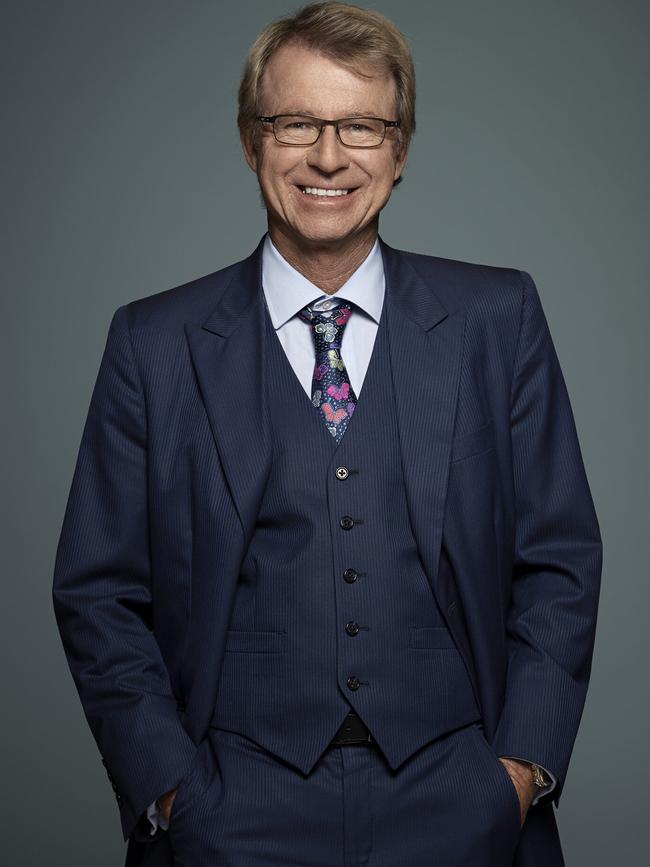

Jim Chalmers’ move to abolish tariffs on 500 goods won’t ease the cost of living, say experts

Moves by Treasurer Jim Chalmers to axe tariffs on products from fridges to chopsticks and pens won’t save consumers significant money, industry experts say.

Consumers are unlikely to see household goods become cheaper following the federal government’s decision to remove 500 “nuisance” tariffs, according to industry figures.

The move, dubbed the biggest unilateral tariff reform in two decades by Treasurer Jim Chalmers, will remove tariffs across a range of imported goods such as toothbrushes, fridges, dishwashers, pyjamas, toasters, ballpoint pens and sanitary products.

Corporate Australia has backed the measures which comes into force from July 1 and will save businesses more than $30m a year in compliance costs, reduce red tape and unnecessary regulation.

But industry says claims by Mr Chalmers that the axing of 500 “nuisance” tariffs will lift productivity and provide cost-of-living relief to households are minimal is likely to have little impact.

Data from the government shows that the soon-to-be removed tariffs on imported washing machines raised less than $140,000 in revenue per year, while fridge freezers raised less than $28,000.

Tariffs on imported toasters, electric blankets, X-ray film, chamois leather and bamboo chopsticks all collected between $200 and $30000 in revenue for government coffers.

Menstrual and sanitary products imports of $211m had tariffs worth $3m imposed on them.

Harvey Norman executive chairman Gerry Harvey told The Australian he was sceptical consumers would see any cheaper goods as the revenue raised was minimal and amounted to just a dollar or two per product.

“The removal of the tariffs won’t make much of a difference to the price of any item if they didn’t raise much money to begin with. Australians are unlikely to see goods become cheaper,” he said.

“It just makes no sense that we even had these tariffs still in place – it is like someone forgot to remove them years ago.

Mr Harvey said the removal of tariffs was good for business, but the government should go further to improve the ease of doing business here.

“We make so many rules and regulations that no one can keep up, or understand what is going on. We should be removing two old rules for every one new rule introduced,” he said.

Mr Chalmers is targeting so-called “nuisance” tariffs where a 5 per cent Customs duty applies on goods that are mostly already eligible for duty-free importation under Australia’s system of free-trade agreements.

AMP chief economist Shane Oliver said the decision by the government was a step in the right direction even though it would have little effect easing inflation or lifting productivity.

“This measure is not something that will see economists go back and revise their outlook for inflation lower or increase productivity forecasts,” he said.

“Most economists would have had this on the list but a long way down; you would get a much bigger positive impact from changing the GST and not being reliant on income for taxation purposes.”

Tariffs were historically designed to protect the domestic industry and to reduce the attractiveness of foreign products, but tariffs fallen from an average of 30 per cent in 1980s to 1 per cent in 2024, Dr Oliver said.

“If you are only raising several hundred thousand dollars from these tariffs then while it is a step in the right direction, it is not going to see a major reduction in prices if anything at all once it works down the supply chain,” he said.

Business Council of Australia chief executive Bran Black said the move showed the government was willing to listen to industry, having made the case for this reform over the past few years.

“We welcome these changes because they remove an unnecessary burden and red tape on many businesses and this will flow through to customers,” he said.

“Productivity Commission analysis shows every dollar of tariff revenue collected costs the economist up to $1.60.”

Mr Black, whose organisation’s members include the big four banks, BHP, Rio Tinto, Qantas and Woolworths, said the removal of nuisance tariffs would help to make cross-border trade cheaper, faster and easier. He also called on the government to launch a review into foreign investment.

“It is important we continue to attract investment into Australia which benefits Australian jobs and economic growth,” he said.

Australian Chamber of Commerce and Industry chief executive Andrew McKellar said that removing tariffs was an important step in simplifying the trade system and driving productivity.

“Ensuring our border systems are as efficient as possible is vital. It means Australian enterprises can spend more time on doing business rather than administering red tape,” he said.

The Productivity Commission has highlighted that tariffs contribute just 0.3 per cent of total government revenue but bear substantial compliance costs.

“The costs of tariffs have eclipsed any revenue benefit generated. Removing these nuisance tariffs is a prudent step, saving businesses $30n on top of the government’s costs by avoiding this bureaucratic process,” Mr McKellar said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout