First-home buyers are back in the hunt as slump scares off investors

Falling house prices are scaring off investors while creating new opportunities for first home buyers.

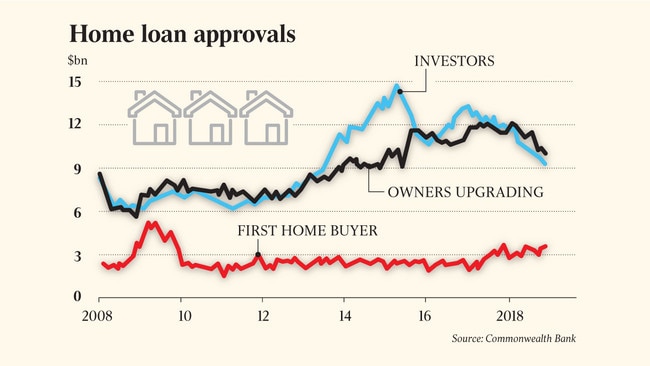

Falling house prices are scaring off both property investors and home owners thinking of upgrading, but the housing downturn is creating new opportunities for first-home buyers.

The value of new housing loans dropped 2.5 per cent in November and is 16 per cent below the level of a year ago, which was close to the market peak.

Economists warn that continuing weak demand is likely to bring further falls in housing prices in the big Sydney and Melbourne markets.

“The flow of credit is a good leading indicator of changes in dwelling prices in the near-term,” Commonwealth Bank senior economist Kristina Clifton said.

The Australian Bureau of Statistics report shows the value of lending to investors dropped 4.5 per cent to $9.3 billion, the lowest level in six years and down by almost 30 per cent from the peak reached in early 2017.

Less widely noted is the fall in loans to owner-occupiers upgrading their homes who are concerned they may not get what they want for their existing home. Ms Clifton said people upgrading arranged $10.1bn in mortgage commitments in November, down by 3.1 per cent from the previous month and 17 per cent below the peak in the middle of last year.

The fall in the Sydney and Melbourne markets, together with state government tax breaks, is encouraging a lift in purchases from first-home buyers, whose share of housing finance has risen to 18.3 per cent, the highest level since 2012.

National Australia Bank economist Kaixin Owyong noted that the downturn in mortgage approvals for both owner-occupiers and investors was concentrated in NSW and Victoria, consistent with lower turnover and lower house prices in those states.

Investor approvals are rising in South Australia and to a lesser extent in Queensland. There are signs the owner-occupier market in Western Australia is also beginning to recover.

Lending for construction of new homes is down everywhere except Tasmania. Nationally, loans for new housing dropped 2 per cent in November, and were 9 per cent below a year earlier.

Housing Industry Association chief economist Tim Reardon said this reflected the credit squeeze which began in 2017 when the Australian Prudential Regulation Authority, imposed restrictions on interest-only lending and has intensified as banks become more cautious.

“The time taken to gain approval for a loan to build a new home has blown out form around two weeks to more than two months,” he said, adding there was a risk the downturn in housing construction could get worse.

Citigroup economists noted that the Australian Prudential Regulation Authority had eased its lending limits, and this removed a major negative of investors being forced to roll their interest-only loans into principal and interest loans.

They said this would be a “marginal positive” for the investor segment of the housing market, but said they still expected housing prices to suffer a 10 per cent fall nationally this year.

APRA originally imposed a 10 per cent cap on growth in investor lending in late 2014 but removed this last April, with Reserve Bank figures showing investor lending is now rising at only 1.1 per cent.

It limited interest-only loans to no more than 30 per cent of new approvals in 2017 before removing the limit from this year, but NAB estimates this is now down to 16.6 per cent.