While China has just about wiped out Australian barley exports with the 80 per cent tariff imposed last year, and taken action against other products such as wine, coal and timber, it showing signs of snapping up the Australian summer wheat harvest.

Figures released by the Bureau of Statistics this week show Australia exported more than $145bn worth of goods to China in 2020, another near record despite the increasingly bitter political relationship.

For December, Australia shipped 600,000 tonnes of wheat to China, more than double the 265,000 tonnes shipped to both Vietnam and Indonesia.

Brett Hosking, chairman of industry lobby group Grain Growers, estimates China will buy two million tonnes of wheat from Australia over the period from December to February, worth $600m.

It is a lot better than a year ago, when the amount of wheat available for export from Australia was hit by a prolonged drought.

“With the orders now waiting to be executed we are looking like approaching two million tonnes of wheat to be exported to China from Australian ports, which is quite strong,” Hosking says.

He admits there was “a lot of nervousness” in the industry last year following the imposition of tariffs on barley that have wiped out the once booming barley exports business to China.

“In any commodity which deals with China, there is always a little bit of caution that sits in the back of the mind,” he said.

“We have seen some devastating outcomes from some of the trade tensions.

“But as 2021 has kicked off we have seen an end to a lot of fear and speculation about the China market.

“The damaging rumours have disappeared and it has been really positive for [the wheat] trade.

“There is a bit more confidence that perhaps China isn’t a market we have to be as nervous about as we had thought.”

His comments have an odd sound given the years of increasing rhetoric and concern about trade and economic ties with China.

It may well be that the step-up in demand for wheat is as a result of a number of specific circumstances, including the fact that it is winter in China when wheat is not harvested, as well as there being supply issues from China’s traditional suppliers in Russia.

A year ago the wheat harvest was affected by the drought so there was not the same amount of grain available to export, making it difficult to assess all the forces behind the upturn in this year’s sales.

And wine exports to China have been hit with tariffs of up to 200 per cent while some 70 ships of Australian coal remains off the coast of China, waiting for delivery, and imports of other goods such as lobsters have been hit by arbitrary actions in China.

It would be naive to overreact to the “good news” about wheat exports, but Hosking’s comments are one of those reminders that when dealing with China, the devil is in the detail.

He believes the rhetoric from China about his grains sector has eased off since Australia filed its complaint about barley tariffs with the WTO last month.

Under the WTO process, the lodging of a complaint is supposed to be followed by a period of negotiations as a part of a mediation process.

Hosking is hoping to hear more details about that process soon, maybe taking a glass-half-full approach that it could provide an opportunity for trade officials from Australia and China to talk directly to each other, something that has not happened for some time on a range of issues.

Much of the continued strength in the trade with China has been in the iron ore market, which has been kept up because of continued problems in Brazil, the main alternative source of supply of iron ore, and the strength of the Chinese economy.

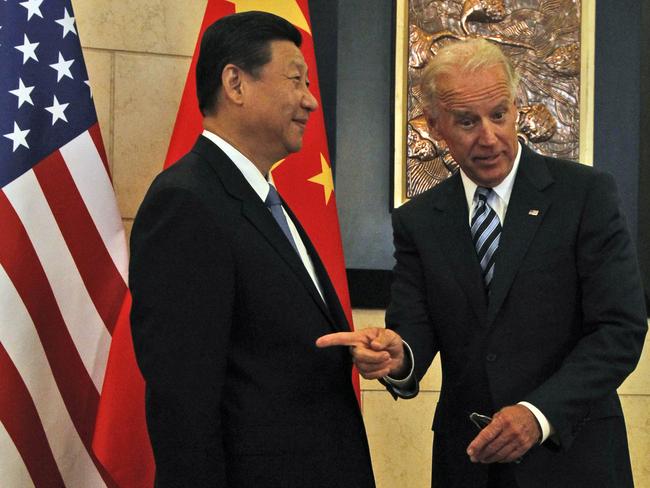

The other new factor to be assessed in the trade relationship is the approach of the Biden administration towards China.

Joe Biden intends to continue to take a strong line on China, but the US President has made it clear he intends to tone down the harsh rhetoric. He said this week that the administration would stop calling COVID-19 a “China virus” or a “Wuhan virus”, something Donald Trump did repeatedly.

Biden argued that this was important because of the risks of a backlash against Asians, particularly Chinese, in the US. It also helps in relations with Beijing, which, as Australia has found out to its cost, is particularly sensitive to assertions about the origins and cause of the virus.

If — as some believe — Australia’s controversial early call for an inquiry into the origins of COVID-19 that so angered Beijing came as a result of a deliberate wind-up from the Trump administration, that has now eased off.

It is early days in assessing how the Biden administration will conduct its relationship with China but, as President Xi Jinping’s speech to the online Davos conference this week shows, both sides are now stressing the importance of multilateralism.

White House press secretary Jen Psaki this week said Biden wants to approach relations with China with “strategic patience”.

Asked what Biden would do about the tariffs imposed on imports from China under the Trump administration, she said he would be taking a “multilateral approach [that] includes evaluating the tariffs currently in place”.

“The President is committed to stopping China’s economic abuses on many fronts and the most effective way to do that is through working in concert with our allies and partners to do just that.”

Will Xi seize the opportunity of a new administration in Washington to take a more conciliatory approach to the world?

It is too early to tell if Biden will provide a circuit breaker for US-China tensions that also eases Australia-China tensions, but it is good news at least that Australian wheat farmers have been able to access the China market with unexpectedly positive results.

When it comes to dealing with China, it pays to look at what is actually happening as well as the rhetoric.