policy, the board decided to hold the cash rate steady at this meeting”, but “due to both global and domestic factors, it is reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target.”

Moreover, the RBA would “continue to monitor developments carefully, including in the labour market (and) it remains prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout