Reserve Bank upbeat despite fire, virus crises

The RBA has predicted the economic hit from bushfires and coronavirus will be short-lived, despite more pessimistic predictions.

The Reserve Bank has predicted the economic hit from bushfires and the coronavirus will be short-lived, as it left the official interest rate unchanged, reaffirmed its growth forecasts and maintained predictions that unemployment would continue to fall.

Reserve Bank governor Philip Lowe, in a statement released after the RBA board’s first meeting of the year on Tuesday, remained positive on the general direction and outlook for the Australian economy.

The bank believes that reconstruction activity work in the wake of the “Black Summer” bushfires will counterbalance the damage wrought and hopes the short-lived SARS outbreak of 2003 will prove a template for the coronavirus scare.

Despite more pessimistic predictions from market economists, Dr Lowe stuck to the bank’s growth forecasts set last November and said the central scenario was for the economy to grow by about 2.75 per cent this year, and by 3 per cent next year

Dr Lowe said the economic hit from the devastating bushfire season and unfolding virus threat would only “temporarily weigh on domestic growth”, amid fears of a potential contraction in the March quarter. He noted there were signs the slowdown in global growth that started in 2018 was “coming to an end” and that global growth was expected to be slightly stronger this year and next than it was last year.

He said the virus was a “source of uncertainty” that was “having a significant effect on the Chinese economy at present”. However, Dr Lowe, who is scheduled to address the National Press Club in Sydney on Wednesday, said it was too early to determine how long-lasting the impact would be.

In an upbeat assessment, Dr Lowe said: “The overall outlook is also being supported by the low level of interest rates, recent tax refunds, ongoing spending on infrastructure, a brighter outlook for the resources sector and, later this year, an expected recovery in residential construction.”

Dr Lowe also pointed to the Australian dollar being “around its lowest levels in recent times”, which would boost exporters.

Josh Frydenberg said the RBA’s outlook was consistent with the government’s forecasts in its latest budget documents and noted Dr Lowe’s assertion that the effects of the coronavirus would be short-lived.

“With China accounting for a third of Australia’s exports, we are watching these developments closely,” the Treasurer said. “Australia is in a strong position to respond to the challenges we face as responsible budget management has given us the ability to respond to economic shocks without increasing taxes or cutting essential services.”

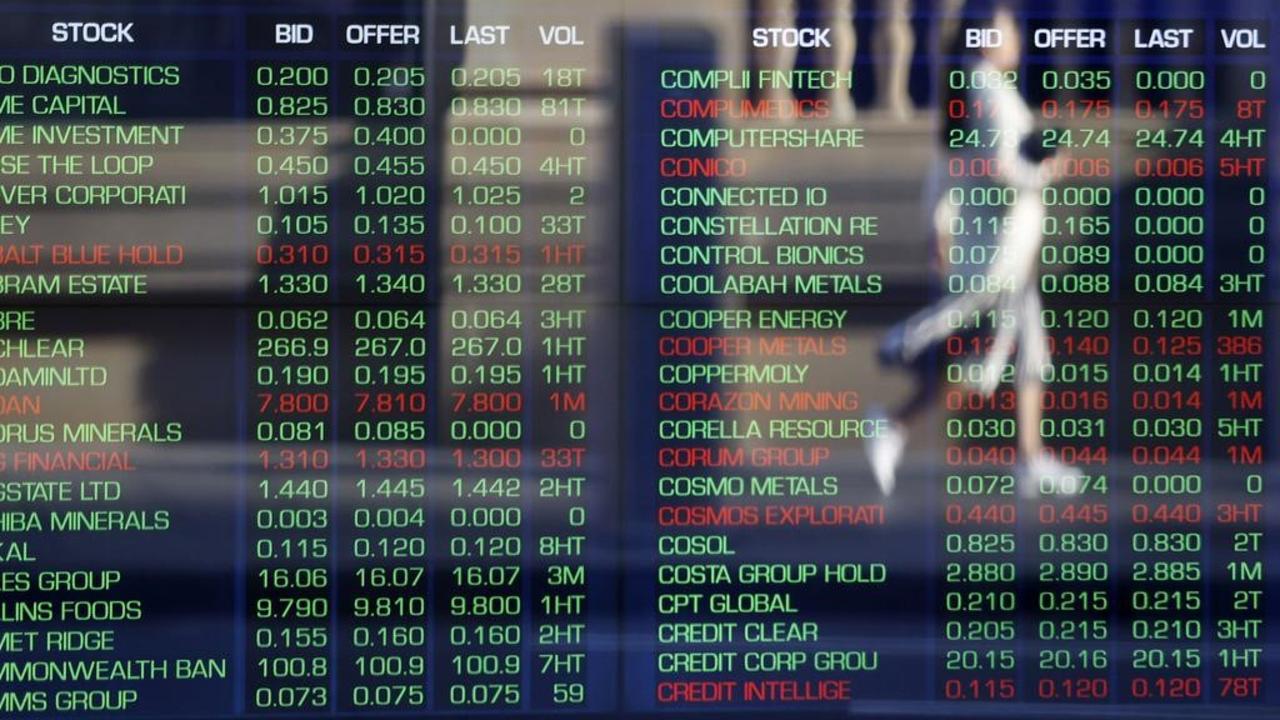

The Australian dollar jumped 0.4 per cent to US67.2c immediately following the RBA’s rates announcement, as traders responded to the bank’s upbeat message. The currency, however, remained near decade lows.

NAB chief economist Alan Oster expressed scepticism that the economy would rebound to 2.75 per cent growth through this year. “You’re not going to get there, you’re just not,” he said.

Mr Oster pointed to continued weakness in the domestic economy and the additional damage from the fires and the virus. “I don’t see those forecasts as credible,” he said.

The economy grew by 1.7 per cent over the year to September, according to seasonally adjusted data from the Australian Bureau of Statistics. Mr Oster said he did not expect the economy to accelerate from this pace in 2020.

AMP Capital chief economist Shane Oliver said he believed the economy would grow by only 2 per cent this year, and that the cash rate would fall to 0.25 per cent by the middle of 2020.

Quarterly GDP growth has averaged 0.4 per cent over the year to September. Mr Oliver said the bushfires could subtract 0.3 percentage points from that figure and the impact from coronavirus could be a further 0.1 to 0.2 percentage points.

On Friday, the RBA will release its biannual Statement on Monetary Policy, in which it will have the opportunity to expand on its forecasts. Futures traders and economists expected the RBA to hold fire on another rate cut after strong employment and firm inflation data last week suggested Dr Lowe could afford to wait and see how the three reductions last year were working through the economy.

Economic forecasters expect the RBA to ease rates in April, and again in the following months as it struggles to set the economy on a path to achieving its mandate of 2-3 per cent inflation over time.

Consumer prices grew by 1.7 per cent over the year to December, and the central bank has failed to achieve its inflation target for nearly three years.

Dr Lowe has flagged that the unemployment rate needs to push below 4.5 per cent before wages pressure emerges — a precondition for a sustainable lift in inflation. The unemployment rate sits at 5.1 per cent and has been steady around that level for the past year. The RBA expects the jobless figure to remain around that level this year and move below 5 per cent next year.

Dr Lowe has indicated that he will consider quantitative easing policies once the official cash rate hits 0.25 per cent but has said that this is very unlikely.

The government was also confident on Tuesday that a tumbling iron ore price on the back of global fears over the coronavirus would not yet affect the budget’s forecast company tax revenue.

The iron price dropped $US10 to $US81 a tonne on Tuesday. The government’s conservative assumption has the iron ore price at $US55 a tonne by the end of June.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout