Labor to embark on biggest tariff cuts in two decades

Jim Chalmers unveils plans to abolish tariffs on hundreds of goods in a bid to boost productivity, reduce business costs and provide cost-of-living relief to households.

Jim Chalmers will abolish nearly 500 “nuisance” tariffs on imported goods from July in a bid to save Australian businesses more than $30m a year in compliance costs, lift productivity and provide further cost-of-living relief to households.

In a move being dubbed the biggest unilateral tariff reform in two decades, the Treasurer will remove tariffs across a range of imported goods including toothbrushes, fridges, dishwashers, pyjamas, toasters, ballpoint pens and menstrual and sanitary products.

It comes as Australia’s largest employers call on Dr Chalmers to undertake a sweeping review of the nation’s foreign investment settings amid concern for lagging productivity and sluggish economic growth.

With Australia falling from fourth to 19th in global competitiveness, the Business Council of Australia has urged the Treasurer to cut barriers to foreign investment, saying it was vital for economic growth and Australian jobs.

The government will provide an assurance on Monday that the new round of tariff reductions will not constrain Australia in any sensitive ongoing free-trade negotiations or undercut the value of any of Australia’s existing agreements.

Dr Chalmers is targeting so-called “nuisance” tariffs where a 5 per cent Customs duty applies on goods that are mostly already eligible for duty-free importation under Australia’s system of free-trade agreements.

Under the changes, 14 per cent of Australia’s total tariffs will be abolished to streamline about $8.5bn worth of annual trade while slashing more than $30m in costs for businesses.

“These tariffs impose a regulatory burden on Australian businesses and raise the costs of imported goods but they do little to protect our workers and businesses,” Dr Chalmers said.

“Tariff reform will provide a small amount of extra help with the cost-of-living challenge by making everyday items such as toothbrushes, tools, fridges, dishwashers and clothing just a little bit cheaper.”

Dr Chalmers said the abolition of hundreds of import tariffs would “reduce red tape, boost productivity, ease the burden on small businesses and help to cut the cost of doing business”.

“This is meaningful economic reform that will deliver meaningful benefits to businesses of all sizes around Australia,” he said.

The full list of tariffs to be abolished will be provided in the budget and consultation on the changes is already under way, with submissions on the Treasury website scheduled to close on April 1.

The Productivity Commission’s Trade and Assistance Review for 2021-22, published last year, noted that businesses incurred compliance costs when they imported goods subject to tariffs but where a preferential rate or concession could be accessed. This was because businesses devoted resources to accessing the preferential and concessional rates of Customs duty.

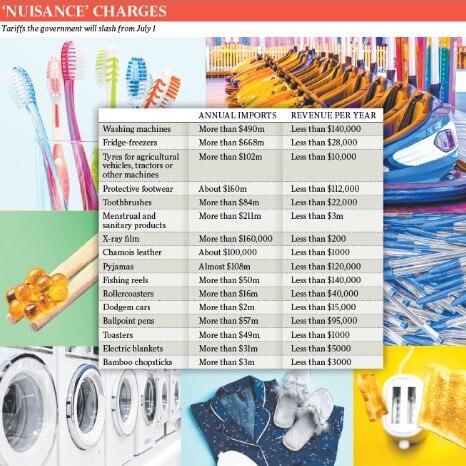

Examples of products that will be subject to removal of the 5 per cent Customs duty include washing machines, where annual imports worth over $490m raise less than $140,000 in revenue per annum, and fridge-freezers, where annual imports worth over $668m raise less than $28,000 in revenue a year.

Other goods include tyres for agricultural vehicles, where annual imports worth over $102m raise less than $10,000 in revenue a year; protective footwear, where annual imports worth $160m raise less than $112,000 in revenue a year; toothbrushes, where annual imports worth over $84m raise less than $22,000 in revenue a year; and menstrual and sanitary products where over $211m in annual imports raise less than $3m in revenue a year.

Tariffs will also be removed on X-ray film, chamois leather, pyjamas, fishing reels, roller-coasters, dodgem cars, ballpoint pens, toasters, electric blankets and bamboo chopsticks.

Trade Minister Don Farrell said trade that was “simple, fast, and cost-effective” could “boost Australia’s international competitiveness, help create jobs, and reduce cost-of-living pressures”.

Ahead of the May 14 federal budget, Business Council of Australia chief executive Bran Black said red tape and cumbersome regulation were driving capital away from Australia in critical areas, including mining and energy production.

In its pre-budget submission, the BCA urged the government to adopt a similar approach to that undertaken by the UK government’s Harrington review which sought to find better ways to attract foreign investment in growth sectors.

Mr Black – whose members include the big four banks and accounting firms, BHP, Rio Tinto, Coles Group, Qantas and Woolworths – said Australia’s ability to get major projects off the ground was being hampered by a foreign investment drought. He noted Australia was currently a net exporter of capital, meaning more money was leaving the country than there was coming in.

“Australia is facing an investment drought and if we don’t urgently fix the problem, then what is at stake is Australian jobs and the economic growth which our economy so badly needs,” Mr Black said.

“We cannot afford to be left behind and we can’t stand by and let economic investment and opportunities flow into other countries.”

The BCA’s “reclaiming our competitiveness” pre-budget submission also called on the government to cap real expenditure growth at an annual 2 per cent and implement more realistic economic and commodity price forecasting.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout