HomeBuilder hangover triggers plunge in approvals

The end of the Morrison government’s $25,000 grant to build a new home sent construction approvals crashing by nearly 20pc.

The end of the Morrison government’s $25,000 cash grant to build a new home sent the number of dwelling construction approvals crashing by nearly 20 per cent in January.

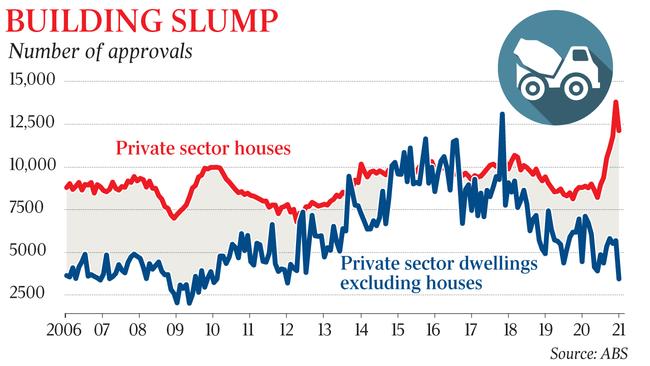

Approvals to construct stand-alone houses surged to record highs in December as Australians rushed to qualify for the first phase of the HomeBuilder program. This created a hangover that sent house approvals down by 12 per cent, Australian Bureau of Statistics data showed.

Approvals to build townhouses and apartments extended a downward trajectory that began in mid-2016, dropping by a further 40 per cent in January to the lowest level in nine years, the ABS reported.

In total, home building approvals dropped by 19.4 per cent to 15,926 in the month, including 12,124 houses and 3434 apartments/townhouses.

Despite the reversal, approvals to build houses remained 38 per cent higher than a year earlier, the ABS seasonally adjusted figures revealed.

ABS director of construction statistics Daniel Rossi said “the surge in HomeBuilder applications at the end of 2020, as well as the extension of the program to March (at a lower rate of $15,000), will continue to provide support for private house approvals in the coming months.”

CBA senior economist Belinda Allen said she was surprised by the size of the pullback, with professional forecasters having expected a drop of only 2 per cent.

“The fact that it was a fall was not surprising, although the magnitude of the fall was a lot larger than expected,” Ms Allen said.

EY chief economist Jo Masters said January’s pullback highlighted “the temporary nature of the recent surge in building approvals,” and that when the HomeBuilder scheme closes in March, “we should expect to see a sizeable pull back in approvals as weak population growth and high residential vacancy rates in Australia’s largest cities weigh on demand for new housing”.

Nonetheless, the strength of building approvals in late 2020 should support construction activity through the first half of this year, Ms Allen said.

A cocktail of the cheapest borrowing rates in history, generous government incentives and growing faith in the economic recovery from the nation’s worst downturn in close to 100 years have supercharged residential property markets around the country.

Home price data released on Monday showed house prices grew by 2.1 per cent in January, the fastest pace in 17 years, while ABS figures revealed Australians took out a record $29bn in new home loans in the same month.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout