Property price falls could top 20pc, spurring RBA cut, says AMP

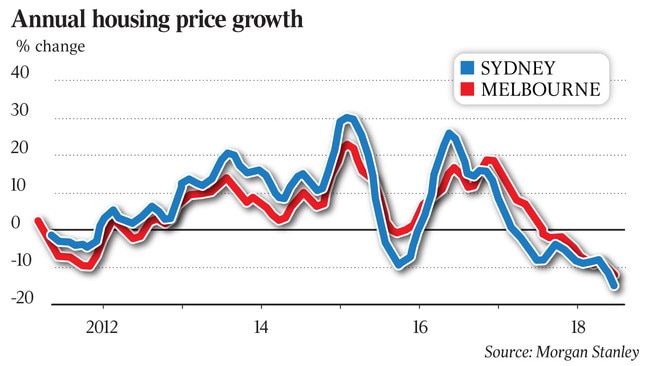

RBA could take rates further into uncharted territory as property price falls in Sydney and Melbourne top 20 per cent.

The Reserve Bank could lower interest rates further into uncharted territory as soon as the first half of the year, as house price falls in Sydney and Melbourne from their 2017 highs may now exceed 20 per cent on average, AMP Capital’s head of investment strategy and chief economist Shane Oliver has warned.

Dr Oliver, who has long held one of the more pessimistic views on the housing market, said such sharp falls in Sydney and Melbourne push the national average price down 10 per cent from the peak.

“The plunge in clearance rates and acceleration in the pace of house price falls late last year, along with the ongoing credit tightening, the record pipeline of units yet to be completed, reduced foreign demand, investor uncertainty over potential changes to negative gearing and capital gains tax, along with price falls feeding on themselves, suggest that the risks to Sydney and Melbourne prices are on the downside of our 20 per cent forecast falls,” Dr Oliver said in a research note on Friday.

“The threat this poses to consumer spending, along with rising bank funding costs and out-of-cycle mortgage rate hikes, reinforces our view that the RBA will cut interest rates this year but the cuts could come earlier than the second half that we have been allowing for.”

Dr Oliver is one of several revising down their view on the housing market and consequent rate outlook as housing data continues to disappoint.

In its latest quarterly outlook, Capital Economics said on Thursday it now expects the central bank to cut its official cash rate to a new record low of 1 per cent by mid-year, from 1.5 per cent now.

Senior economist Marcel Thieliant cited the deepening housing downturn as one of his biggest concerns.

“House prices fell the most since the current downturn started in December and our sales-to listings ratio fell to a fresh low. That suggests that prices will keep falling at a similar or even faster pace in the first half of this year,” Mr Thieliant said.

Mr Thieliant predicted house prices in the eight capital cities would fall by 15 per cent from their peak.

His new forecast — revised down from a previously expected fall of 12 per cent — would put the Australian housing market squarely into the longest and deepest of its downturns in modern history.

“The lesson from history is that housing downturns usually don’t end well,” said Mr Thieliant, who has studied 58 housing downturns across 18 economies since 1980.

“In 85 per cent of cases, central banks had to cut interest rates within three years of the start of the downturn,” he added.

Joining the chorus, analysts at investment bank UBS earlier this week said house prices were likely to fall by an average of at least 10 per cent from peak values nationally.

“Given this, compounded by the recently weaker data across residential and non-residential commencements, and consumer sentiment, we think the risk of a rate cut from the RBA has increased,” UBS Australia chief economist, George Tharenou said.

“Our long-held forecast peak-to-trough drop in loans was 20 per cent, but our risk case of negative 30 per cent seems increasingly likely; seeing housing credit growth slow towards flat by 2020.”

Citi Australia chief economist Paul Brennan has gone so far as to say Australia is poised to be the only of its 60 global economies under coverage to experience year-on-year housing declines exceeding 10 per cent from peak to trough, followed closely by Sweden and South Korea.

Mr Brennan said only 11 countries are at significant risk of notable home price falls over the next 12 months. If all 11 were to realise falls, it could create a drag of 0.2 percentage points from global real GDP growth.