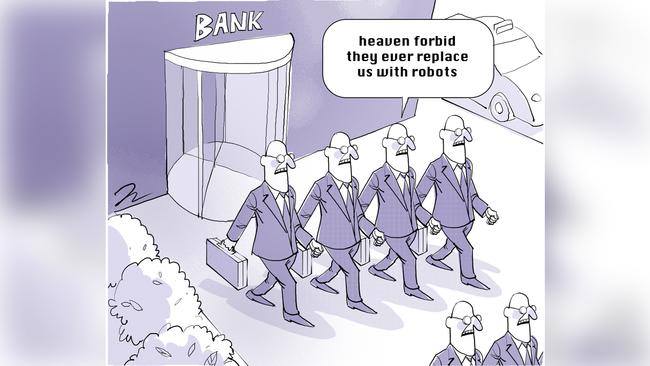

The banks and BHP have fired the starters’ gun for the biggest white-collar mass retrenchment program in our history.

Major Australian enterprises have been slow to embrace some newer technologies, but a series of events will trigger a catch-up program.

The Australian’s Margin Call has revealed that both Commonwealth Bank and ANZ are planning major retrenchment programs. The other big banks will be doing the same thing and will need to move or their costs will become hopelessly out of line with their rivals.

And the programs revealed by Margin Call indicate the initial steps being considered are up to 25 per cent of staff. That sounds big but unfortunately it’s only about half way. The technology people in the banks know that over the next decade staff levels will be halved.

As Bill Shorten and Scott Morrison canvass capital city electorates, they never mention the biggest employment problem the new government will face. Indeed it’s the biggest for a generation.

The problem is that the new technologies revolutionise not just the banks, but the likes of BHP too. Telstra, accounting firms, law offices — almost the entire big organisation society. The biggest staff reduction potential is in the public service, but the public service unions will successfully fight it until the community simply cannot afford to pay administrative costs that are way out of line with the rest of society.

But the flow on goes deeper. I recently had occasion to spend and extended time in a suburban Westpac branch. I was helping an Australian living overseas with his banking tangle. The branch had abundant space and well-appointed facilities. But there were token numbers of customers, and, as a result few staff. I had made an appointment and was well looked after.

At one time the view was that these branches would be turned into investment advisory centres. Westpac, along with other banks are now exiting that business. So bank branches in suburban shopping centres will close in big numbers, thus further reducing property values for landlords and the lifestyles of those who own this type of real estate.

The bank branch change is simply about people doing their banking online and the banks slashing the amount loan processing they undertake in branches in favour of mortgage brokers, who now have 60 or cent of the market. Of course brokers will need retail space, but at nowhere near the level established by banks.

The brokers and the others are now moving into small business loans as the banks move from being massive retailers to providers of commodity products.

Accordingly their costs must be razor sharp or they will go out of business. And that means that their back offices must embrace the very latest technology.

And this technology will move from conventional systems into block chain.

In turn, that means that the enormous number of white collar teams that collect and collate data and information in banks, law firms, for accountants, manufacturers and just about every business are no longer required. With the help of artificial intelligence the technology creates systems that are akin to the robots currently used in manufacturing and distribution

At some time in the future (probably many years away) we will have driverless vehicles which will extend this white collar robot revolution into transportation.

All of this has been widely predicted and I have devoted part of my journalism to preparing people for this revolution. There will still be many jobs in large organisations but a much higher proportion of our children and grandchildren will need to devise enterprises that generate value for the new society. We can’t tell them what those enterprises will be but we can help give them a better chance.

And so in this context, arguably one of the greatest achievements of any government in the last decade was the small business tax tribunal because people in the Australian Taxation Office were trying to turn the clock back by refusing ABN numbers and using their enormous powers to destroy legitimate small businesses and decimate selected research efforts.

The small business tax tribunal will be responsible to the court system (but will have limited lawyers) and not the ATO. We all have to hope that if the ALP wins government they will not be bullied into destroying it.

Scott Morrison has rarely mentioned this great achievement, which shows how out of touch the politicians have become to what is happening in the real world.

But thanks to small business minister Michaelia Cash and assistant treasurer Stuart Robert, the Coalition has also moved to enforce fair contracts and extend the rules to government, reducing payment times to 20 to 30 days and encouraging cash flow lending

These are all actions required to create an environment for people to develop new ideas. We need many more.

On the other side the ACTU wants to lift wages and provide greater job security. These are wonderful aims but in the current technology environment they just speed up the retrenchment process.