Chalmers the stock picker makes a bad call

The Future Fund has thrived by having the independence to make its own financial calls. The Treasurer wants to trash this with his own risky bets.

The Future Fund has thrived by having the independence to make its own financial calls. The Treasurer wants to trash this with his own risky bets.

Jim Chalmers has paved the way for additional government spending in the lead-up to the election, as he warned the mid-year fiscal update would show tepid economic growth figures.

ASIC has warned super funds not to blame third party administrators for problems in servicing their members, including processing death benefit claims.

Business failures in the hospitality sector have almost doubled over the past year and are tipped to climb further as costs mount, tax debts grow and consumers tighten their belts.

The recent loosening of Australia’s still-tight labour market may have stalled, the RBA has said, as it warned it could require more than one ‘good’ dose of inflation news before cutting rates.

The RBA gives little hope of interest rate cuts before May and warns of scenarios where it may need to lift rates again, its November meeting minutes show.

Despite incessant chatter otherwise, central banks don’t determine economies’ or stocks’ direction through their interest rate decisions.

Much of the global tariff fight is set to take place between China and the US, but it has major implications for Australia.

In the UK more than one business per day is being sold to its employees and data shows the model is outperforming national productivity numbers by some margin.

Australian producers should act quickly to enjoy the coming free trade agreement with the increasingly important UAE.

While most economists are optimistic that the RBA will ease the load on homebuyers by February, money-market traders feel that won’t happen until as far away as August.

Trading on the ASX is poised to open lower on Monday on the back of Wall Street’s Friday fall, thanks to doubts about the timing of more US interest rate cuts.

Donald Trump believes we are entering a ‘golden age’ of investment returns but legendary stock picker Warren Buffett is screaming ‘SELL’. So who’s Barefoot Investor backing?

The sharemarket appears to have welcomed Donald Trump’s election with open arms but data shows Republican presidencies lead to worse outcomes for investors so what happens next?

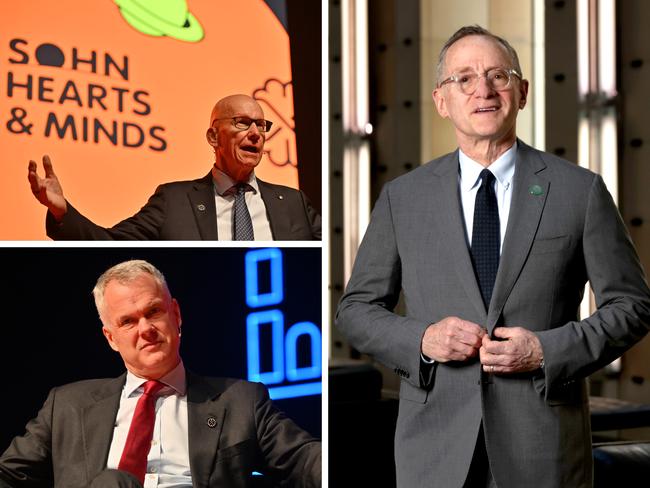

Speakers at the Sohn investment conference warned the world would need to get used to a period of continued inflation – and a potential bull market.

Donald Trump’s second stint at being US President could have more of an impact on your money than you think. Here’s why.

Almost two million Australians have fallen behind on their everyday payments and are now being chased by debt collectors.

There are two fundamental traits to understand how Trump approaches dealmaking says former National Security Agency head Mike Rogers, who is now in high demand advising business.

NAB has become the first major lender to push back its forecast of an interest-rate cut to May, as Reserve Bank governor Michele Bullock issues a warning on the labour market.

Some of Australia’s largest companies are experiencing cashflow problems due to the economic environment, a McGrathNicol Advisory report shows.

Original URL: https://www.theaustralian.com.au/business/economics/page/14