Jobless rate to plunge if we splurge, says RBA

The pace of the economic recovery hinges on households’ willingness to spend the tens of billions of dollars in savings accumulated through the pandemic, the RBA says.

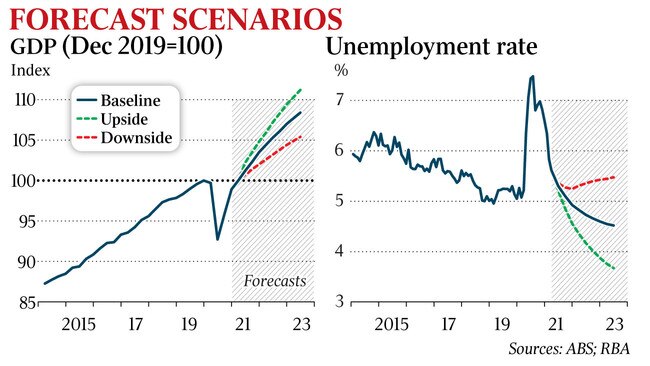

Australia’s jobless rate could plunge to 3.75 per cent in two years’ time if households prove confident enough to splurge the tens of billions of dollars saved during the pandemic, according to a “plausible” upside economic scenario from the Reserve Bank.

The most optimistic of three employment forecasts in Friday’s statement on monetary policy would push underlying inflation to 2.25 per cent — within the 2-3 per cent target range — by the middle of 2023, the RBA said. In this event, inflation from June 2023 “remains on an upward trajectory”.

Economists said the central bank had described a scenario in which the cash rate could rise from its historical low of 0.1 per cent sooner than expected, although the bank again maintained that any move was “unlikely to be until 2024 at the earliest”.

“A plausible upside scenario centres on stronger household consumption, where increases in housing and equity prices raise households’ desire to consume by more than assumed in the baseline scenario,” the quarterly statement read.

“At the same time, the ongoing improvement in labour market conditions boosts labour income, out of which households consume, and increases households’ willingness to draw down on savings that were accumulated during 2020.”

Australians’ incomes were boosted by emergency government support through the pandemic. The household saving ratio in the June quarter national accounts jumped to 22 per cent, before sliding to 12 per cent in December quarter. The RBA predicted it would fall to 8 per cent by the end of this year.

Worried about the future and with fewer opportunities to spend, households have deposited an extra $124bn in the bank since COVID hit, according to figures this week from the Australian Prudential Regulatory Authority.

“As uncertainty associated with the pandemic fades and restrictions ease, households are expected to avail of opportunities to spend,” the RBA said.

RBA governor Philip Lowe on Tuesday revealed the bank expected the nation to experience an essentially inflation-free economic boom, upgrading its real GDP growth forecasts to 4.75 per cent this year.

The bank’s more optimistic predictions were compared to the “baseline” unemployment forecast of 4.5 per cent by the end of the RBA’s forecast period, and inflation of 2 per cent.

“The Australian economy is transitioning from recovery to expansion phase earlier and with more momentum than anticipated,” the quarterly statement read. “It is also likely that there will be fewer job losses arising from the end of the JobKeeper program than previously expected.”

Reflecting this confidence, the RBA predicted unemployment would be at 5.25 per cent by June, from 5.6 per cent in March.

The economy is now expected to accelerate much more rapidly through 2021-22, with year-average growth (Treasury’s preferred measure) now expected to hit 5 per cent, against the RBA’s February forecast of 3.75 per cent.

The RBA said its central forecasts were “based on the assumption that the domestic vaccine rollout accelerates in the second half of the year, allowing the international border to be reopened gradually from early 2022”.

Trade Minister Dan Tehan on Friday, however, suggested Treasury would take a more conservative view in Tuesday’s budget, saying that “the best guess (around the resumption of international travel) would be in the middle to the second half of next year”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout