Coronavirus contagion will mean a global recession

Investors have sent markets tumbling, amid fears the world is nearing a coronavirus pandemic that could trigger a global recession.

Investors have sent sharemarkets tumbling, amid fears the world is on the verge of a coronavirus pandemic that could trigger recessions across the globe.

As Scott Morrison prepares a targeted fiscal response to prevent an economic downturn at home, weak tax receipts blasted a $3.7bn hole in the government’s budget estimates and further dimmed hopes for a surplus this financial year.

Former ANZ chief economist Warren Hogan warned that Australia could soon have its first recession in almost three decades.

Department of Finance figures showed the government running a $26.6bn budget deficit over the financial year to January — down on the $22.9bn expected in December’s mid-year outlook.

The benchmark S&P/ASX 200 index tumbled 9.8 per cent over the past five trading days, and is now 10 per cent off its record high posted the previous week.

Overnight, the Dow Jones Industrial Average shed more than 1,000 points — more than 3.5 per cent — before staging a fightback in the final hour.

Like stocks on Wall Street, the ASX 200 has suffered its quickest correction in history and was down 3.3 per cent to 6441.2 points on Friday — it’s worst day since September 2011.

The Australian dollar sank to an 11-year low at US65.2c, while 10-year government bond yields fell to a record low of 0.85 per cent.

Futures markets late on Friday pointed to the rout extending in Europe overnight. In Asia, Japan’s Nikkei 225 plunged 3.7 per cent, South Korea’s KOSPI lost 3.3 per cent, Singapore’s FTSE Straits Times index fell 3 per cent and the Hang Seng dropped 2.5 per cent while China’s Shanghai Composite dived 3.3 per cent.

Following the monthly financial update for January, ANZ’s budget expert Cherelle Murphy said: “There is no way the government will record a surplus in 2019-20.”

Ms Murphy said the sharp increase in the budget shortfall was driven by a fall in tax receipts in January and there was no evidence bushfire recovery spending had contributed to the results.

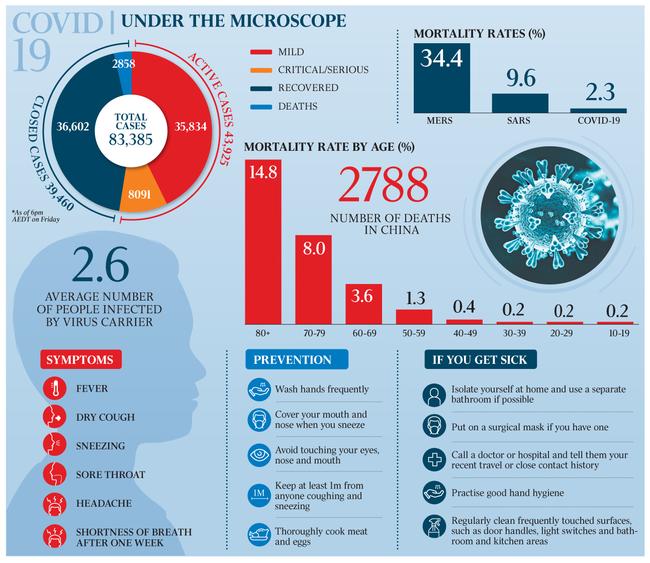

The bad news on the budget and the dramatic week on global financial markets followed major outbreaks of the coronavirus in Italy, South Korea, Japan and Iran. There have now been 83,385 cases of the virus worldwide and 2858 deaths.

The Reserve Bank board will meet on Tuesday to decide whether it should cut rates for the fourth time since June last year, to 0.5 per cent. Analysts say the coronavirus outbreak will dominate the board’s discussions.

National accounts figures on Wednesday are expected to show the economy failed to pick up momentum leading into the new year, before the twin shocks of the Black Summer fire season and the unfolding coronavirus health scare.

Finance Minister Mathias Cormann stressed the December and January budget numbers had consistently been two of the most volatile months. He said the new figures were therefore “not indicative of a trend in the overall budget position or expected final budget outcome”.

“The government is of course very conscious of the fact that the coronavirus, following on from the drought and bushfires, will have a negative impact on our economy and consequently is likely to have an impact on our budget,” Senator Cormann said.

“However, it remains too early to assess precisely what that impact will be.”

Professor Hogan said the rapid spread of the coronavirus outside China over the past week, and the hit to global growth that would likely follow, meant there was “a very good chance of a technical recession” in Australia.

He stressed that correctly timed and targeted fiscal support could be the difference between a “mild recession” — the probability of which he currently puts at 50 per cent — and something far worse.

“If the government is ahead of the game on how to support key areas which are stressed, then by providing support in the right places (it) means if we do get a recession it will be a mild one, and not a major labour market recession,” Professor Hogan said.

Josh Frydenberg is awaiting Treasury’s initial estimate of the potential economic toll from the epidemic, including the effect of the China travel ban — now entering its fifth week — on key export industries such as education and tourism.

The Prime Minister said on Thursday that initial advice from Treasury was that any fiscal support measures “would only be effective if they were targeted, modest and scalable”.

Modelling done by current Treasury boss Steven Kennedy in 2006 on the economic impact of an influenza pandemic in Australia that killed 0.2 per cent of the population found it would lead to a “large fall in consumption (which) results in a recession, and an increase in the unemployment rate which exacerbates the fall in consumption”.

The 2006 paper, co-authored by Jim Thomson and Petar Vujanovic, suggested “quickly re-establishing consumer and investor confidence” was likely to be one of the important roles for governments to play.

Professor Hogan said at some point, containment strategies, such as the travel ban, were so damaging that they would not be economically feasible.

“If people get really worried (the virus) is coming to Australia, do we have a period of a few months where people really take fright and not go out to restaurants or the shops? The whole premise of the RBA’s economic recovery in 2020 is on consumer spending,” Professor Hogan said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout