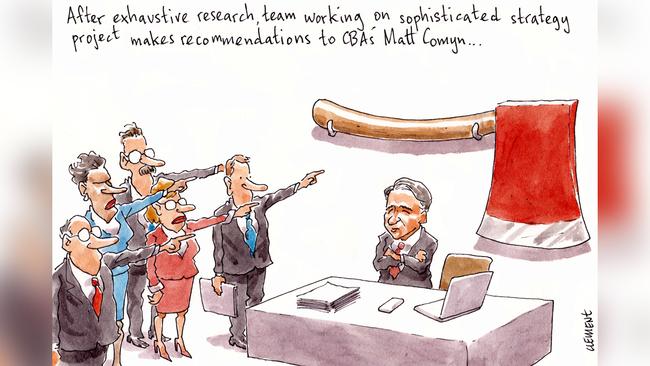

Commonwealth Bank working on secret plan to slash 10,000 jobs, save $2bn

Commonwealth Bank boss Matt Comyn is believed to be working on a plan to cut more than 10,000 employees, about $2 billion of costs, at Australia’s biggest and most profitable bank.

No wonder Comyn wants to keep the plan secret — at least until after the May 18 election.

Margin Call has learned of the bank’s previously unknown plan to dramatically reduce its workforce in coming years as Comyn’s executive team — including newish chief financial officer Alan Docherty — try to please profit-focused investors.

“In the near term we are delivering better outcomes for our customers and we are focused on running the business efficiently and effectively to invest in the future,” said a CBA spokesman.

Margin Call understands internal work on the project at the bank — which last year made a net profit of $9.23bn — has been underway for some time, with the closure of up to 300 of the bank’s national network of almost 1000 branches said to be under consideration.

A reduction of up to 25 per cent of the bank’s workforce — which numbers more than 40,000 people in Australia and almost 50,000 worldwide — has been canvassed.

Cuts at that level could see between 10,000 and 12,000 jobs go in coming years.

CBA’s spokesman declined to comment on the specifics of the under-wraps cost-cutting project or confirm or deny the magnitude of the proposed reductions.

Margin Call understands that Comyn’s CBA, which is now implementing recommendations from the Hayne royal commission, had planned to keep the cost cuts under wraps until at least after the upcoming federal election.

As part of its considerations, Margin Call understands a substantial analysis of CBA’s branch network has been undertaken, based on their profitability as well as which electorates they fall in.

Some local members are louder than others.

Closing 300 bricks-and-mortar outlets would account for about 30 per cent of the Australian network, but would bring the bank more into line with its big four peers.

According to the 2018 CBA annual report, operating expenses in the year totalled $11.6bn, from $10.6bn previously, representing an almost 10 per cent increase.

Staff costs were $6bn, which accounted for more than half of the bank’s operating costs.

A $2bn cost-reduction program would cover a bit more than 17 per cent of the bank’s $11.6bn in operating costs.

All this as outflows elsewhere in the operation soar, with Comyn last month telling the House of Representatives’ Economics Committee that the bank had racked up a $1.4bn bill for customer remediation over the past five years.

The Brian Hartzer-led Westpac, Shayne Elliott-led ANZ and the now Phil Chronican-led NAB have all been cutting jobs at the other big four banks.

But only NAB, then under the leadership of Andrew Thorburn, turned it into a spectacle.

In November 2017, just before the royal commission was called, NAB announced that — along with making a $5.3bn profit — it was cutting 6000 staff over three years.

Peculiarly, Thorburn even used it to spruik his redundancy program, which he dubbed “The Bridge”.

Westpac, meanwhile, has been quietly reducing its headcount for years, while ANZ has been remarkably low key as it has cut more than 10,000 staff since 2015.

ANZ chair David Gonski has too much political nous to allow his CEO to trumpet the cuts as he announced its whopping profits ($6.5bn last year).

No doubt CBA’s chair Catherine Livingstone and the rest of Comyn’s team will be advising similar discretion.

Capital requirements

In light of the above item, it won’t surprise readers to learn there is one exception to the big four banks’ country-wide pruning: Canberra.

Late last year, CBA opened a new Canberra headquarters in the Parliamentary Triangle, a clear signal of its changed focus under its new leader Matt Comyn.

After the Age of Tempered Justice comes the Age of Government Relations.

CBA’s new outpost houses its local business bankers, government-focused institutional bankers and a government relations hub, which includes the Canberra-based Claire Dawson, a newish member of Andrew Hall’s corporate affairs empire.

The Forrest office — conveniently located an easy stroll from local power diner Ottoman, where Comyn has been shoring up his relations with the Canberra Press Gallery — also makes for a handy executive base when the CEO is in the capital, a regular occurrence in his first year in the job as he took a more hands-on approach to government relations than his predecessor.

ANZ has also buffed up its Canberra presence in recent years, with its head of corporate affairs Tony Warren working out of its longstanding Moore Street office. That’s in the same building as Small Business Ombudsman Kate Carnell, making the elevator trips exciting when Shayne Elliott drops in.

NAB’s business banking centre is just over the road on Childers Street, the spot where Phil Chronican last month spent the afternoon mediating with nearly 30 unhappy customers before his first — and likely only — appearance before the House of Representatives Economics Committee.

Westpac — which does the most commercial banking in the city — has its Canberra HQ on the other side of Civic on London Circuit.

That outpost is led by Jason Duarte, the head of the public sector operations at Westpac Institutional Bank.

Its customers include much of the federal bureaucracy and Andrew Barr’s never-ending ACT government, a dream client.

Back Packer’s retreat

There’s much talk of billionaire James Packer turning his back on corporate Australia, but the billionaire’s extraction from local shores began years before Wynn Resorts arrived on the scene.

And Margin Call can reveal his corporate retreat continued, behind the scenes, in the days before this week’s $10bn Wynn bombshell.

Packer, 51, hasn’t officially lived on Australian shores for about five years.

Since 2015 he has variously called Tel Aviv, Los Angeles and now Aspen (where he’s been this leaky week) home.

In the middle of last year the gaming mogul resigned from all 22 of his Australian corporate directorships, including his main private company Consolidated Press Holdings.

Packer’s long-serving CPH finance director Michael Johnston, who is also a director of the listed gaming business Crown, has taken over those corporate roles for his proprietor.

In recent days, as news of the Matthew Maddox-led Wynn Resorts’ interest in Crown was leaked — in what people within the company insist was a cock-up, despite rumours suggesting otherwise — Packer’s domestic retreat continued apace.

Packer’s 20-year-old Casthree Pty Ltd was deregistered last Friday, following an official process that began with the corporate regulator in January.

The company was controlled by ConsPress International.

Also off the books as of a week ago is Packer’s almost 60-year-old Australian Fluorine Chemicals, controlled by domestic vehicle ConsPress Holdings.

Both entities over time have been used as holding companies for listed stocks, including Packer’s foray into the fashion business.

Small steps, sure, compared with flogging a $4bn-plus stake in a listed entity.

But still moves that are part of a broader retreat from Australia.

All of which seems to give an inevitability to the sale of his Crown stock.

The offloading was first pointed to in our colleague Damon Kitney’s best selling book The Price of Fortune.

Investors haven’t been short of signals on this one.