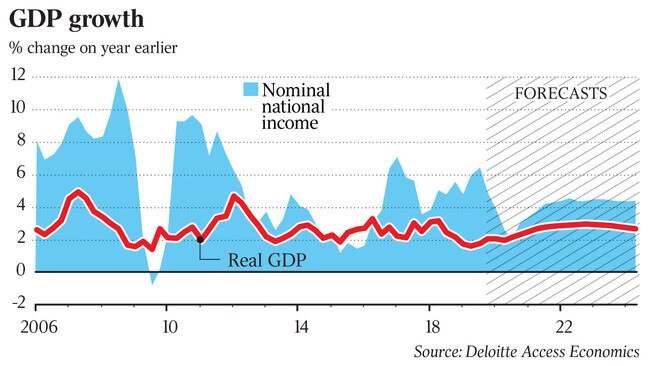

Lack of confidence condemns Australia to slow growth: Deloitte

A collapse in consumer and business confidence has locked Australia into slow growth, Deloitte Access Economics warns.

A collapse in consumer and business confidence has locked Australia into slow growth, with the economy expected to tread water as the nation navigates through the impact of drought, housing-related weakness and scared consumers, according to the latest business outlook report from Deloitte Access Economics.

The Reserve Bank’s quest to lift inflation, meanwhile, would see it slash the official cash rate twice this year but hold fire on quantitative easing, Deloitte partner Chris Richardson said.

The predictions come as former RBA board member Warwick McKibbin called for the central bank to hold fire on further cuts, warning that lower rates may deepen fears about the outlook for the economy.

“Australia has been battling the dual demons of drought and housing-related negatives ... But now there’s a third threat: cratered confidence among consumers and business,” Mr Richardson said.

“Our crumbling confidence has a few causes (and this summer’s bushfires don’t help), but the Reserve Bank hasn’t covered itself in glory as it communicates with the public.

“That has left confidence worse than the economy itself, which in turn risks becoming a self-fulfilling prophecy.” But there were positives, Mr Richardson noted, including tax and rate cuts, the lower dollar and the rebound in property prices, which were helping to steady the outlook in the near term but were “bad news” over the long term.

“That leaves Australia locked into slow growth, but it doesn’t spell the disaster that the punters are fearing.

“We’re on course to keep muddling through the impacts of drought, housing-related weakness and scared consumers.

“Yet the nation’s growth won’t lift all that much from today’s decade low, and we don’t expect unemployment to drop or wages to accelerate through 2020. We’ll be comfortably treading water rather than roaring into recovery,” he predicted.

Treasurer Josh Frydenberg said the business outlook confirmed the importance of the Coalition’s budget management in the face of domestic and global economic challenges and that if needed, “Australia can use fiscal firepower in a way few other nations can”.

“Our disciplined approach to budget management has allowed us to respond to areas of need, without increasing taxes or cutting spending in other areas,” he said.

But opposition treasury spokesman Jim Chalmers said Australians were paying for the “ineptitude and inaction of a do-nothing Morrison government”.

“Weak economic growth like we are seeing is the inevitable consequence of a government with a political strategy but not an economic plan,” he said.

Futures markets have priced in a more than 55 per cent probability of the RBA cutting rates by 25 basis points when it meets early next month, bringing the cash rate to a record-low 0.5 per cent, with some predicting a second cut later in the year.

Professor McKibbin earlier raised concerns about the impact of another rate cut.

“Once rates get to a certain level, the effects start to disappear quickly. There’s a balance between cheaper credit and making people concerned that there is a serious problem. There are much better policies to stimulate growth than cutting rates,” he told The Australian.

UBS economist George Tharenou is among those predicting the RBA will cut next month and also sees the central bank downgrading the economic outlook in its Statement on Monetary Policy, also due next month.

“It is likely the bushfire crisis will drag on fourth-quarter 2019 and first-quarter 2020 GDP, potentially by as much as … a quarter of a per cent,” Mr Tharenou said in a recent note.

“Further, higher food prices (due to drought and bushfires) along with rising insurance premiums will likely see higher headline inflation, albeit much of this impact will likely be trimmed out of ‘core’ measures so will likely be looked through by the RBA. Overall we think this makes a rate cut from the RBA in Feb more likely,” he noted.

Morgan Stanley also expects further rate cuts: one in February, followed by a second in August.

“Credit growth, the labour market and fiscal positioning will all be key to the rate outlook,” the investment bank’s equity strategists said last week. “We think the combination of these factors will see growth stabilise below current expectations, leading to two rate cuts but no QE in 2020,” they said.